The European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 1.68%, and major indices like Germany’s DAX and the UK’s FTSE 100 seeing gains, driven by strong business activity and consumer confidence. In this environment of economic optimism, identifying high growth tech stocks that demonstrate robust expansion potential can be particularly appealing to investors looking to capitalize on technological advancements within a strengthening market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| argenx | 21.83% | 26.68% | ★★★★★★ |

| Bonesupport Holding | 27.78% | 51.58% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| Comet Holding | 10.81% | 36.12% | ★★★★★☆ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| MGI Digital Technology Société Anonyme | 27.30% | 40.88% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★★☆

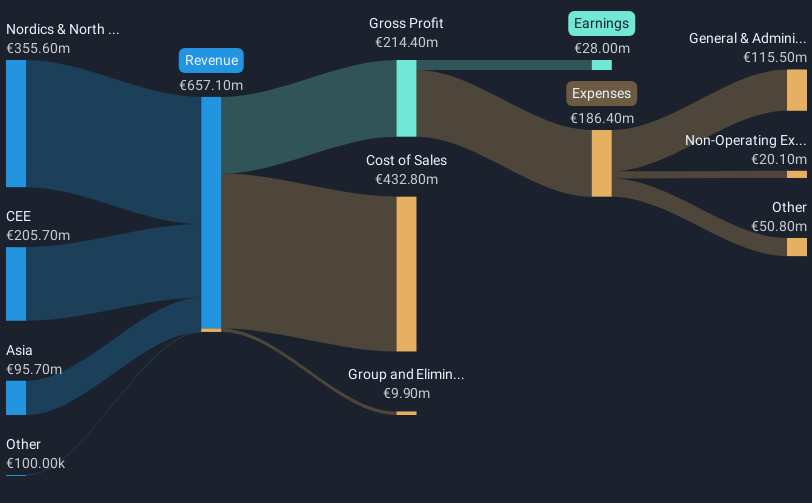

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries, including Norway, Sweden, and the United States, with a market cap of NOK14.37 billion.

Operations: Kitron ASA generates revenue primarily from its Electronics Manufacturing Services (EMS) segment, which accounts for €665.20 million. The company operates across various countries, including Norway and the United States, focusing on delivering comprehensive manufacturing solutions.

Kitron's recent performance underscores its strengthening position in the high-growth sectors like Defence/Aerospace, highlighted by a significant EUR 100 million order. With a robust revenue forecast growth of 16.6% per year, outpacing the Norwegian market's 2.4%, and an earnings surge anticipated at 26.3% annually, Kitron is navigating ahead despite broader industry challenges. The firm’s strategic R&D investment aligns with these ambitions, ensuring sustained innovation and competitiveness in its market offerings. Recent financial results reflect this positive trajectory; Q3 sales jumped to EUR 167.8 million from EUR 145.1 million year-over-year, coupled with a net income increase to EUR 9.1 million from EUR 6.1 million, signaling strong operational execution and growing market demand particularly in specialized sectors.

- Click here and access our complete health analysis report to understand the dynamics of Kitron.

Evaluate Kitron's historical performance by accessing our past performance report.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of NOK6.23 billion.

Operations: Pexip generates revenue primarily through the sale of collaboration services, amounting to NOK1.19 billion. The company operates across several key regions, providing a comprehensive video conferencing platform and digital infrastructure solutions.

Pexip Holding's recent performance has been marked by substantial growth, with a second-quarter sales increase to NOK 281.12 million from NOK 265.58 million year-over-year and a net income surge to NOK 43.88 million from NOK 7.03 million, reflecting a robust operational execution. The company's strategic focus on innovation is evidenced by its significant R&D investments, aligning with its earnings growth forecast of 20.5% per year, outpacing the Norwegian market average of 13.9%. Additionally, Pexip's recent share repurchase of 1,685,437 shares for NOK 99.9 million underscores its confidence in sustained growth and shareholder value enhancement amidst competitive tech landscapes.

- Unlock comprehensive insights into our analysis of Pexip Holding stock in this health report.

Review our historical performance report to gain insights into Pexip Holding's's past performance.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

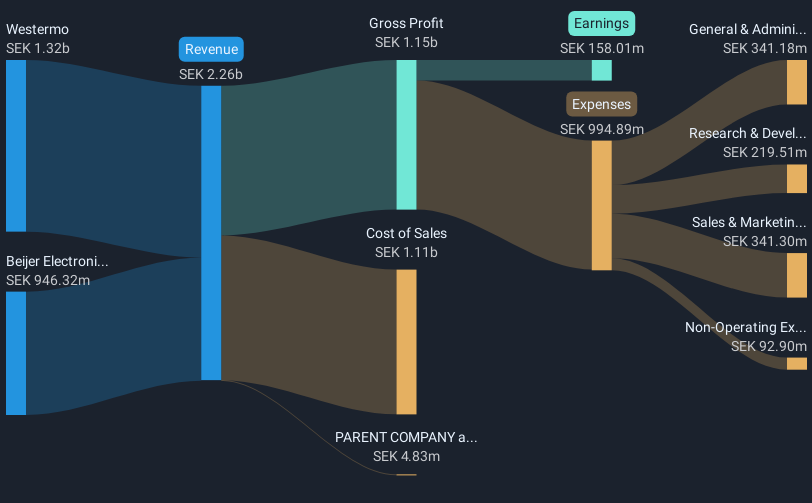

Overview: Ependion AB, with a market cap of SEK3.97 billion, offers digital solutions focused on secure control, management, visualization, and data communication for industrial applications through its subsidiaries.

Operations: Ependion generates revenue through its subsidiaries, with Westermo contributing SEK1.36 billion and Beijer Electronics (including Korenix) adding SEK875.54 million. The company focuses on providing digital solutions for industrial applications, emphasizing secure control and data communication.

Ependion AB's recent financials indicate a resilient trajectory in the tech sector, with third-quarter sales rising to SEK 543.59 million from SEK 493.03 million year-over-year, and net income increasing to SEK 40.44 million from SEK 31.41 million. Despite a slight dip in nine-month sales to SEK 1,649.4 million from SEK 1,679.91 million year-on-year, the company's earnings growth is projected at an impressive rate of 29.1% annually, outstripping Sweden's market average growth of just 3.8%. This performance is backed by robust R&D investments that not only fuel innovation but also position Ependion for sustained competitive advantage in a rapidly evolving electronic industry landscape where it has faced challenges with negative earnings growth over the past year (-11.9%).

- Click to explore a detailed breakdown of our findings in Ependion's health report.

Explore historical data to track Ependion's performance over time in our Past section.

Turning Ideas Into Actions

- Unlock more gems! Our European High Growth Tech and AI Stocks screener has unearthed 48 more companies for you to explore.Click here to unveil our expertly curated list of 51 European High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PEXIP

Pexip Holding

A video technology company, provides end-to-end video conferencing platform and digital infrastructure in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives