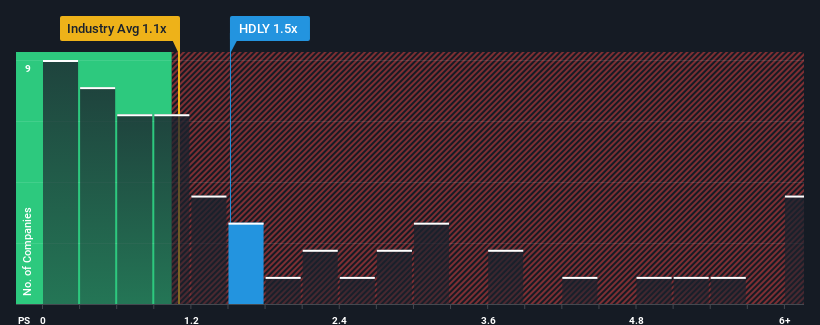

It's not a stretch to say that Huddly AS' (OB:HDLY) price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" for companies in the Communications industry in Norway, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Huddly

How Has Huddly Performed Recently?

As an illustration, revenue has deteriorated at Huddly over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Huddly will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Huddly's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 53% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 42% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 1.0% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange that Huddly is trading at a fairly similar P/S in comparison. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does Huddly's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Huddly currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Huddly (3 don't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Huddly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HDLY

Huddly

A technology company, creates tools for team collaboration in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives