The European markets recently experienced a downturn, with the pan-European STOXX Europe 600 Index closing about 1.4% lower due to new U.S. trade tariffs impacting investor sentiment. Despite these challenges, opportunities can still be found in certain segments of the market, such as penny stocks—an investment area that remains relevant for those seeking potential growth at an affordable entry point. These stocks often represent smaller or newer companies and can offer significant value when backed by strong financials and a clear growth path.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.97 | SEK1.89B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.50 | SEK230.3M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.90 | SEK237.27M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.58 | PLN121.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.50 | €52.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.02M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.08 | €60.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Exasol (XTRA:EXL) | €3.17 | €84.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.145 | €296.15M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Airthings (OB:AIRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Airthings ASA is a hardware-enabled software company that develops products and systems for monitoring indoor air quality, radon, and energy efficiency globally, with a market cap of NOK368.71 million.

Operations: The company's revenue is primarily derived from its Consumer segment at $30.19 million, followed by the Business segment with $6.31 million and the Professional segment contributing $2.00 million.

Market Cap: NOK368.71M

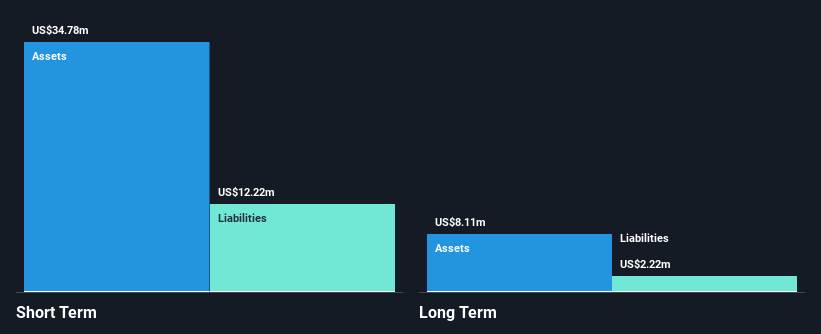

Airthings ASA, a hardware-enabled software company, is navigating the penny stock landscape with a market cap of NOK368.71 million and revenue primarily from its Consumer segment at US$30.19 million. Despite being unprofitable with increasing losses over the past five years, Airthings has reduced its debt to equity ratio significantly and maintains more cash than total debt. The company's short-term assets cover both short- and long-term liabilities comfortably. Recent product launches like the Corentium Home 2 aim to enhance market presence, while revenue guidance for Q1 2025 projects growth between US$9 million to US$11 million amid ongoing volatility in share price stability.

- Dive into the specifics of Airthings here with our thorough balance sheet health report.

- Gain insights into Airthings' future direction by reviewing our growth report.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies, with a market cap of NOK741.26 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, totaling $9.16 million.

Market Cap: NOK741.26M

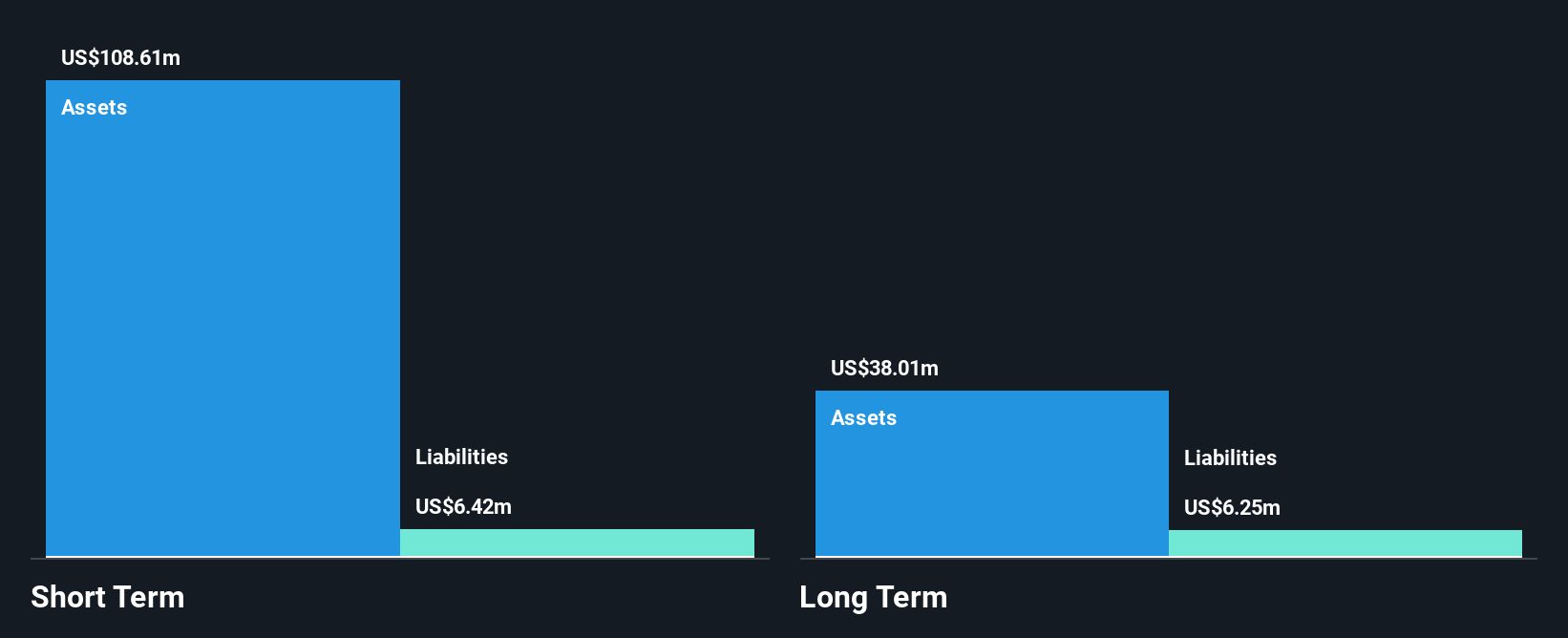

Nykode Therapeutics, with a market cap of NOK741.26 million, is making strides in the biotech sector despite being unprofitable and facing increased losses over five years. Recent preclinical findings highlight its APC-targeted immune therapy's potential in treating autoimmune diseases, showcasing promising data that could enhance its therapeutic portfolio. The company reported annual revenue of US$9.16 million, indicating some revenue generation but still facing challenges with declining earnings forecasts over the next three years. Nykode remains debt-free and has sufficient short-term assets to cover liabilities, though it experiences high share price volatility compared to peers.

- Navigate through the intricacies of Nykode Therapeutics with our comprehensive balance sheet health report here.

- Explore Nykode Therapeutics' analyst forecasts in our growth report.

Forever Entertainment (WSE:FOR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Forever Entertainment S.A. is a video game producer and publisher operating in Poland and internationally, with a market cap of PLN117.50 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: PLN117.5M

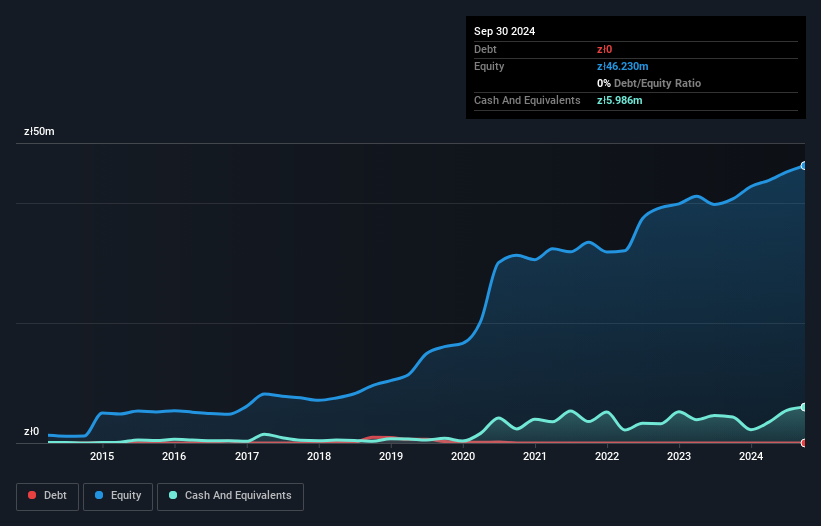

Forever Entertainment S.A., with a market cap of PLN117.50 million, reported a revenue decline to PLN31.1 million for 2024 from PLN36.73 million the previous year, yet net income rose to PLN6.73 million from PLN5.89 million. The company maintains strong financial health with more cash than debt and short-term assets covering both short and long-term liabilities comfortably. Despite a historical earnings decline over five years, recent profit growth of 14.2% surpasses industry averages, supported by high-quality earnings and improved profit margins, though Return on Equity remains low at 14.1%. The board's average tenure is experienced at 9.4 years.

- Click to explore a detailed breakdown of our findings in Forever Entertainment's financial health report.

- Gain insights into Forever Entertainment's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Navigate through the entire inventory of 416 European Penny Stocks here.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AIRX

Airthings

A hardware-enabled software company, engages in the development of products and systems for monitoring indoor air quality, radon, and energy efficiency worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives