Undiscovered Gems With Strong Fundamentals To Explore In November 2024

Reviewed by Simply Wall St

In a week marked by significant macroeconomic activity, global markets saw mixed results with small-cap stocks holding up better than their larger counterparts, despite the broader indices finishing mostly lower. Amidst this backdrop of cautious earnings reports and fluctuating economic indicators, investors are increasingly seeking opportunities in stocks that exhibit strong fundamentals and resilience. In such an environment, identifying companies with solid financial health and growth potential becomes crucial for those looking to navigate market volatility successfully.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.32% | 13.06% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea with a market capitalization of approximately ₩910.74 billion.

Operations: Cheryong Electric generates revenue primarily from the sale of power electric equipment. The company's net profit margin has shown variability, reflecting fluctuations in operational efficiency and cost management.

Cheryong Electric, a relatively small player in the electrical industry, has shown impressive earnings growth of 134% over the past year, outpacing the industry's 11.6%. This growth is supported by its debt-free status and high-quality earnings profile. Trading at a significant discount of 92.8% below estimated fair value, it appears to offer good relative value compared to peers. The company seems well-positioned with positive free cash flow and no concerns about interest coverage due to its lack of debt. However, recent share price volatility may be a point for potential investors to consider carefully.

- Click here to discover the nuances of Cheryong ElectricLtd with our detailed analytical health report.

Evaluate Cheryong ElectricLtd's historical performance by accessing our past performance report.

SmartCraft (OB:SMCRT)

Simply Wall St Value Rating: ★★★★★☆

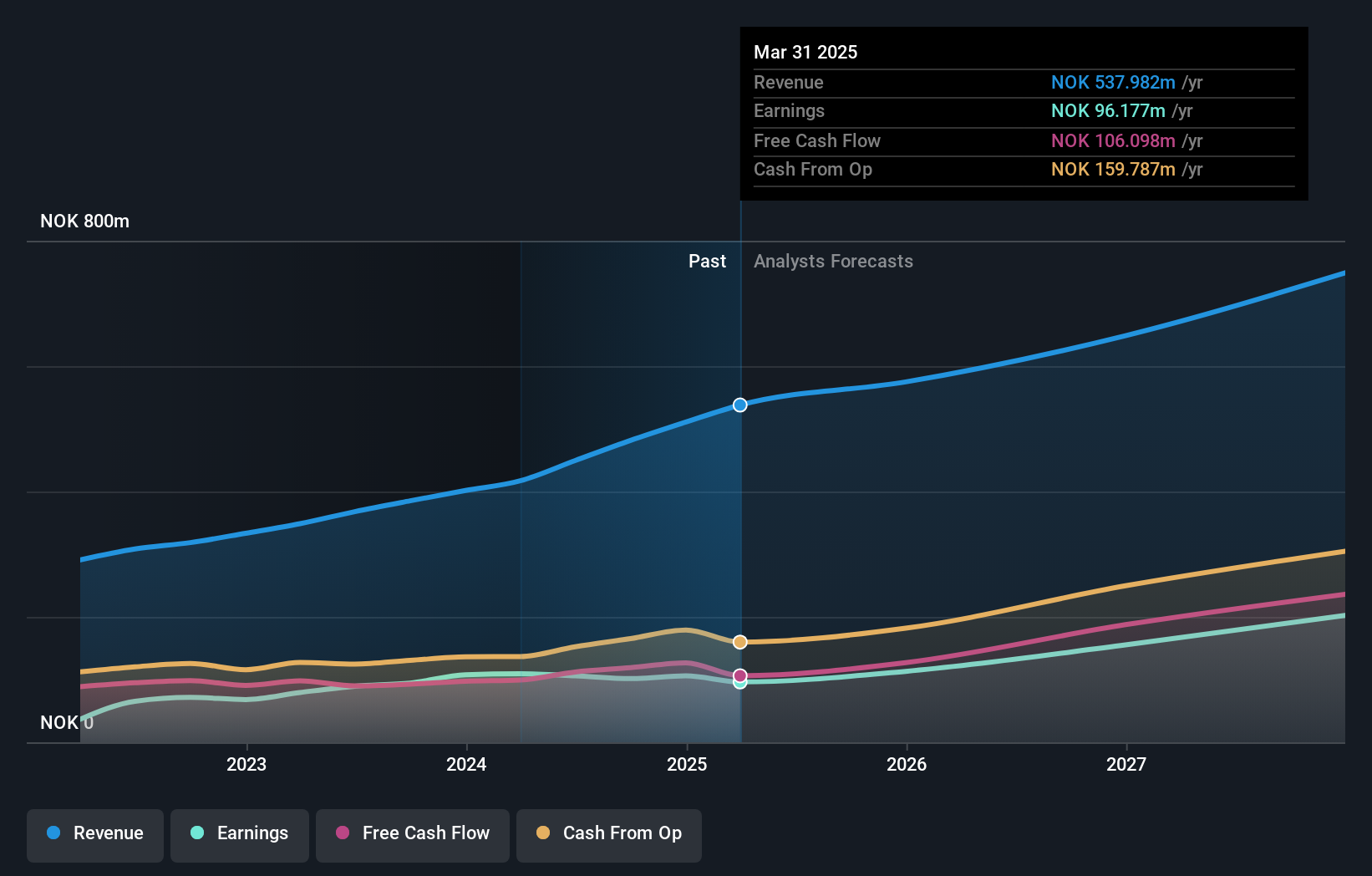

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, and Finland, with a market cap of NOK5.18 billion.

Operations: SmartCraft ASA generates revenue primarily through its software solutions targeted at the construction sector in Norway, Sweden, and Finland. The company's market cap stands at approximately NOK5.18 billion.

SmartCraft, a nimble player in the software industry, has shown resilience by eliminating debt over the past five years from a debt to equity ratio of 63.5%. The company is trading at a discount, 22.4% below its estimated fair value, which may intrigue value seekers. Despite recent insider selling activity in the last quarter, SmartCraft's earnings growth of 18.5% outpaces the industry's 11.5%, showcasing robust performance with high-quality earnings reported consistently. In Q2 2024, sales rose to NOK 133 million from NOK 100.9 million year-on-year; however, net income slightly dipped to NOK 27 million from NOK 29.3 million previously noted for the same period last year.

- Take a closer look at SmartCraft's potential here in our health report.

Review our historical performance report to gain insights into SmartCraft's's past performance.

Tianjin LVYIN Landscape and Ecology Construction (SZSE:002887)

Simply Wall St Value Rating: ★★★★☆☆

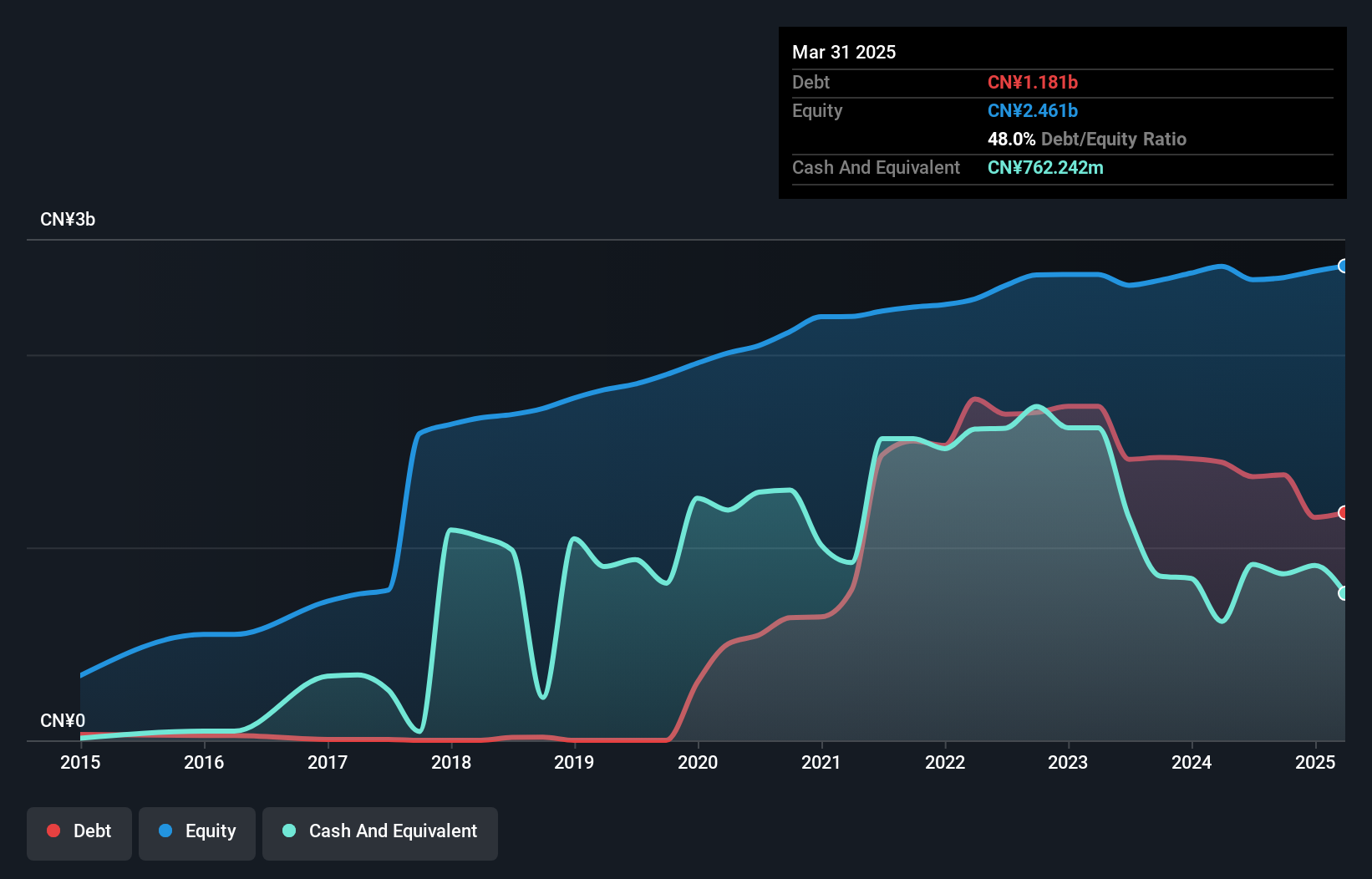

Overview: Tianjin LVYIN Landscape and Ecology Construction Co., Ltd is engaged in ecological restoration and landscaping construction in China, with a market cap of CN¥2.37 billion.

Operations: LVYIN Landscape and Ecology Construction derives its revenue primarily from the construction industry, amounting to CN¥398.29 million.

Tianjin LVYIN Landscape and Ecology Construction, a smaller player in its field, is currently trading at 93% below estimated fair value, suggesting potential undervaluation. The company reported sales of CN¥243.65 million for the first nine months of 2024, slightly down from CN¥245.7 million the previous year. Net income was CN¥51.65 million compared to last year's CN¥76.82 million, reflecting some challenges despite a satisfactory net debt to equity ratio of 21.4%. Earnings grew by 14% over the past year and are expected to increase by about 6% annually moving forward, indicating steady growth prospects amid industry headwinds.

Where To Now?

- Reveal the 4736 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, Finland, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives