SmartCraft ASA's (OB:SMCRT) CEO Looks Due For A Compensation Raise

Key Insights

- SmartCraft's Annual General Meeting to take place on 2nd of May

- CEO Gustav Line's total compensation includes salary of kr2.75m

- The overall pay is 64% below the industry average

- SmartCraft's total shareholder return over the past three years was 73% while its EPS grew by 50% over the past three years

The solid performance at SmartCraft ASA (OB:SMCRT) has been impressive and shareholders will probably be pleased to know that CEO Gustav Line has delivered. At the upcoming AGM on 2nd of May, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

View our latest analysis for SmartCraft

How Does Total Compensation For Gustav Line Compare With Other Companies In The Industry?

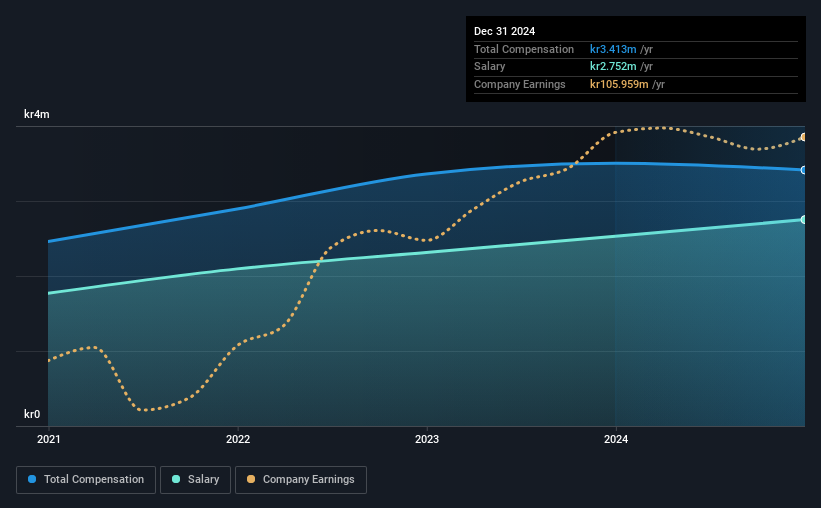

According to our data, SmartCraft ASA has a market capitalization of kr4.3b, and paid its CEO total annual compensation worth kr3.4m over the year to December 2024. That's mostly flat as compared to the prior year's compensation. In particular, the salary of kr2.75m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Norwegian Software industry with market capitalizations ranging from kr2.1b to kr8.3b, the reported median CEO total compensation was kr9.5m. This suggests that Gustav Line is paid below the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr2.8m | kr2.5m | 81% |

| Other | kr661k | kr974k | 19% |

| Total Compensation | kr3.4m | kr3.5m | 100% |

Talking in terms of the industry, salary represented approximately 73% of total compensation out of all the companies we analyzed, while other remuneration made up 27% of the pie. It's interesting to note that SmartCraft pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

SmartCraft ASA's Growth

SmartCraft ASA's earnings per share (EPS) grew 50% per year over the last three years. It achieved revenue growth of 27% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has SmartCraft ASA Been A Good Investment?

Most shareholders would probably be pleased with SmartCraft ASA for providing a total return of 73% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

Whatever your view on compensation, you might want to check if insiders are buying or selling SmartCraft shares (free trial).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, Finland, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives