The European market has shown mixed results recently, with the pan-European STOXX Europe 600 Index remaining flat and major indexes like France's CAC 40 and Italy's FTSE MIB posting modest gains. In this environment, high growth tech stocks in Europe are drawing attention for their potential to thrive amidst steady inflation rates and a resilient labor market, making them intriguing options for investors seeking innovation-driven opportunities.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 24.39% | 57.52% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| VusionGroup | 20.44% | 73.56% | ★★★★★★ |

We'll examine a selection from our screener results.

Seco (BIT:IOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seco S.p.A. is a technology company that develops and delivers innovative solutions for the digitization of industrial products and processes across multiple regions including Europe, the Middle East, Africa, the United States, and Asia-Pacific, with a market cap of €343.05 million.

Operations: Seco focuses on providing advanced digitization solutions for industrial products and processes globally. The company operates across various regions, including Europe, the Middle East, Africa, the U.S., and Asia-Pacific.

Seco S.p.A. recently spotlighted its strategic direction at the Italian Investment Conference, emphasizing a robust commitment to maintaining a 50% gross profit margin while projecting revenues to exceed EUR 50 million in Q2 2025. Despite a slight downturn in Q1 with sales nearly flat at EUR 47.16 million and shifting from a net income to a loss of EUR 2.02 million, the company's forward-looking statements suggest confidence in rebounding performance. This optimism is underpinned by their consistent R&D investment, crucial for sustaining innovation and competitiveness in the high-tech European market.

- Delve into the full analysis health report here for a deeper understanding of Seco.

Gain insights into Seco's past trends and performance with our Past report.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, Finland, and the United Kingdom, with a market capitalization of NOK4.69 billion.

Operations: SmartCraft ASA specializes in providing software solutions to the construction sector across several European countries, including Norway, Sweden, Finland, and the United Kingdom. The company is valued at NOK4.69 billion.

With the recent appointment of Hanna Konyi as interim CEO, SmartCraft ASA is poised to leverage her successful track record in enhancing Bygglet's revenue by 353% over seven years. This leadership change coincides with innovative product launches like SmartCraft Spark, aimed at modernizing operations for electricians through digital solutions. Despite a challenging year with a 12% decline in earnings, the company's strategic share repurchases and robust product development signal a resilient push towards revitalizing its market position and capitalizing on growing demands within the tech sector.

- Click to explore a detailed breakdown of our findings in SmartCraft's health report.

Examine SmartCraft's past performance report to understand how it has performed in the past.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Better Collective A/S is a digital sports media company with operations in Europe, North America, and internationally, and has a market cap of SEK8.48 billion.

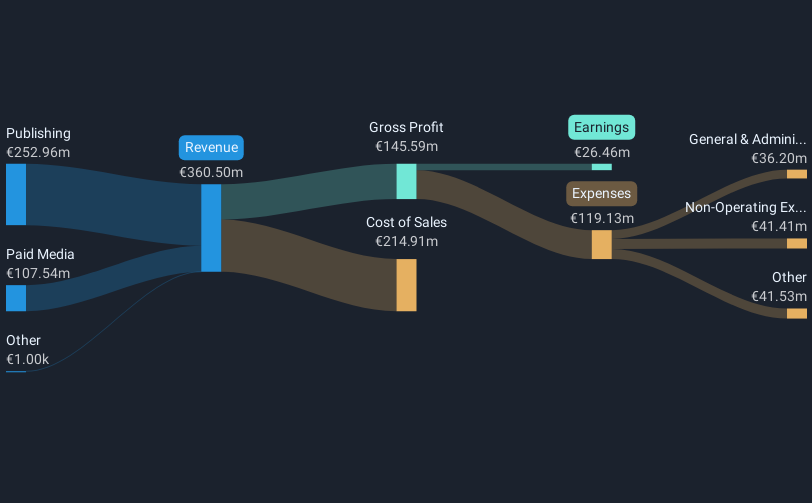

Operations: The company generates revenue primarily through its Publishing segment (€256.40 million) and Paid Media segment (€102.65 million).

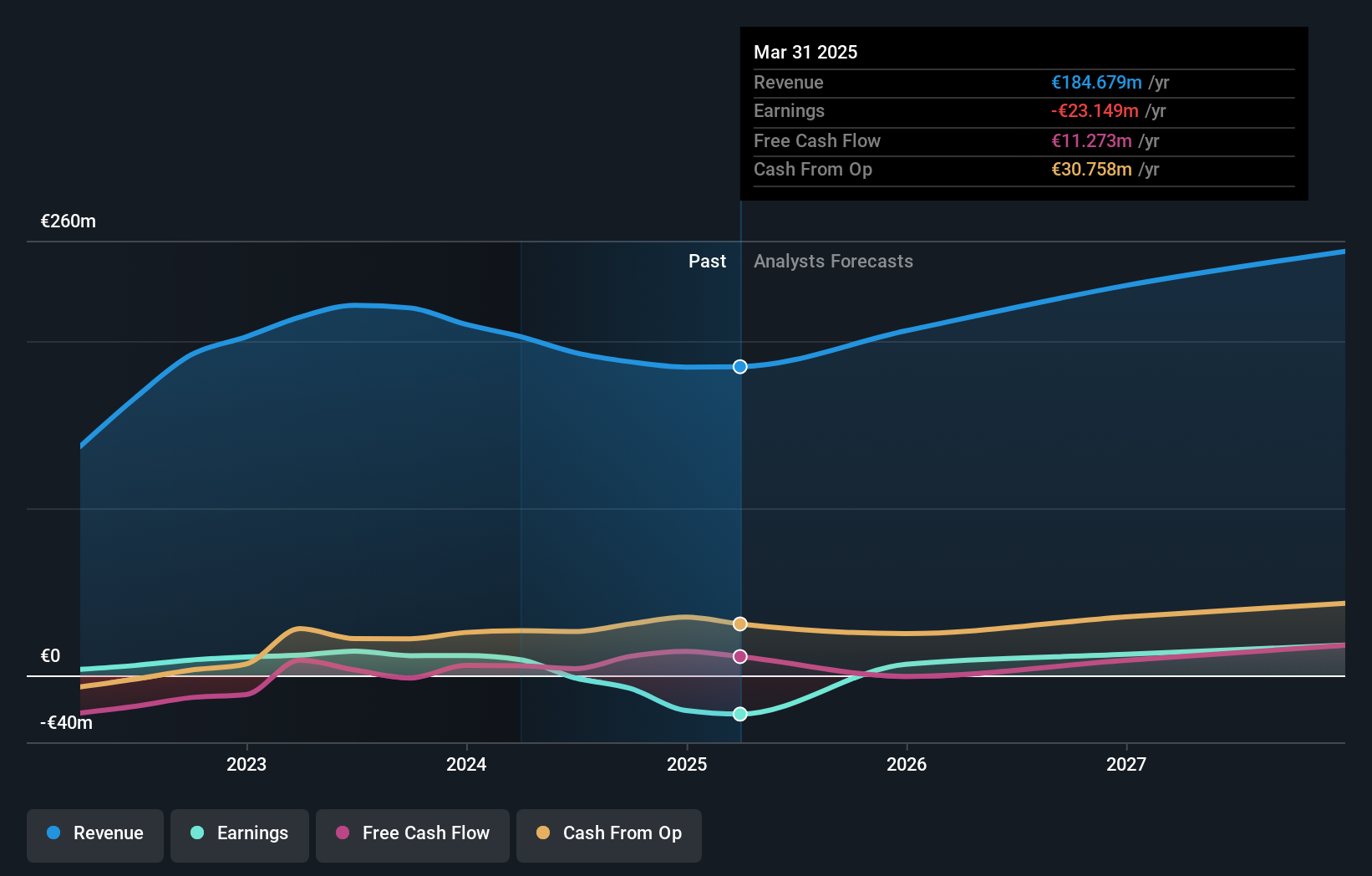

Better Collective A/S, a European tech firm, recently initiated a share repurchase program, signaling confidence in its financial health despite a dip in Q1 earnings to €3.64 million from €7.55 million year-over-year. This move aligns with their strategy to enhance capital structure and support long-term incentive plans. With revenue forecasts set between €320 million and €350 million for 2025, the company outpaces the Swedish market's growth expectations, reflecting its robust position within the Interactive Media and Services industry where it has shown an impressive 13.8% earnings growth over the past year against an industry decline of 3.2%.

- Unlock comprehensive insights into our analysis of Better Collective stock in this health report.

Explore historical data to track Better Collective's performance over time in our Past section.

Make It Happen

- Explore the 232 names from our European High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, Finland, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives