As European markets navigate a landscape marked by cautious optimism and mixed performances across major indices, the tech sector continues to capture investor interest with its potential for high growth despite broader economic uncertainties. In this environment, identifying promising tech stocks often involves looking at companies that demonstrate strong innovation capabilities and resilience in adapting to shifting market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Yubico | 21.27% | 26.82% | ★★★★★★ |

| Truecaller | 20.03% | 24.78% | ★★★★★★ |

| Xbrane Biopharma | 59.87% | 137.43% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 73.11% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kitron ASA is an electronics manufacturing services company with operations across Europe, Asia, and the United States, and has a market capitalization of NOK8.15 billion.

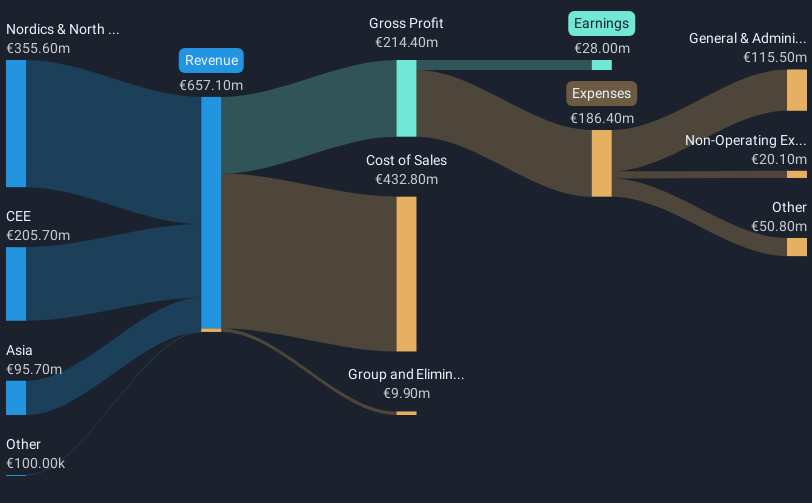

Operations: The company generates revenue primarily from its Electronics Manufacturing Services (EMS) segment, amounting to €647.20 million. It operates in multiple regions, including Europe, Asia, and the United States.

Amidst a challenging year, Kitron's strategic moves in the defense and aerospace sectors underscore its resilience and adaptability. The company secured significant contracts, such as the NOK 300 million deal for Naval Strike Missile electronics with Kongsberg Defence & Aerospace, set to bolster future revenues from 2026. Despite a dip in annual sales to EUR 647.2 million from EUR 775.2 million and a reduced net income of EUR 28 million, down from last year's EUR 51.1 million, Kitron's forward-looking orders and its recent expansion into advanced optical assemblies for drones highlight its commitment to diversifying product offerings and enhancing technological capabilities in high-growth areas. These strategic decisions are critical as Kitron navigates below-industry-average earnings growth (-45.2%) yet maintains an optimistic revenue growth forecast at 8.7% per year, outpacing the Norwegian market prediction of 3.1%.

- Unlock comprehensive insights into our analysis of Kitron stock in this health report.

Gain insights into Kitron's past trends and performance with our Past report.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

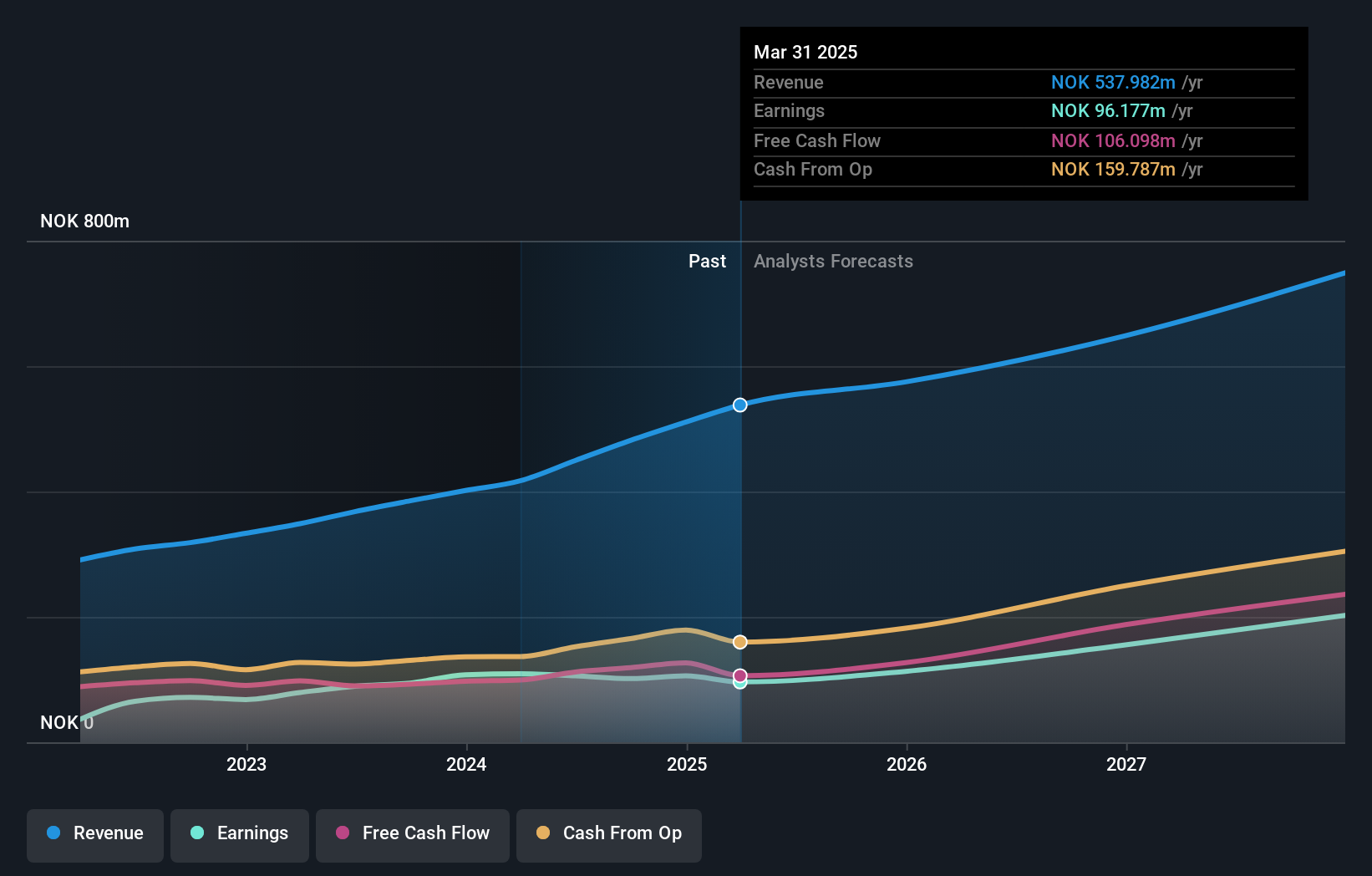

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, and Finland, with a market capitalization of NOK4.66 billion.

Operations: The company generates revenue through its specialized software solutions designed for the construction sector in Norway, Sweden, and Finland.

SmartCraft ASA's recent performance underscores its potential in the high-growth tech sector, despite some challenges. With annual revenue growth at 12.6%, SmartCraft outpaces the Norwegian market's 3.1% expansion rate, reflecting robust market positioning and demand for its offerings. The company's earnings are also set to rise by an impressive 21.5% annually, signaling strong profitability ahead. Notably, R&D investments remain pivotal; in 2024 alone, SmartCraft dedicated NOK 50 million to innovation—about 10% of its total revenue—underscoring a commitment to advancing its technological edge in competitive markets. These strategic focuses are crucial as they navigate through a slight earnings dip last year (-2%) compared to the industry average of 20.4%.

- Click here to discover the nuances of SmartCraft with our detailed analytical health report.

Assess SmartCraft's past performance with our detailed historical performance reports.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

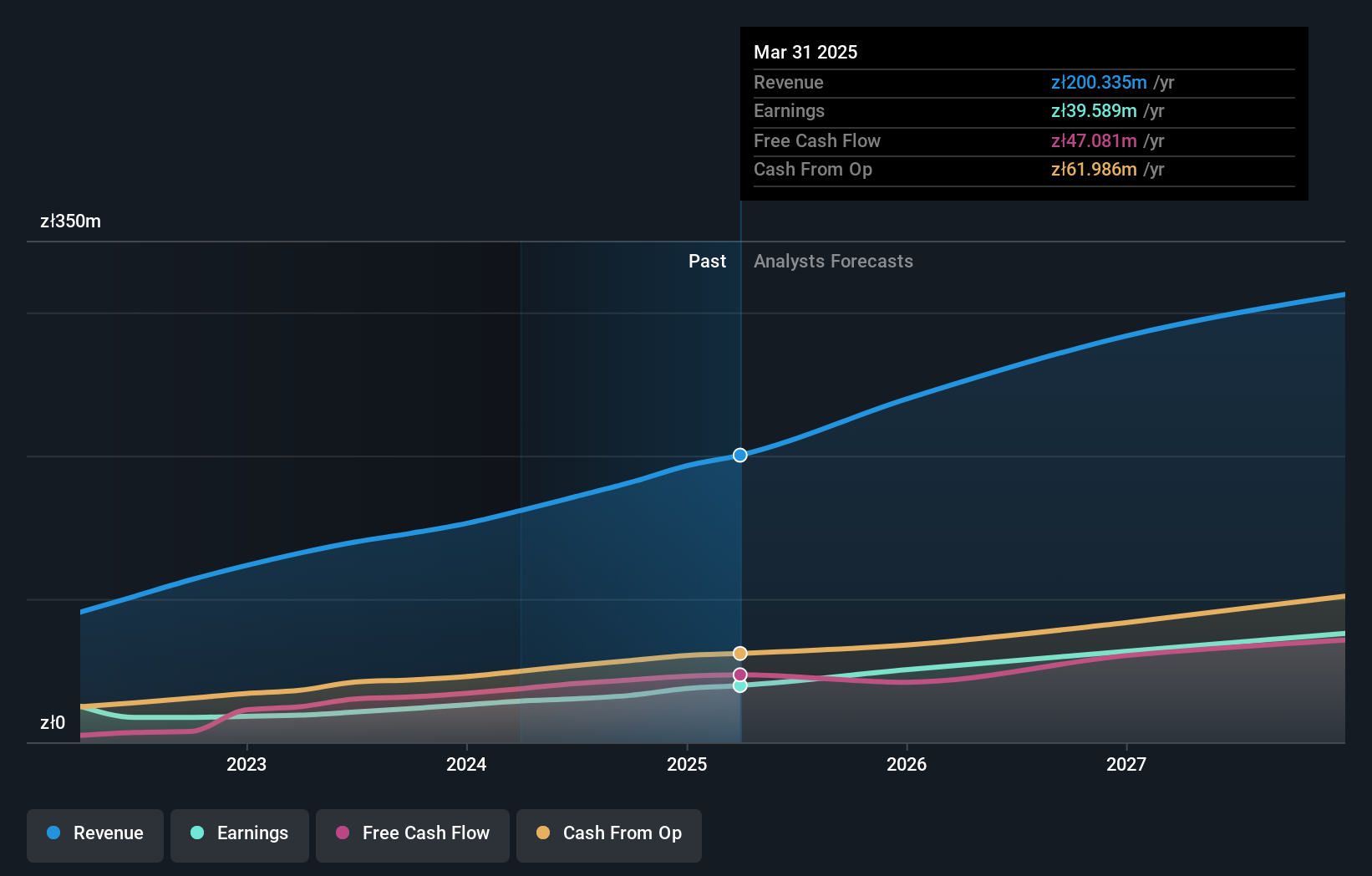

Overview: Shoper SA offers Software as a Service solutions tailored for e-commerce businesses in Poland, with a market capitalization of PLN1.18 billion.

Operations: The company generates revenue primarily through its Solutions segment, contributing PLN141.44 million, and Subscriptions segment, adding PLN39.87 million.

Shoper S.A. stands out in the European tech landscape with a robust annual revenue growth of 14.8%, significantly outpacing the Polish market's average of 4.9%. This growth is complemented by an impressive forecast in earnings increase at 26.6% per year, reflecting strong market demand and operational efficiency. The company's strategic R&D investment is notable, enhancing its competitive edge in a rapidly evolving industry. Recently, Shoper expanded its market presence through a strategic acquisition valued at approximately PLN 547.5 million, signaling aggressive expansion and synergy potential with Cyber_Folks S.A., which could further bolster its innovative capabilities and market reach.

- Click to explore a detailed breakdown of our findings in Shoper's health report.

Examine Shoper's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click this link to deep-dive into the 246 companies within our European High Growth Tech and AI Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Outstanding track record with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion