- Italy

- /

- Construction

- /

- BIT:ICOP

Discover 3 European Stocks Estimated To Trade Below Intrinsic Value By Up To 48.2%

Reviewed by Simply Wall St

The European stock markets have recently experienced a downturn, with the pan-European STOXX Europe 600 Index falling 1.57% amid renewed uncertainty surrounding U.S. trade policy and escalating geopolitical tensions in the Middle East. Despite these challenges, investors are on the lookout for opportunities, focusing on stocks that may be trading below their intrinsic value due to temporary market pressures or broader economic concerns.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN520.00 | PLN1023.60 | 49.2% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.275 | RON8.43 | 49.3% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK365.75 | 49.9% |

| Montana Aerospace (SWX:AERO) | CHF20.00 | CHF39.24 | 49% |

| Lectra (ENXTPA:LSS) | €23.60 | €46.53 | 49.3% |

| Exsitec Holding (OM:EXS) | SEK132.00 | SEK256.86 | 48.6% |

| dormakaba Holding (SWX:DOKA) | CHF717.00 | CHF1400.68 | 48.8% |

| BigBen Interactive (ENXTPA:BIG) | €1.082 | €2.11 | 48.6% |

| Absolent Air Care Group (OM:ABSO) | SEK212.00 | SEK416.91 | 49.1% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €35.70 | €71.01 | 49.7% |

Let's explore several standout options from the results in the screener.

I.CO.P.. Società Benefit (BIT:ICOP)

Overview: I.CO.P. S.p.A. Società Benefit offers construction and special engineering services to both public and private clients in Italy and internationally, with a market cap of €345.43 million.

Operations: The company's revenue is primarily derived from its heavy construction segment, totaling €110.92 million.

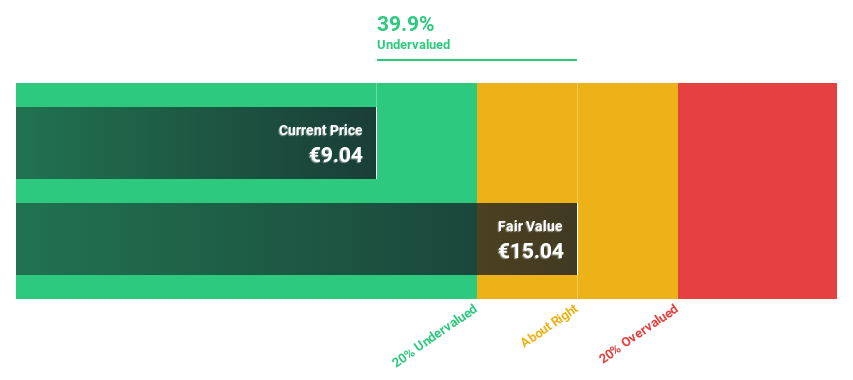

Estimated Discount To Fair Value: 48.2%

I.CO.P. Società Benefit is trading significantly below its estimated fair value of €24.15, with a current price of €12.5, indicating it may be undervalued based on cash flows. The company reported a substantial increase in net income to €17.86 million for 2024 from the previous year, and earnings are forecast to grow at 28.78% annually, outpacing the Italian market's growth rate of 7.4%. However, its share price has been highly volatile recently.

- The analysis detailed in our I.CO.P.. Società Benefit growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of I.CO.P.. Società Benefit stock in this financial health report.

Pexip Holding (OB:PEXIP)

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of NOK6.27 billion.

Operations: The company's revenue primarily comes from the sale of collaboration services, amounting to NOK1.17 billion.

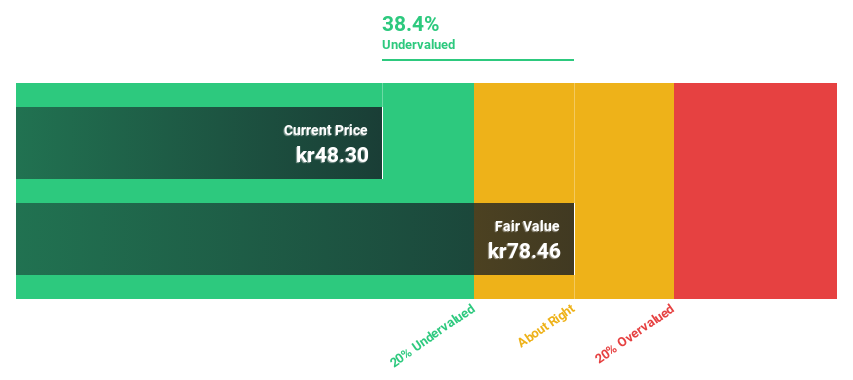

Estimated Discount To Fair Value: 20.4%

Pexip Holding is trading at NOK 61.6, significantly below its estimated fair value of NOK 77.42, suggesting it could be undervalued based on cash flows. The company's earnings are expected to grow at 23.7% annually, surpassing the Norwegian market's growth rate of 8.3%. Recent announcements include a share repurchase program and a partnership expansion with Google, enhancing interoperability for video meetings across platforms like Microsoft Teams and Zoom from Google Meet hardware.

- Upon reviewing our latest growth report, Pexip Holding's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Pexip Holding's balance sheet by reading our health report here.

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, Finland, and the United Kingdom, with a market cap of NOK4.41 billion.

Operations: SmartCraft ASA generates revenue from providing software solutions to the construction sectors in Norway, Sweden, Finland, and the United Kingdom.

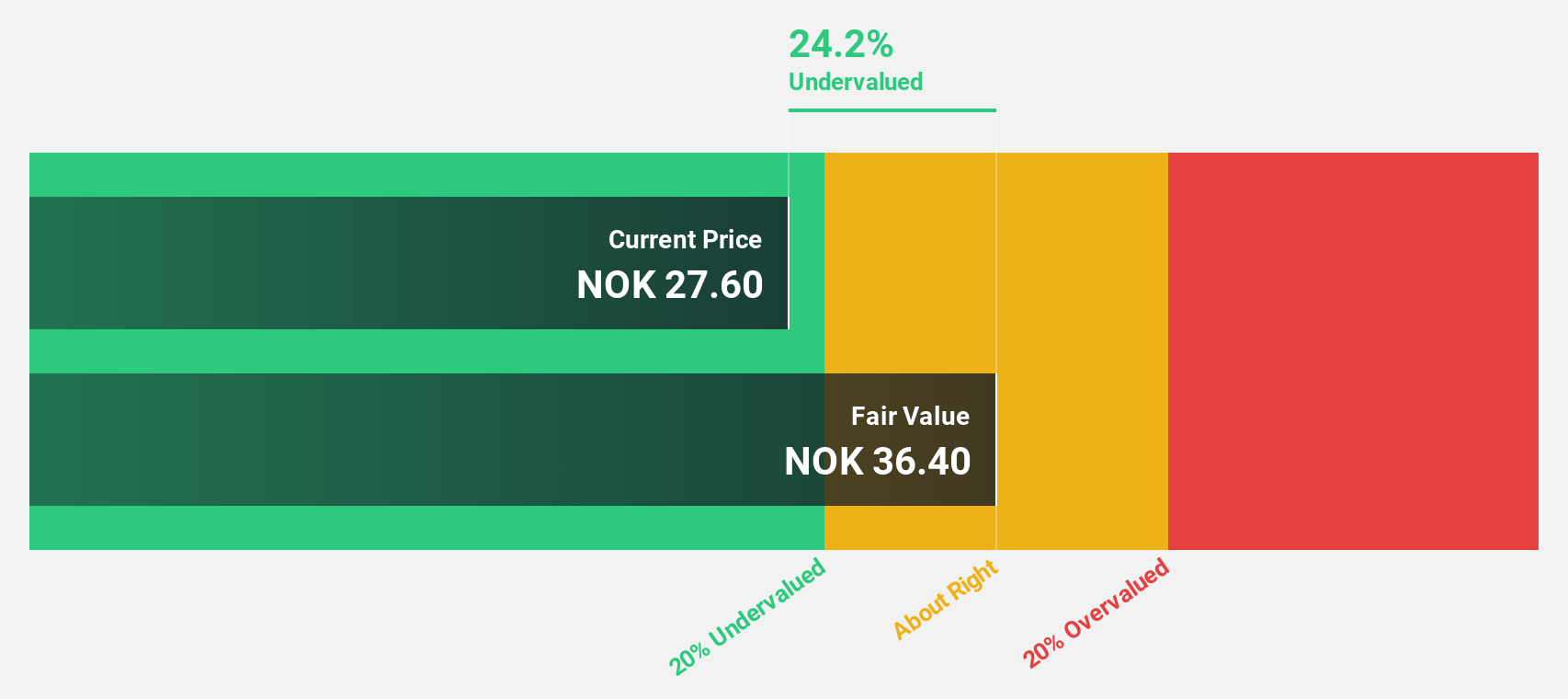

Estimated Discount To Fair Value: 26.8%

SmartCraft, trading at NOK 26.6, is priced below its estimated fair value of NOK 36.36, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 27.3% annually, outpacing the Norwegian market's growth rate of 8.3%. Recent product launches like SmartCraft Spark and Congrid's BIM feature aim to enhance efficiency in electrical and construction sectors, although profit margins have declined from last year’s figures.

- Our comprehensive growth report raises the possibility that SmartCraft is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of SmartCraft.

Summing It All Up

- Get an in-depth perspective on all 177 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ICOP

I.CO.P.. Società Benefit

Engages in providing construction and special engineering services to public and private clients in Italy and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives