3 European Stocks Estimated To Be Up To 42.4% Below Intrinsic Value

Reviewed by Simply Wall St

The European stock market has experienced a mixed performance, with the pan-European STOXX Europe 600 Index rising by 1.77% following the end of the U.S. federal government shutdown, though enthusiasm was tempered by cooling sentiment on artificial intelligence investments. Amid these fluctuating conditions, identifying undervalued stocks can present opportunities for investors looking to capitalize on discrepancies between market price and intrinsic value, especially in an environment where economic indicators and investor sentiment are in flux.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| STEICO (XTRA:ST5) | €20.40 | €40.20 | 49.3% |

| Spindox (BIT:SPN) | €12.90 | €25.38 | 49.2% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.88 | 49.9% |

| NOBA Bank Group (OM:NOBA) | SEK100.14 | SEK198.13 | 49.5% |

| NEUCA (WSE:NEU) | PLN778.00 | PLN1553.92 | 49.9% |

| GN Store Nord (CPSE:GN) | DKK93.34 | DKK186.26 | 49.9% |

| E-Globe (BIT:EGB) | €0.665 | €1.30 | 48.8% |

| Bonesupport Holding (OM:BONEX) | SEK199.10 | SEK395.70 | 49.7% |

| Allegro.eu (WSE:ALE) | PLN32.225 | PLN64.22 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK203.00 | SEK400.29 | 49.3% |

Let's dive into some prime choices out of the screener.

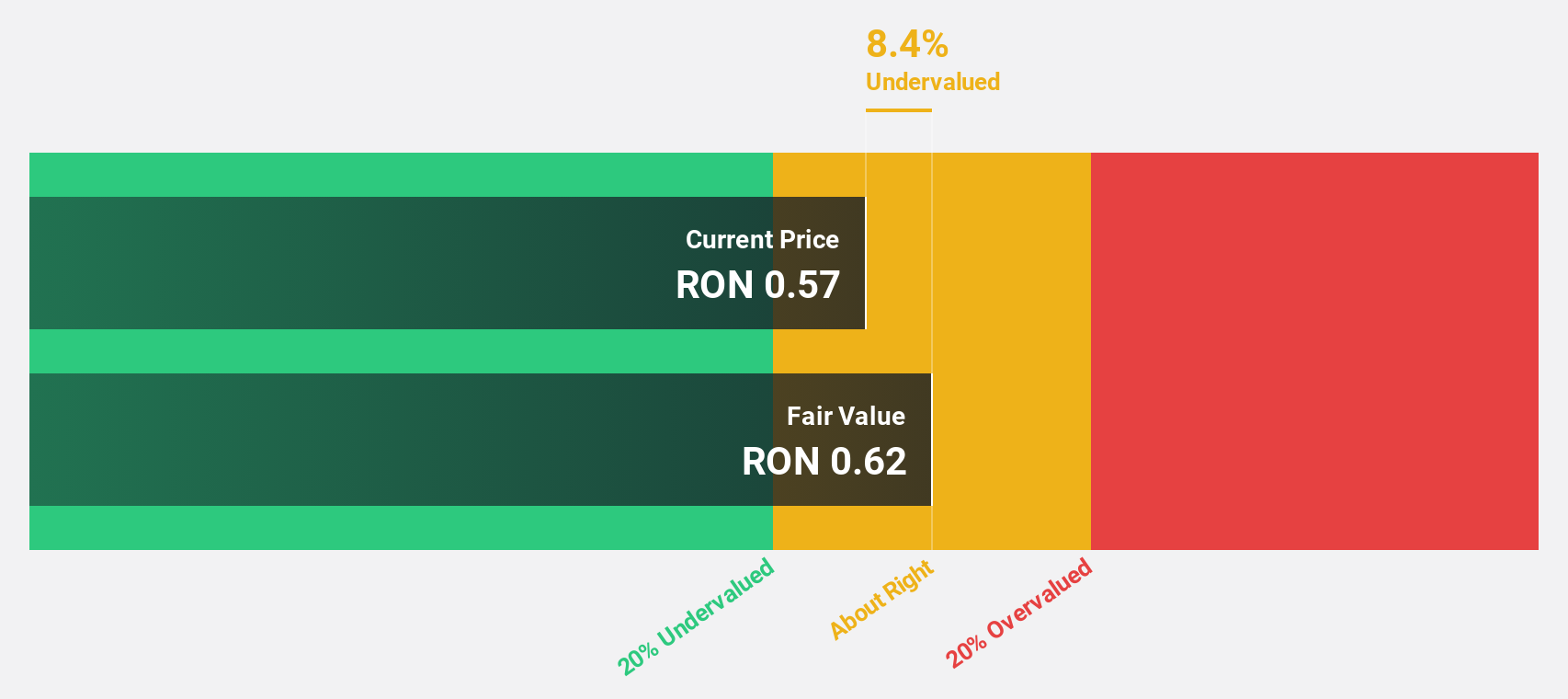

Teraplast (BVB:TRP)

Overview: Teraplast S.A. is a polymer processor operating in Romania and internationally, with a market capitalization of RON1.28 billion.

Operations: The company's revenue is derived from several segments: Carpentry joinery (RON54.05 million), Flexible Packaging (RON148.89 million), Installations and Recycling (RON780.90 million), and Granules, Including Recycled (RON90.27 million).

Estimated Discount To Fair Value: 19.3%

Teraplast is trading at RON0.43, below its estimated fair value of RON0.53, indicating potential undervaluation based on cash flows. Despite interest payments not being well covered by earnings, the company reported a net income of RON 6.7 million for the first nine months of 2025, reversing a loss from the previous year. Revenue growth is forecasted at 11.2% annually, outpacing market averages and supporting expectations for profitability within three years.

- Our earnings growth report unveils the potential for significant increases in Teraplast's future results.

- Dive into the specifics of Teraplast here with our thorough financial health report.

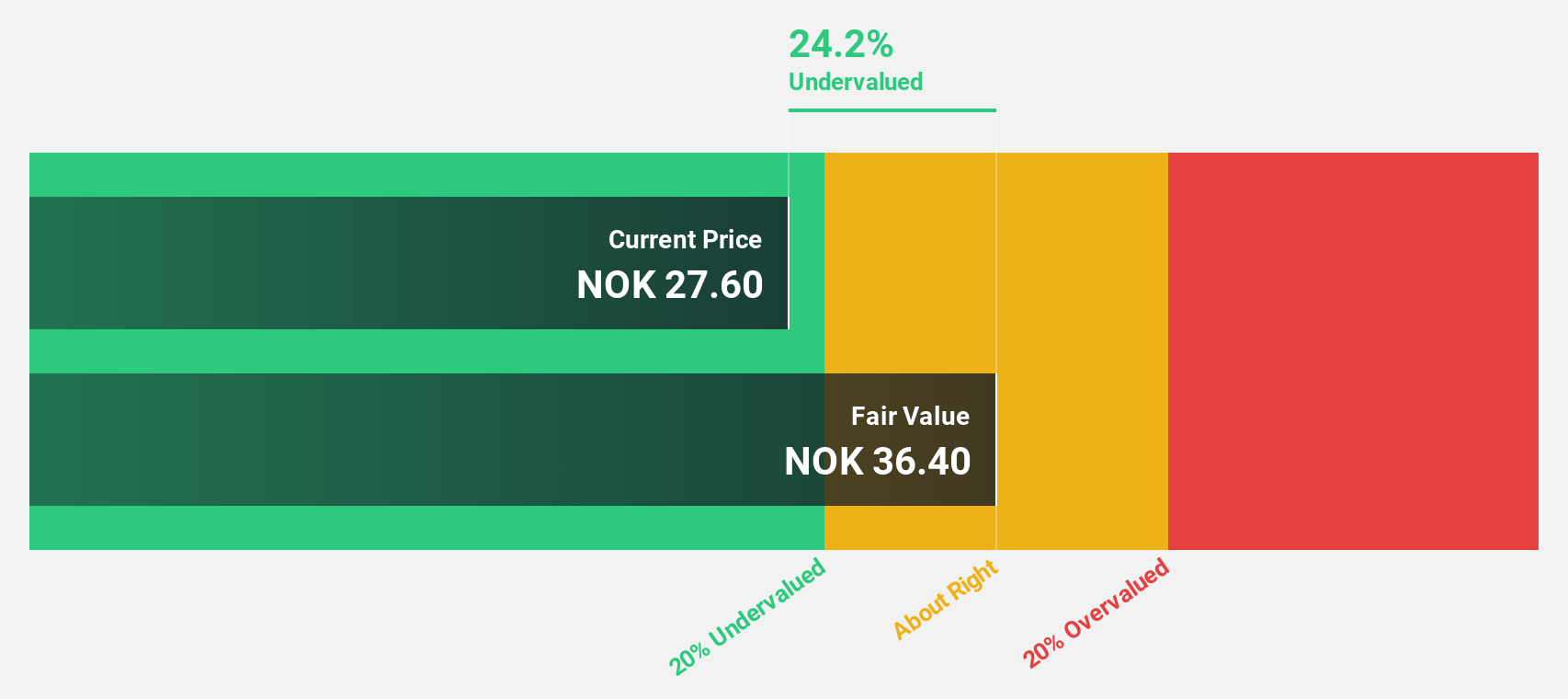

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, Finland, and the United Kingdom, with a market cap of NOK3.74 billion.

Operations: Revenue segments for SmartCraft ASA include software solutions provided to the construction industry in Norway, Sweden, Finland, and the United Kingdom.

Estimated Discount To Fair Value: 40.3%

SmartCraft, trading at NOK 22.6, is significantly undervalued compared to its estimated fair value of NOK 37.88 based on cash flows. Despite a recent dip in nine-month net income to NOK 73.23 million from NOK 79.9 million the previous year, earnings are forecasted to grow over 30% annually for the next three years, outpacing both revenue growth and market averages in Norway. Recent share buybacks further enhance shareholder value amid executive transitions.

- The growth report we've compiled suggests that SmartCraft's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of SmartCraft.

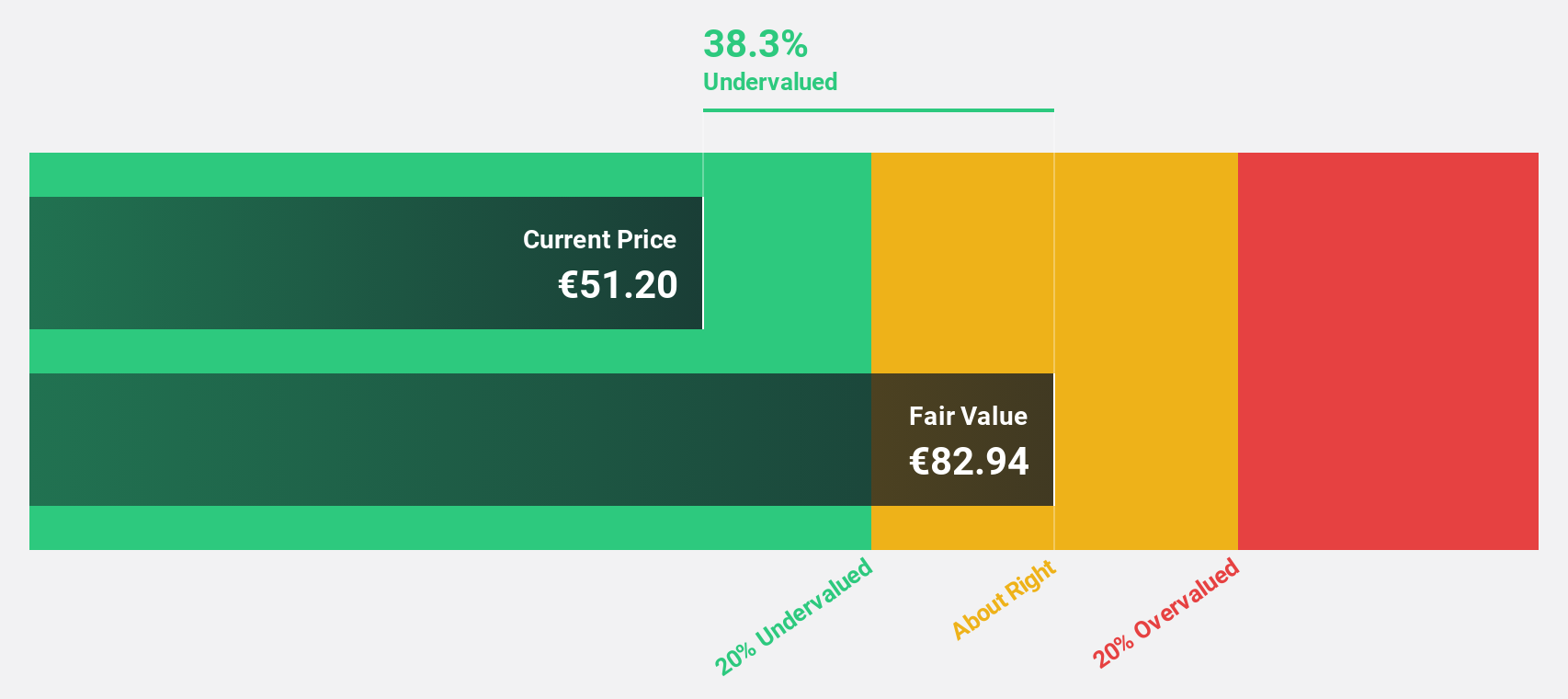

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA operates in the out-of-home and digital out-of-home advertising sectors both in Germany and internationally, with a market cap of approximately €1.92 billion.

Operations: The company's revenue segments include Daas & E-Commerce (€355.69 million), Out-Of-Home Media (€983.71 million), and Digital & Dialog Media (€869.35 million).

Estimated Discount To Fair Value: 42.4%

Ströer SE KGaA is trading at €34.4, significantly below its estimated fair value of €59.71 according to discounted cash flow analysis. Despite a decrease in third-quarter net income to €24.63 million from €34.75 million the previous year, earnings are expected to grow significantly at 23.1% annually over the next three years, surpassing German market averages. However, revenue growth projections lag behind market expectations and high debt levels remain a concern for investors focusing on cash flows.

- Our comprehensive growth report raises the possibility that Ströer SE KGaA is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Ströer SE KGaA stock in this financial health report.

Next Steps

- Access the full spectrum of 195 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teraplast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TRP

Teraplast

Operates as a polymer processor in Romania and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives