Arne Mjøs is the CEO of Itera ASA (OB:ITE). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Itera

How Does Arne Mjøs's Compensation Compare With Similar Sized Companies?

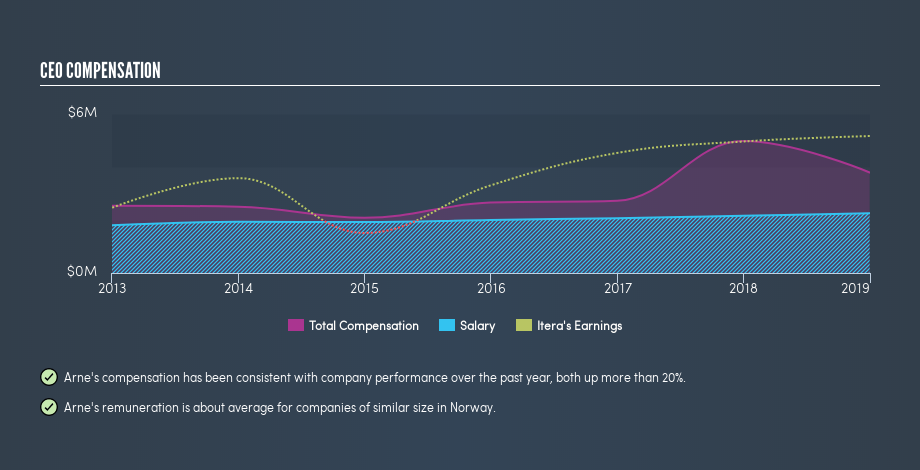

According to our data, Itera ASA has a market capitalization of kr651m, and pays its CEO total annual compensation worth kr3.8m. (This number is for the twelve months until December 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at kr2.3m. We looked at a group of companies with market capitalizations under kr1.8b, and the median CEO total compensation was kr3.0m.

So Arne Mjøs receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context.

The graphic below shows how CEO compensation at Itera has changed from year to year.

Is Itera ASA Growing?

Over the last three years Itera ASA has grown its earnings per share (EPS) by an average of 17% per year (using a line of best fit). Its revenue is up 11% over last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business.

Has Itera ASA Been A Good Investment?

I think that the total shareholder return of 141%, over three years, would leave most Itera ASA shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Arne Mjøs is paid around what is normal the leaders of comparable size companies.

The company is growing earnings per share and total shareholder returns have been pleasing. So one could argue the CEO compensation is quite modest, if you consider company performance! Whatever your view on compensation, you might want to check if insiders are buying or selling Itera shares (free trial).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:ITERA

Itera

Provides digital solutions for businesses and organizations in Norway, Sweden, Ukraine, Denmark, the Czech Republic, Iceland, Poland, and Slovakia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion