The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Bouvet (OB:BOUV). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Our analysis indicates that BOUV is potentially undervalued!

How Fast Is Bouvet Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Impressively, Bouvet has grown EPS by 20% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

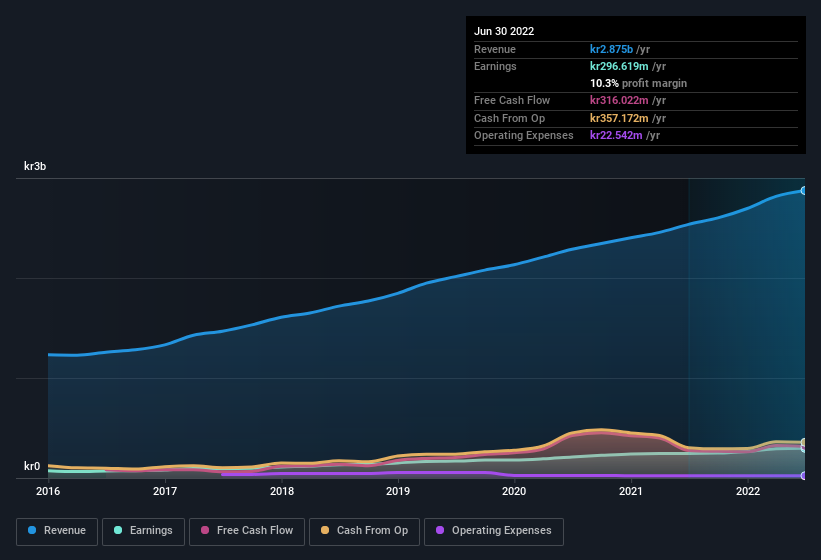

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Bouvet remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 13% to kr2.9b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Bouvet Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that Bouvet insiders spent a staggering kr12m on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, Bouvet will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was Independent Director Egil Dahl who made the biggest single purchase, worth kr11m, paying kr56.20 per share.

Along with the insider buying, another encouraging sign for Bouvet is that insiders, as a group, have a considerable shareholding. Holding kr507m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. Amounting to 8.4% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Per Tronsli, is paid less than the median for similar sized companies. For companies with market capitalisations between kr2.0b and kr8.1b, like Bouvet, the median CEO pay is around kr5.4m.

Bouvet offered total compensation worth kr4.0m to its CEO in the year to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Bouvet Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Bouvet's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Bouvet. You might benefit from giving it a glance today.

The good news is that Bouvet is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bouvet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:BOUV

Bouvet

Provides IT and digital communication consultancy services for public and private sectors in Norway, Sweden, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives