Does Atea's Upbeat Q3 and Reaffirmed Outlook Strengthen the Bull Case for OB:ATEA?

Reviewed by Sasha Jovanovic

- Atea ASA recently reported third-quarter 2025 results with sales rising to NOK8.43 billion and net income reaching NOK226 million, while also reaffirming its full-year outlook, projecting gross sales at the top end of NOK57 billion–NOK60 billion and EBIT in the middle of its guidance range.

- The company’s strengthened quarterly earnings and confirmed outlook point to operational resilience and underscore management’s ongoing confidence in achieving its annual targets.

- To better understand how Atea’s reaffirmed guidance shapes the company’s future, we’ll assess its impact on the investment narrative and growth trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Atea Investment Narrative Recap

To be an Atea shareholder, you need confidence in the company's ability to balance robust revenue growth, driven by new market share, government contracts, and expanding AI services, with the challenge of margin pressure from shifting product mix and evolving vendor incentives. The recent Q3 results and reaffirmed 2025 guidance confirm Atea’s operational steadiness and suggest minimal impact on the key short-term catalyst: strong sales execution across Scandinavia. The biggest risk remains margin compression if high-margin segments underperform or incentive changes persist, though the reaffirmed outlook reduces immediate concern.

Among recent announcements, the large frame agreement won in Finland stands out, dovetailing with growth catalysts such as public sector spending and market share wins. This contract should help support the targeted sales figures in the updated guidance, providing some counterweight to margin headwinds and underlining the company’s market position ahead of further earnings reports.

However, investors should also consider that if vendor incentives shift again or hardware volumes soften, there are risks to margins that...

Read the full narrative on Atea (it's free!)

Atea's narrative projects NOK48.4 billion revenue and NOK1.5 billion earnings by 2028. This requires 10.1% yearly revenue growth and an earnings increase of NOK736 million from NOK764 million today.

Uncover how Atea's forecasts yield a NOK170.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

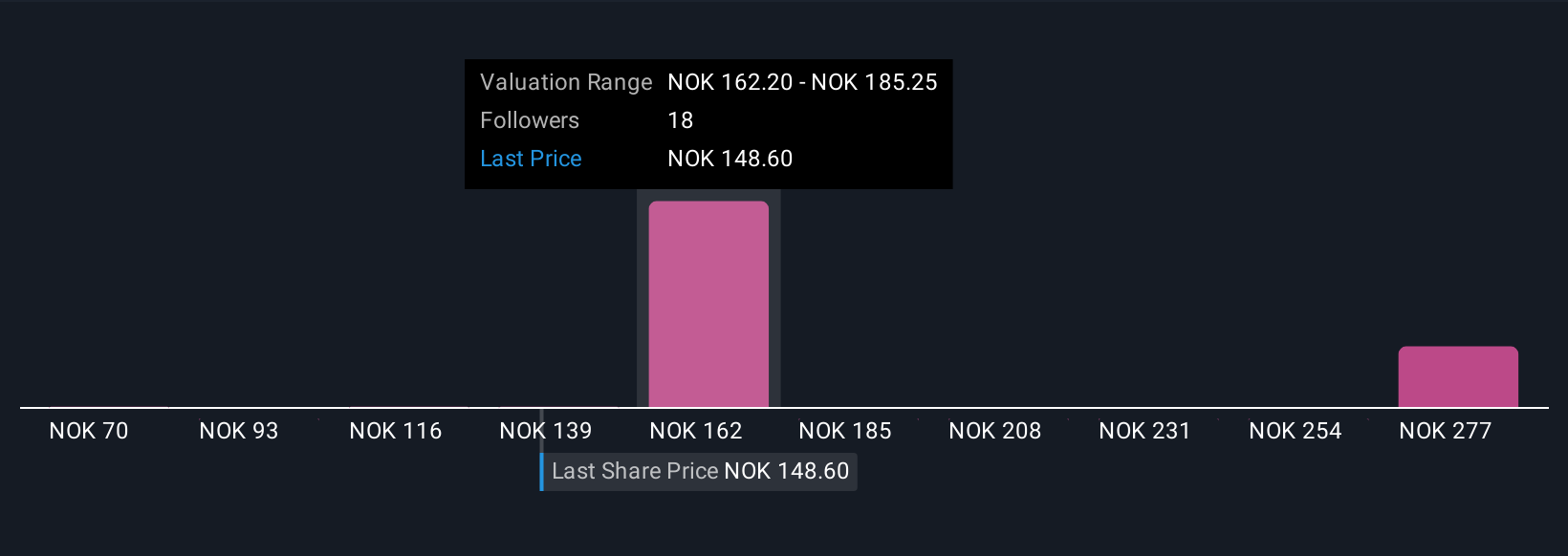

Five Simply Wall St Community members provide fair value estimates ranging from NOK70 to NOK298.44 per share, reflecting widely divergent views. While management guides growth, ongoing changes in vendor incentives will be critical to watch as you consider alternative outlooks.

Explore 5 other fair value estimates on Atea - why the stock might be worth as much as 93% more than the current price!

Build Your Own Atea Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atea research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atea research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atea's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives