- Norway

- /

- Semiconductors

- /

- OB:RECSI

There's No Escaping REC Silicon ASA's (OB:RECSI) Muted Revenues Despite A 33% Share Price Rise

REC Silicon ASA (OB:RECSI) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 87% share price decline over the last year.

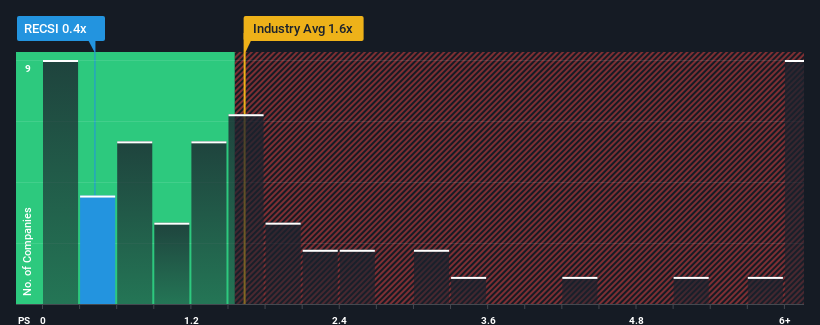

In spite of the firm bounce in price, REC Silicon's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Semiconductor industry in Norway, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for REC Silicon

How Has REC Silicon Performed Recently?

Recent revenue growth for REC Silicon has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on REC Silicon .What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like REC Silicon's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 1.7% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 41% over the next year. With the industry predicted to deliver 14% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that REC Silicon's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does REC Silicon's P/S Mean For Investors?

REC Silicon's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that REC Silicon maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 5 warning signs for REC Silicon (2 make us uncomfortable!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:RECSI

REC Silicon

Produces and sells silicon materials for the solar and electronics industries in Norway and internationally.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives