Stock Analysis

- Norway

- /

- Semiconductors

- /

- OB:RECSI

REC Silicon (OB:RECSI) Shareholders Have Enjoyed A Whopping 512% Share Price Gain

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the REC Silicon ASA (OB:RECSI) share price rocketed moonwards 512% in just one year. It's also good to see the share price up 360% over the last quarter. Having said that, the longer term returns aren't so impressive, with stock gaining just 22% in three years.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for REC Silicon

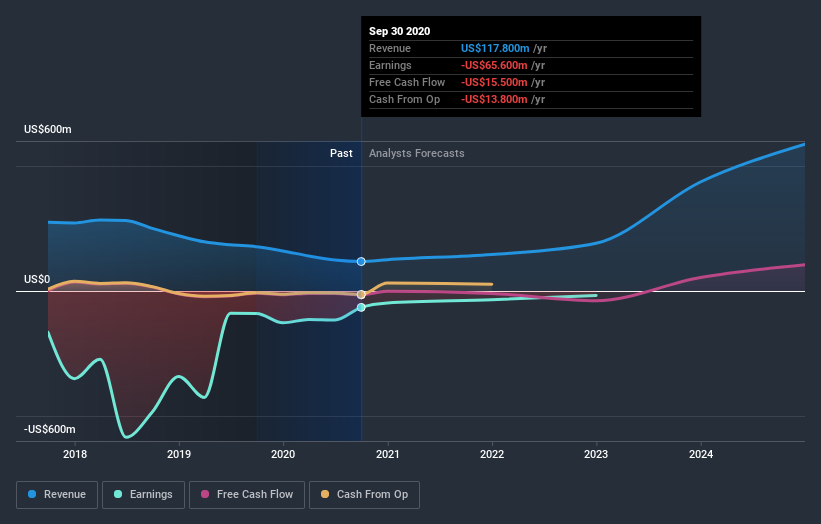

Because REC Silicon made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

REC Silicon actually shrunk its revenue over the last year, with a reduction of 33%. This is in stark contrast to the splendorous stock price, which has rocketed 512% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on REC Silicon's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that REC Silicon shareholders have received a total shareholder return of 512% over one year. Notably the five-year annualised TSR loss of 1.2% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with REC Silicon , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you decide to trade REC Silicon, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether REC Silicon is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:RECSI

REC Silicon

Produces and sells silicon materials for the solar and electronics industries worldwide.

Exceptional growth potential and good value.