- Norway

- /

- Semiconductors

- /

- OB:NOD

Analysts Are Upgrading Nordic Semiconductor ASA (OB:NOD) After Its Latest Results

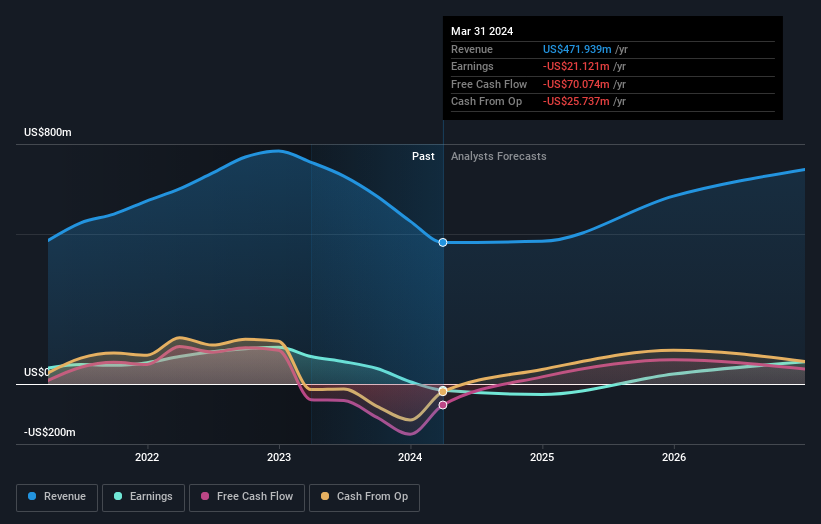

It's shaping up to be a tough period for Nordic Semiconductor ASA (OB:NOD), which a week ago released some disappointing quarterly results that could have a notable impact on how the market views the stock. Revenues missed expectations somewhat, coming in at US$75m and leading to a corresponding blowout in statutory losses. The loss per share was US$0.14, some 19% larger than the analysts forecast. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Nordic Semiconductor

Taking into account the latest results, Nordic Semiconductor's twelve analysts currently expect revenues in 2024 to be US$475.6m, approximately in line with the last 12 months. Per-share losses are expected to explode, reaching US$0.16 per share. Before this earnings announcement, the analysts had been modelling revenues of US$433.5m and losses of US$0.23 per share in 2024. So it seems there's been a definite increase in optimism about Nordic Semiconductor's future following the latest consensus numbers, with a very favorable reduction to the loss per share forecasts in particular.

It will come as no surprise to learn thatthe analysts have increased their price target for Nordic Semiconductor 15% to kr121on the back of these upgrades. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Nordic Semiconductor at kr150 per share, while the most bearish prices it at kr88.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Nordic Semiconductor's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 1.0% growth on an annualised basis. This is compared to a historical growth rate of 19% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 13% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Nordic Semiconductor.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Fortunately, they also upgraded their revenue estimates, although our data indicates it is expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Nordic Semiconductor going out to 2026, and you can see them free on our platform here.

Before you take the next step you should know about the 1 warning sign for Nordic Semiconductor that we have uncovered.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.