Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Baltic Sea Properties AS (OB:BALT) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Baltic Sea Properties

How Much Debt Does Baltic Sea Properties Carry?

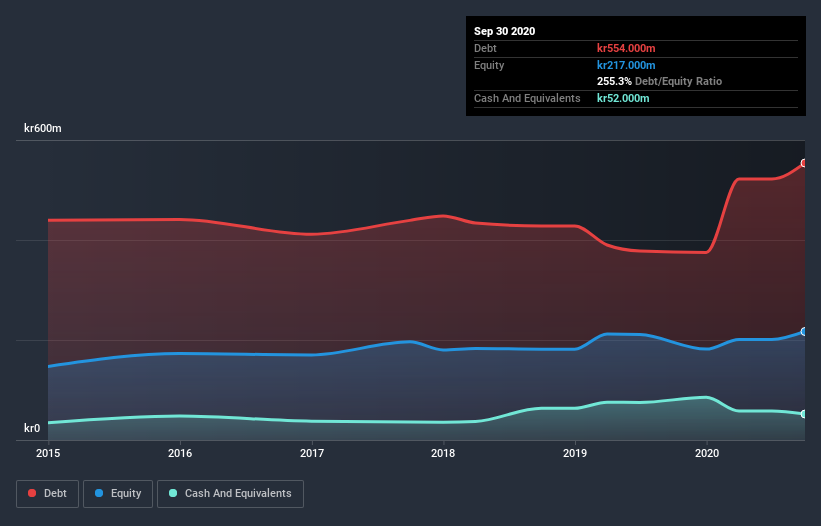

As you can see below, at the end of September 2020, Baltic Sea Properties had kr554.0m of debt, up from kr375.2m a year ago. Click the image for more detail. However, it does have kr52.0m in cash offsetting this, leading to net debt of about kr502.0m.

How Healthy Is Baltic Sea Properties's Balance Sheet?

The latest balance sheet data shows that Baltic Sea Properties had liabilities of kr56.0m due within a year, and liabilities of kr529.0m falling due after that. Offsetting these obligations, it had cash of kr52.0m as well as receivables valued at kr2.42m due within 12 months. So it has liabilities totalling kr530.6m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of kr380.1m, we think shareholders really should watch Baltic Sea Properties's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Baltic Sea Properties shareholders face the double whammy of a high net debt to EBITDA ratio (10.8), and fairly weak interest coverage, since EBIT is just 0.82 times the interest expense. This means we'd consider it to have a heavy debt load. More concerning, Baltic Sea Properties saw its EBIT drop by 4.7% in the last twelve months. If that earnings trend continues the company will face an uphill battle to pay off its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Baltic Sea Properties's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Baltic Sea Properties recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, Baltic Sea Properties's net debt to EBITDA left us tentative about the stock, and its interest cover was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its level of total liabilities also fails to instill confidence. Taking into account all the aforementioned factors, it looks like Baltic Sea Properties has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Baltic Sea Properties (of which 1 makes us a bit uncomfortable!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Baltic Sea Properties, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Baltic Sea Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:BALT

Baltic Sea Properties

Engages in the acquisition, development, letting, and rental of investment properties in Lithuania.

Good value with proven track record.

Market Insights

Community Narratives