- Norway

- /

- Real Estate

- /

- OB:ENTRA

Green Bond Issuance and Index Inclusion Might Change the Case for Investing in Entra (OB:ENTRA)

Reviewed by Sasha Jovanovic

- Earlier this month, Entra ASA completed a NOK 253.27 million floating rate unsecured green bond offering due May 2031 and was added to the Euronext 150 Index.

- This combination provides Entra with improved long-term financing flexibility and introduces the company to a wider pool of institutional investors focused on green credentials.

- We will explore how Entra's new green bond offering may influence its long-term earnings outlook and sustainability-driven positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Entra Investment Narrative Recap

To be an Entra shareholder, you'd likely need to believe in the strength of the Norwegian office market, stable long-term tenants, and the benefits of sustainable property investments. The recent green bond issuance and Euronext 150 inclusion support greater financing flexibility and broaden investor access, yet these moves do not materially address Entra’s most immediate concern: persistent vacancy risk and pressure on rental income from remote work trends.

The green bond offering is particularly relevant when considering Entra’s focus on sustainable office properties and tightening ESG regulations. With tenant and investor demand increasingly emphasizing energy efficiency, this offering reinforces Entra’s appeal but does not eliminate structural pressures from fluctuations in office use or occupancy rates.

However, as Entra works to improve occupancy and revenue, investors should also be aware that...

Read the full narrative on Entra (it's free!)

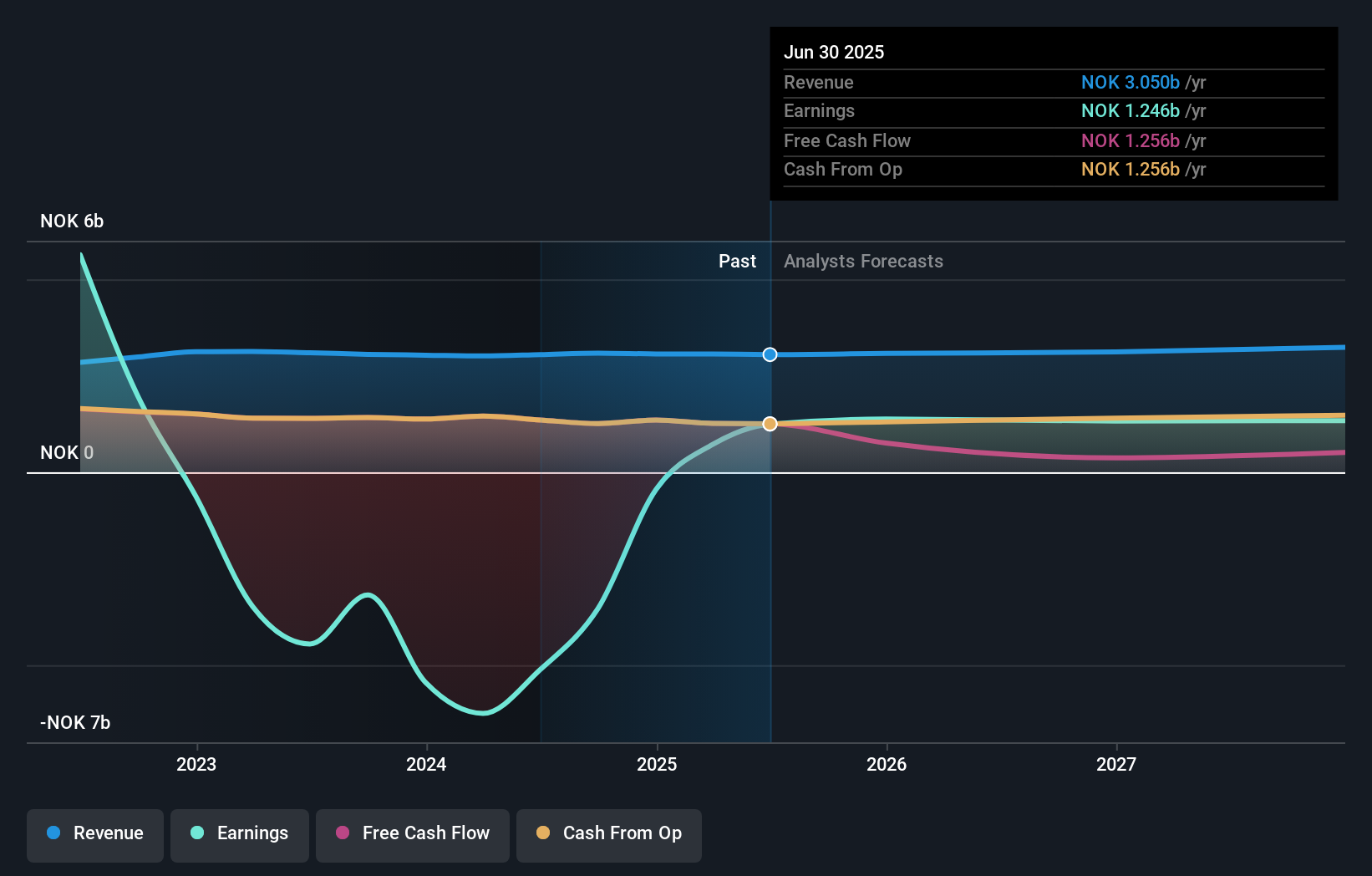

Entra's narrative projects NOK3.3 billion in revenue and NOK1.4 billion in earnings by 2028. This requires 2.2% yearly revenue growth and a NOK200 million earnings increase from the current NOK1.2 billion.

Uncover how Entra's forecasts yield a NOK119.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community pegs Entra at NOK119.50. Vacancy risk and downward pressure on rents remain key variables that may shape future outcomes for shareholders, explore these alternative viewpoints to understand how opinions can differ widely.

Explore another fair value estimate on Entra - why the stock might be worth just NOK119.50!

Build Your Own Entra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Entra research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Entra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Entra's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ENTRA

Entra

Develops real estate properties in Oslo, Bergen, Drammen, Sandvika, and Stavanger.

Fair value unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives