Last week, Thor Medical ASA (OB:TRMED) insiders, who had purchased shares in the previous 12 months were rewarded handsomely. The shares increased by 17% last week, resulting in a kr226m increase in the company's market worth, implying a 75% gain on their initial purchase. As a result, their original purchase of kr1.55m worth of stock is now worth kr2.72m.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

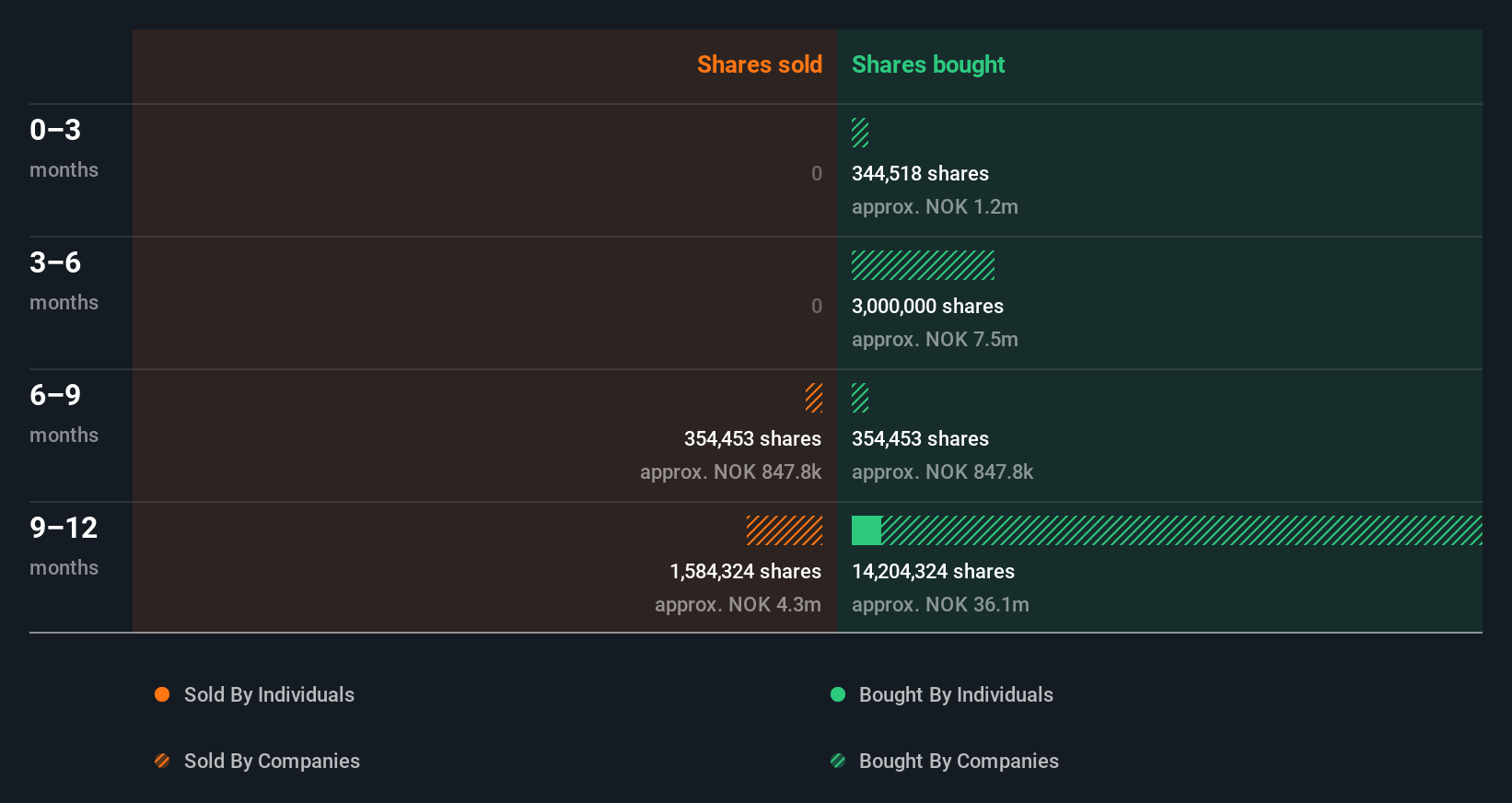

Thor Medical Insider Transactions Over The Last Year

The Executive VP of Business Development & Strategic Advisor Alf Bjørseth made the biggest insider purchase in the last 12 months. That single transaction was for kr1.0m worth of shares at a price of kr2.50 each. We do like to see buying, but this purchase was made at well below the current price of kr4.39. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

Thor Medical insiders may have bought shares in the last year, but they didn't sell any. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

View our latest analysis for Thor Medical

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership Of Thor Medical

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our data indicates that Thor Medical insiders own about kr67m worth of shares (which is 4.3% of the company). However, it's possible that insiders might have an indirect interest through a more complex structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Does This Data Suggest About Thor Medical Insiders?

The fact that there have been no Thor Medical insider transactions recently certainly doesn't bother us. But insiders have shown more of an appetite for the stock, over the last year. Overall we don't see anything to make us think Thor Medical insiders are doubting the company, and they do own shares. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 3 warning signs for Thor Medical (of which 2 are a bit concerning!) you should know about.

Of course Thor Medical may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Thor Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:TRMED

Thor Medical

Produces and supplies alpha-particle emitters for cancer therapy in Norway.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026