Investors Don't See Light At End Of Hofseth BioCare ASA's (OB:HBC) Tunnel And Push Stock Down 26%

The Hofseth BioCare ASA (OB:HBC) share price has fared very poorly over the last month, falling by a substantial 26%. Longer-term, the stock has been solid despite a difficult 30 days, gaining 11% in the last year.

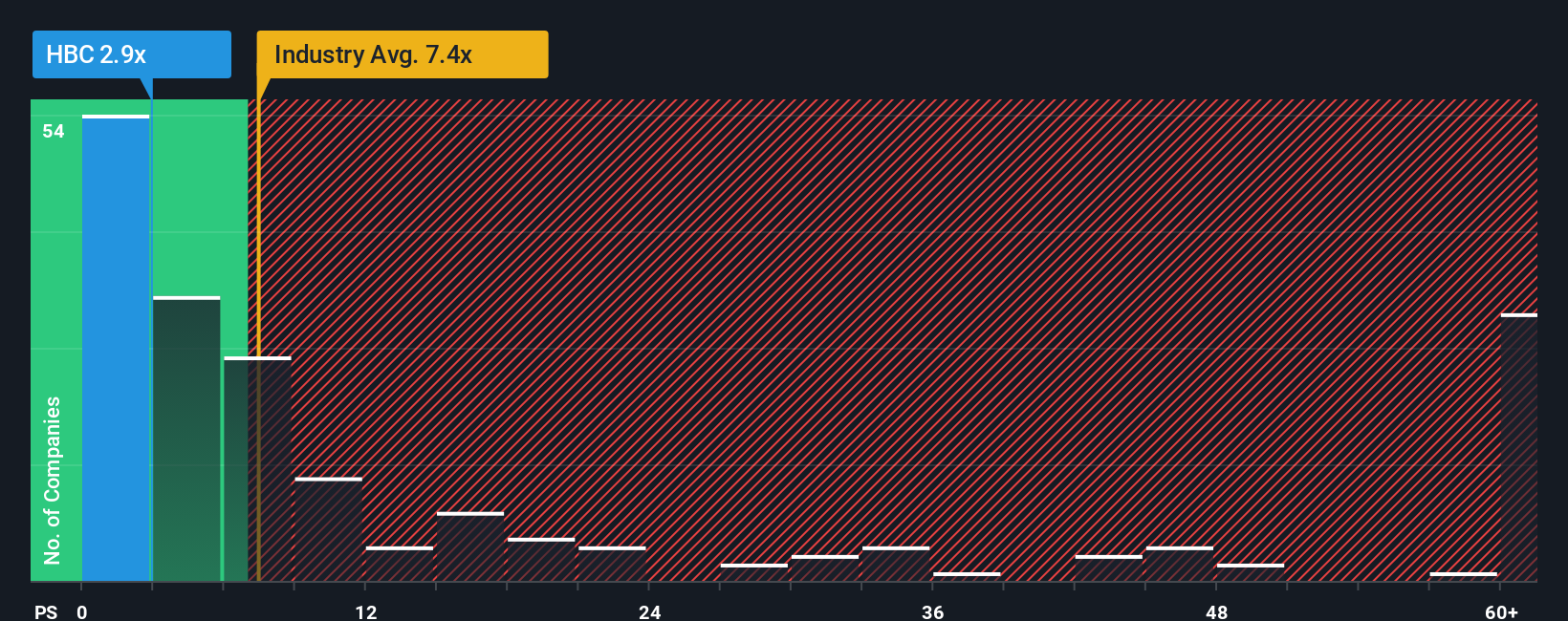

Since its price has dipped substantially, Hofseth BioCare's price-to-sales (or "P/S") ratio of 2.9x might make it look like a strong buy right now compared to the wider Biotechs industry in Norway, where around half of the companies have P/S ratios above 10.2x and even P/S above 2698x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Hofseth BioCare

How Has Hofseth BioCare Performed Recently?

For example, consider that Hofseth BioCare's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Hofseth BioCare will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hofseth BioCare's earnings, revenue and cash flow.How Is Hofseth BioCare's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Hofseth BioCare's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 121% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that to the industry, which is predicted to deliver 219% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Hofseth BioCare's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Hofseth BioCare's P/S Mean For Investors?

Having almost fallen off a cliff, Hofseth BioCare's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Hofseth BioCare confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Hofseth BioCare (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of Hofseth BioCare's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hofseth BioCare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HBC

Hofseth BioCare

Produces and sells health nutritional products for humans and pets in Norway, the United Kingdom, France, Belgium, Italy, Germany, rest of Europe, Japan, Asia, and the United States.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success