European Penny Stocks Spotlight: Valuno Group And 2 Others To Consider

Reviewed by Simply Wall St

As European markets remain mixed, with the pan-European STOXX Europe 600 Index ending roughly flat amid ongoing trade discussions, investors are keeping a close watch on economic indicators and geopolitical developments. Amid these conditions, penny stocks—often representing smaller or newer companies—continue to attract attention for their potential blend of affordability and growth. Despite their name's vintage feel, penny stocks can still offer significant value when backed by strong financials; this article will spotlight several such stocks that may hold long-term promise.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.46 | €45.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.494 | RON16.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.89 | €60.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.40 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Libertas 7 (BME:LIB) | €2.30 | €49.01M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.26 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.17 | €299.6M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.71M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 335 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Valuno Group (NGM:VALUNO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valuno Group AB (publ) is a fintech company based in Sweden with a market cap of approximately SEK 133.68 million.

Operations: The company's revenue segment includes a solution for e-merchants, generating €363.8 million.

Market Cap: SEK133.68M

Valuno Group AB, a Swedish fintech company with a market cap of approximately SEK 133.68 million, is currently unprofitable and pre-revenue. Despite its lack of profitability, the company maintains a positive free cash flow and has sufficient cash runway for over three years. However, it faces challenges with short-term liabilities exceeding short-term assets (€12.8M vs €15.1M). The company's management and board are relatively inexperienced with average tenures under two years and three years respectively. Valuno remains debt-free but experiences high share price volatility compared to most Swedish stocks, reflecting potential risks for investors in this penny stock space.

- Click to explore a detailed breakdown of our findings in Valuno Group's financial health report.

- Evaluate Valuno Group's historical performance by accessing our past performance report.

Arctic Bioscience (OB:ABS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arctic Bioscience AS is a clinical-stage biotechnology company focused on developing and commercializing pharmaceutical and nutraceutical ingredients derived from bioactive marine compounds across Norway, the United States, Europe, and Asia Pacific, with a market cap of NOK101.80 million.

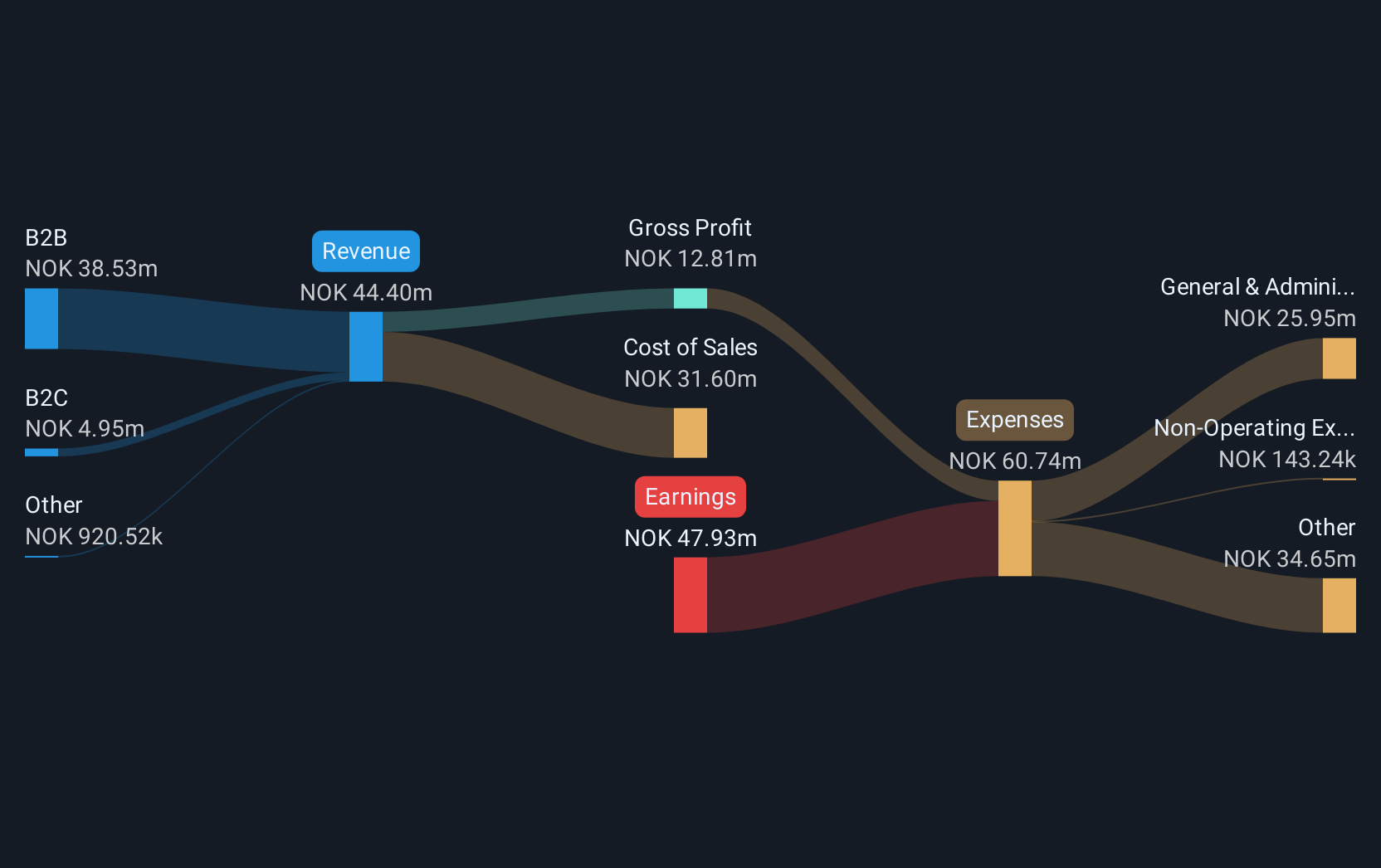

Operations: Arctic Bioscience generates revenue primarily from its B2B segment, which accounts for NOK38.53 million, and its B2C segment, contributing NOK4.95 million.

Market Cap: NOK101.8M

Arctic Bioscience, a clinical-stage biotech firm with a market cap of NOK101.80 million, is navigating financial challenges as it remains unprofitable with a net loss of NOK47.93 million for 2024 and limited revenue streams totaling NOK44.4 million. The company recently announced promising results from its HeROPA phase 2b trial, indicating potential in treating mild-to-moderate psoriasis despite not meeting the primary endpoint due to high placebo response rates. While short-term liabilities exceed assets (NOK67.5M vs NOK57.9M), Arctic Bioscience has raised additional capital to extend its cash runway beyond four months amidst going concern doubts expressed by auditors.

- Get an in-depth perspective on Arctic Bioscience's performance by reading our balance sheet health report here.

- Explore Arctic Bioscience's analyst forecasts in our growth report.

Vo2 Cap Holding (OM:VO2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vo2 Cap Holding AB (publ) operates in the media tech industry and has a market cap of SEK159.30 million.

Operations: The company generates SEK356.17 million from its advertising segment.

Market Cap: SEK159.3M

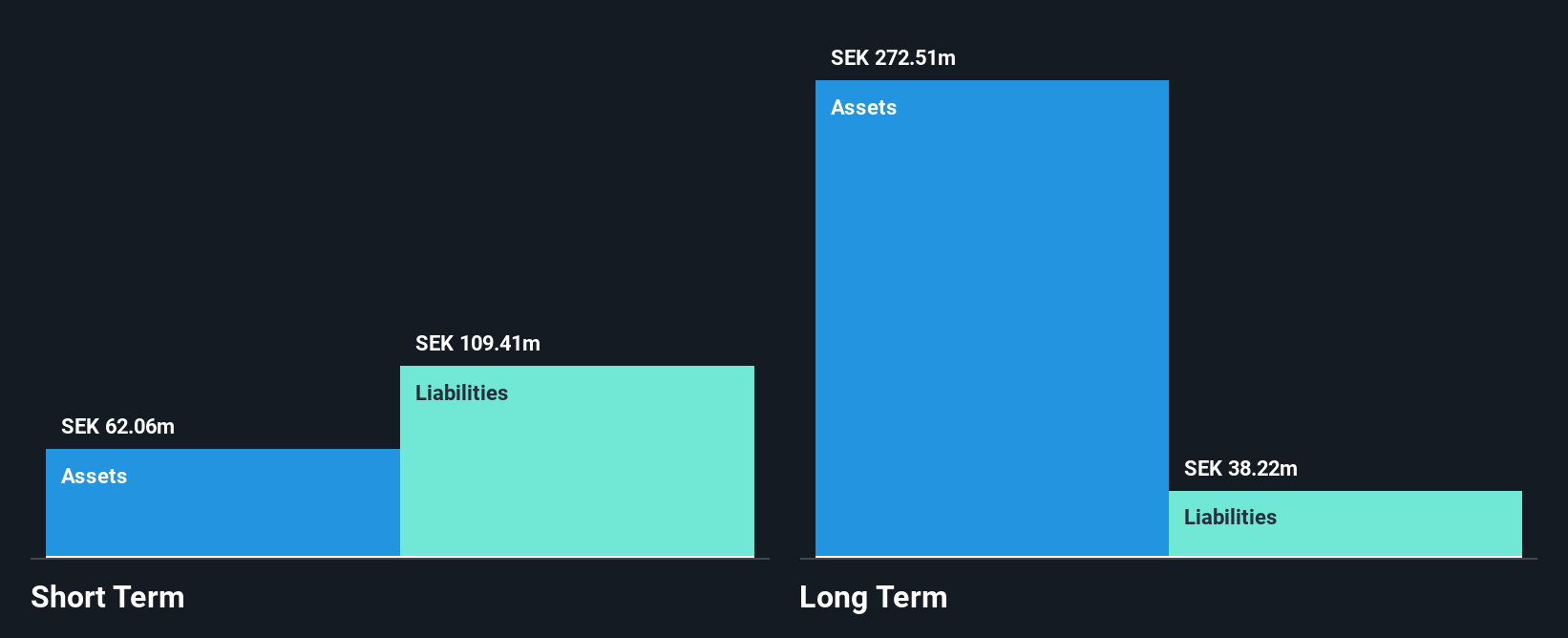

Vo2 Cap Holding AB, with a market cap of SEK159.30 million, operates in the media tech industry and reported first-quarter sales of SEK75.49 million, down slightly from the previous year. Despite being unprofitable with a net loss of SEK1.69 million for the quarter, Vo2 has more cash than total debt and maintains a positive free cash flow runway exceeding three years. However, its short-term liabilities surpass short-term assets (SEK101.1M vs SEK68.8M), and it faces challenges like high share price volatility and an inexperienced board with an average tenure of two years.

- Dive into the specifics of Vo2 Cap Holding here with our thorough balance sheet health report.

- Examine Vo2 Cap Holding's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Navigate through the entire inventory of 335 European Penny Stocks here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:VALUNO

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives