- Norway

- /

- Interactive Media and Services

- /

- OB:VEND

Vend Marketplaces (OB:VEND) Valuation in Focus as Share Issue Deadline Approaches

Reviewed by Simply Wall St

Vend Marketplaces (OB:VEND) has set November 13, 2025, as the deadline for its ongoing share issue, giving eligible A shareholders one last chance to buy in before the subscription period closes. This update carries weight for existing investors because the completion of the share issue could influence the company’s capital structure and how the market perceives its shares.

See our latest analysis for Vend Marketplaces.

The share price has pulled back over the past three months, with a 90-day share price return of -21.95%. This reflects some fading momentum after a strong long-term run. Still, Vend Marketplaces’ three-year total shareholder return stands out at 137.67%, showing that patient investors have been well rewarded even amid near-term volatility.

If this shift in momentum has you interested in what’s trending elsewhere, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

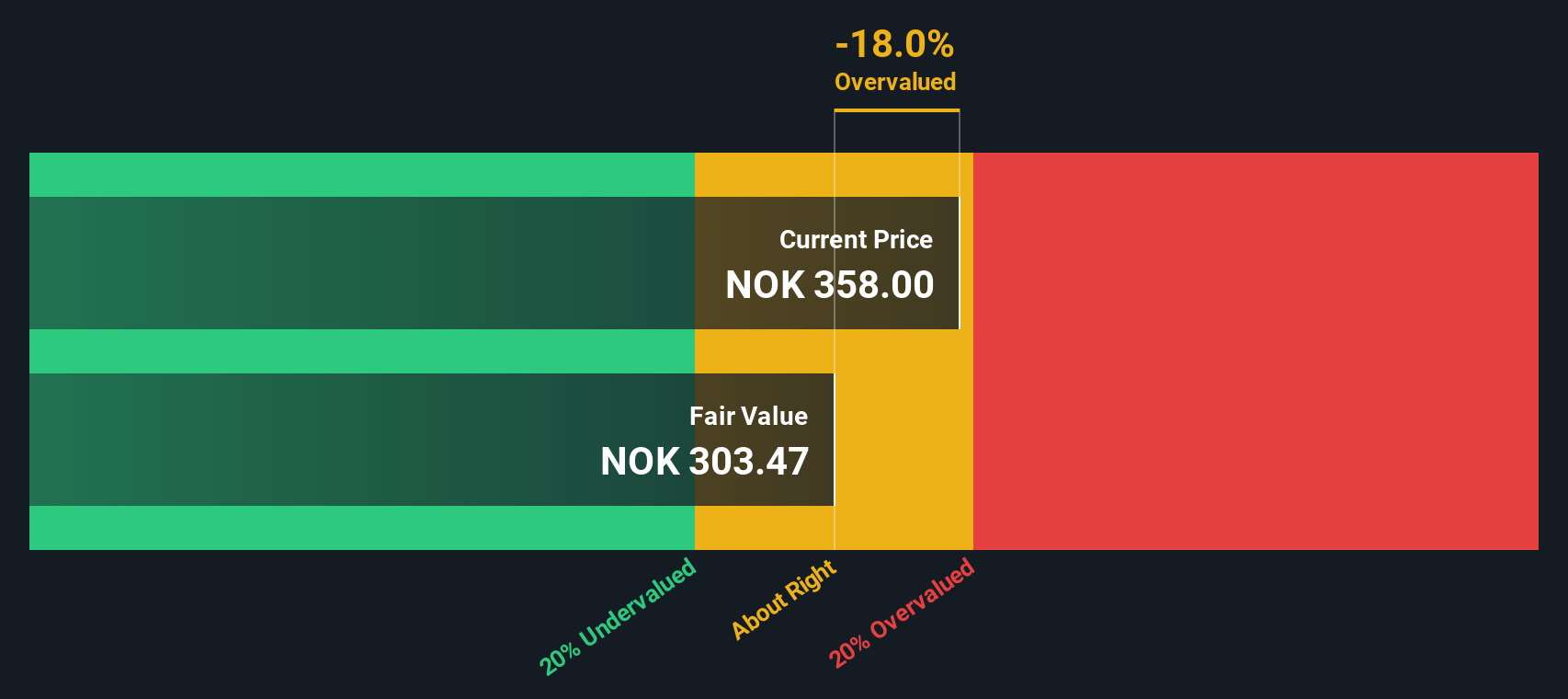

With shares trading below analyst targets and recent volatility weighing on sentiment, the real question is whether Vend Marketplaces is trading at a bargain today or if the market has already factored in its future prospects.

Price-to-Earnings of 46.2x: Is it justified?

Vend Marketplaces currently trades at a price-to-earnings (P/E) ratio of 46.2x, which is sharply higher than both its industry peers and fair value benchmarks. With the last close at NOK303.6, investors are paying a premium for each unit of earnings.

The price-to-earnings ratio measures how much investors are willing to pay today for a unit of current earnings. In the context of Interactive Media and Services, it reflects expectations for future growth and profitability.

The implication here is significant. The market appears to be pricing in robust future performance, despite recent profit declines and a large one-off gain skewing results. This elevated ratio may not be justified, considering Vend’s declining earnings and lower return on equity.

- Compared to the global industry average P/E of 22.6x and a peer average of 23.7x, Vend is far more expensive. Furthermore, its ratio is also notably higher than the estimated fair P/E of 36.3x. This is a level the market could potentially adjust toward if current growth does not materialize.

Explore the SWS fair ratio for Vend Marketplaces

Result: Price-to-Earnings of 46.2x (OVERVALUED)

However, persistently slow revenue growth and limited profit expansion could challenge the optimistic valuation narrative if these trends were to accelerate over coming quarters.

Find out about the key risks to this Vend Marketplaces narrative.

Another View: SWS DCF Model Perspective

The SWS DCF model presents a different view compared to the earnings multiple. According to our DCF analysis, Vend Marketplaces is trading above its estimated fair value of NOK291.46, suggesting the stock may be slightly overvalued based on projected cash flows. Does this challenge the current premium reflected in its price-to-earnings ratio?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vend Marketplaces for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vend Marketplaces Narrative

If you see things differently or want to dig deeper into the numbers yourself, it’s easy to form your own narrative in just a few minutes, and Do it your way.

A great starting point for your Vend Marketplaces research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let this be your only opportunity. Tap into the Simply Wall Street Screener for unique stocks that align with your strategy and goals. You could spot your next big winner.

- Spot strong income potential by checking out these 16 dividend stocks with yields > 3%, which delivers yields above 3% to boost your portfolio’s returns.

- Harness the momentum of tomorrow’s breakthroughs and seize opportunity in these 25 AI penny stocks, paving the way in artificial intelligence innovation.

- Uncover hidden value with these 877 undervalued stocks based on cash flows, shaping the landscape for bargain hunters looking for companies trading beneath their fair worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEND

Vend Marketplaces

Develops and operates various marketplaces in Sweden, Norway, Denmark, Finland, and Poland.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives