Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Polaris Media ASA (OB:POL) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Polaris Media

What Is Polaris Media's Debt?

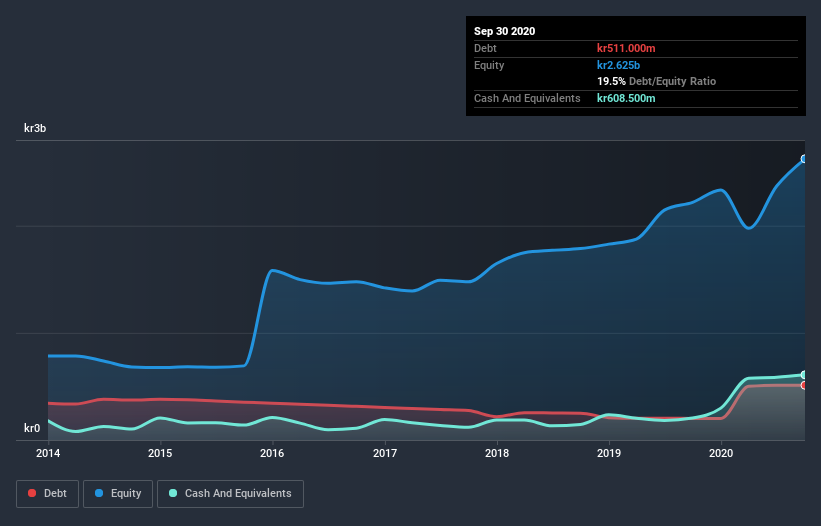

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Polaris Media had kr511.0m of debt, an increase on kr201.6m, over one year. But on the other hand it also has kr608.5m in cash, leading to a kr97.5m net cash position.

How Strong Is Polaris Media's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Polaris Media had liabilities of kr1.13b due within 12 months and liabilities of kr1.63b due beyond that. Offsetting these obligations, it had cash of kr608.5m as well as receivables valued at kr274.9m due within 12 months. So it has liabilities totalling kr1.88b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of kr2.47b, so it does suggest shareholders should keep an eye on Polaris Media's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, Polaris Media also has more cash than debt, so we're pretty confident it can manage its debt safely.

Better yet, Polaris Media grew its EBIT by 129% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But it is Polaris Media's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Polaris Media has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Polaris Media actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

Although Polaris Media's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of kr97.5m. The cherry on top was that in converted 153% of that EBIT to free cash flow, bringing in kr207m. So is Polaris Media's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Polaris Media (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Polaris Media or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:POL

Polaris Media

Operates as a media house and printing company in Norway and Sweden.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives