Yara International (OB:YAR): Valuation Insights After Jefferies' Double-Upgrade and Shifting Industry Tailwinds

Reviewed by Simply Wall St

See our latest analysis for Yara International.

After a strong run in 2024, Yara International is showing renewed momentum. Its share price has gained 24.27% year-to-date, while the total shareholder return over the past year stands at 22.29%. That combination of short-term gains and improving fundamentals suggests investors are warming up to Yara’s long-term growth story, especially as climate policy shifts start to favor the company.

If rising interest in agriculture stocks and global industry shifts have your attention, it is the perfect moment to see what else could be taking off. Broaden your search and discover fast growing stocks with high insider ownership

So after this impressive rally and a double-upgrade from analysts, is Yara International’s current valuation leaving room for upside, or have investors already priced in the company’s improving prospects and policy tailwinds?

Most Popular Narrative: 30% Undervalued

Analysts currently set Yara International's fair value at NOK 380.17, roughly 0.3% above the last close of NOK 378.90. This positions the company as an attractive value opportunity, especially given the perceived underappreciation of its cost control and policy advantages.

The market appears to be pricing in sustained strong demand for value-added and specialty fertilizers, where Yara is a leader, based on long-term increases in agricultural productivity needs and adoption of climate-smart farming. However, current order books and commentary indicate only flat to modest growth in volumes and margins for these products. If the shift to precision agriculture or specialty products stalls, future revenue and net margin expansion could disappoint.

Curious what bold projections justify Yara’s valuation bump? There’s a twist: the secret sauce behind this target is not just optimism, but a careful juggling act of expected margin shifts, revenue pressures, and future profitability assumptions. Want to see what’s making analysts rethink their stance? Peel back the layers in the full narrative.

Result: Fair Value of NOK 380.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy support in the US or Europe, or Yara’s efficient cost controls, could tilt the outlook and drive higher margins than currently expected.

Find out about the key risks to this Yara International narrative.

Another View: Are Multiples Sending a Different Signal?

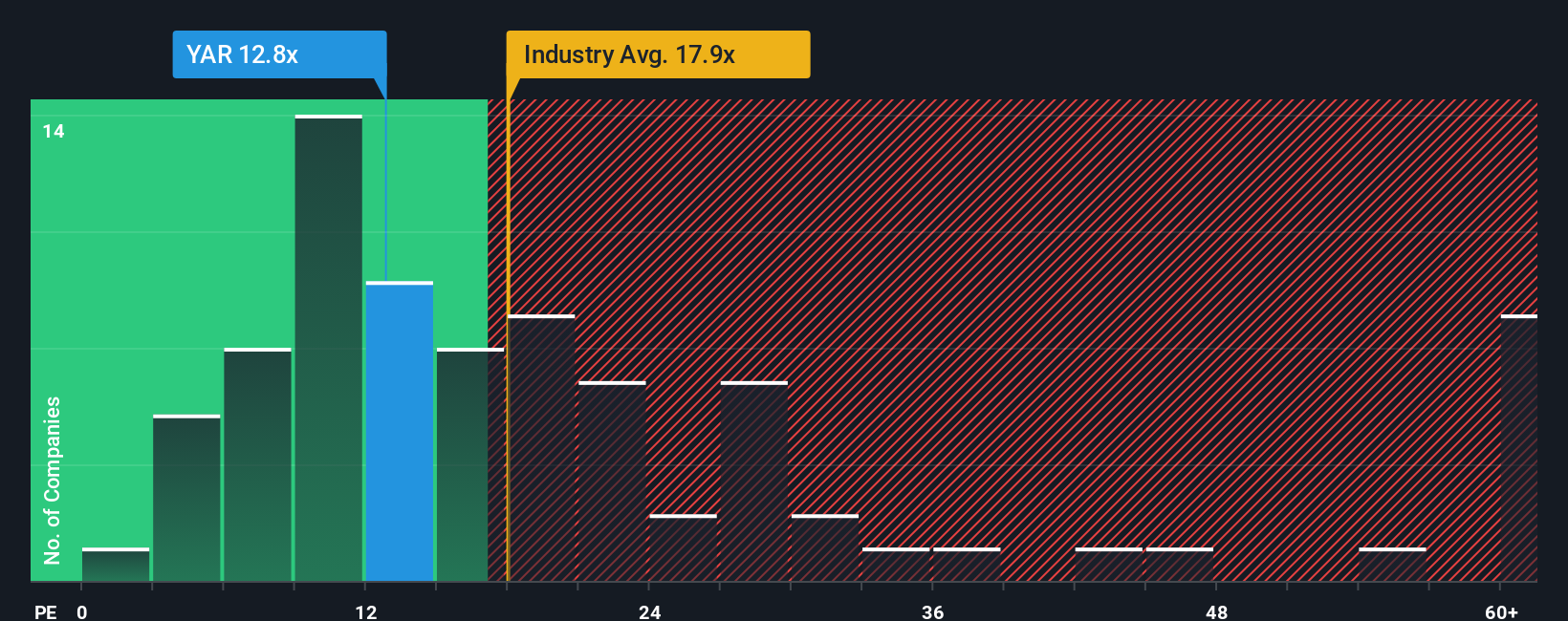

Looking beyond price targets, Yara International is trading at a price-to-earnings ratio of 13.1x, which is more attractive than both the European Chemicals industry average of 17.9x and the peer group average of 19.3x. However, this is only slightly above its fair ratio of 12.8x. This suggests the stock’s discount might be slimmer than it first appears. Is there more value to be found, or is this a value trap in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yara International Narrative

If you see the story differently or want to dig into the numbers yourself, building your own take is easier than ever. You can get started in just a few minutes. Do it your way

A great starting point for your Yara International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at one opportunity when you could catch the momentum in other promising sectors? Smart investors always scan what’s next. Make sure you do too.

- Capitalize on the next wave of artificial intelligence by tapping into these 27 AI penny stocks companies with ambitious tech pipelines and strong growth signals.

- Take advantage of undervalued gems before they’re on everyone's radar with these 870 undervalued stocks based on cash flows powered by in-depth cash flow analysis.

- Boost your income potential confidently with these 15 dividend stocks with yields > 3% that spotlight stocks offering yields above 3% and sustainable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:YAR

Yara International

Provides crop nutrition and industrial solutions in Norway, European Union, Europe, Africa, Asia, North and Latin America, Australia, and New Zealand.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives