Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Scana ASA (OB:SCANA) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Scana

How Much Debt Does Scana Carry?

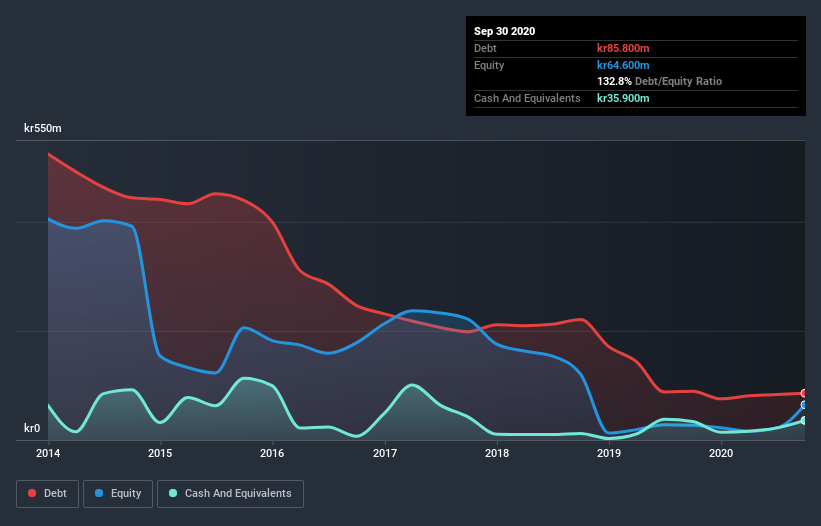

As you can see below, Scana had kr85.8m of debt at September 2020, down from kr89.4m a year prior. However, it also had kr35.9m in cash, and so its net debt is kr49.9m.

A Look At Scana's Liabilities

According to the last reported balance sheet, Scana had liabilities of kr176.2m due within 12 months, and liabilities of kr8.50m due beyond 12 months. Offsetting these obligations, it had cash of kr35.9m as well as receivables valued at kr79.7m due within 12 months. So it has liabilities totalling kr69.1m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Scana is worth kr243.0m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 0.60 times and a disturbingly high net debt to EBITDA ratio of 7.8 hit our confidence in Scana like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. The silver lining is that Scana grew its EBIT by 303% last year, which nourishing like the idealism of youth. If that earnings trend continues it will make its debt load much more manageable in the future. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Scana's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last two years, Scana actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Happily, Scana's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But the stark truth is that we are concerned by its interest cover. All these things considered, it appears that Scana can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Scana (2 are concerning) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Scana, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:SCANA

Scana

Provides technology and services for the offshore and energy industries in Norway, other European countries, the United States, Asia, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives