Elkem (OB:ELK) Profit Margin Drop Reinforces Market Caution on Recent Earnings Quality

Reviewed by Simply Wall St

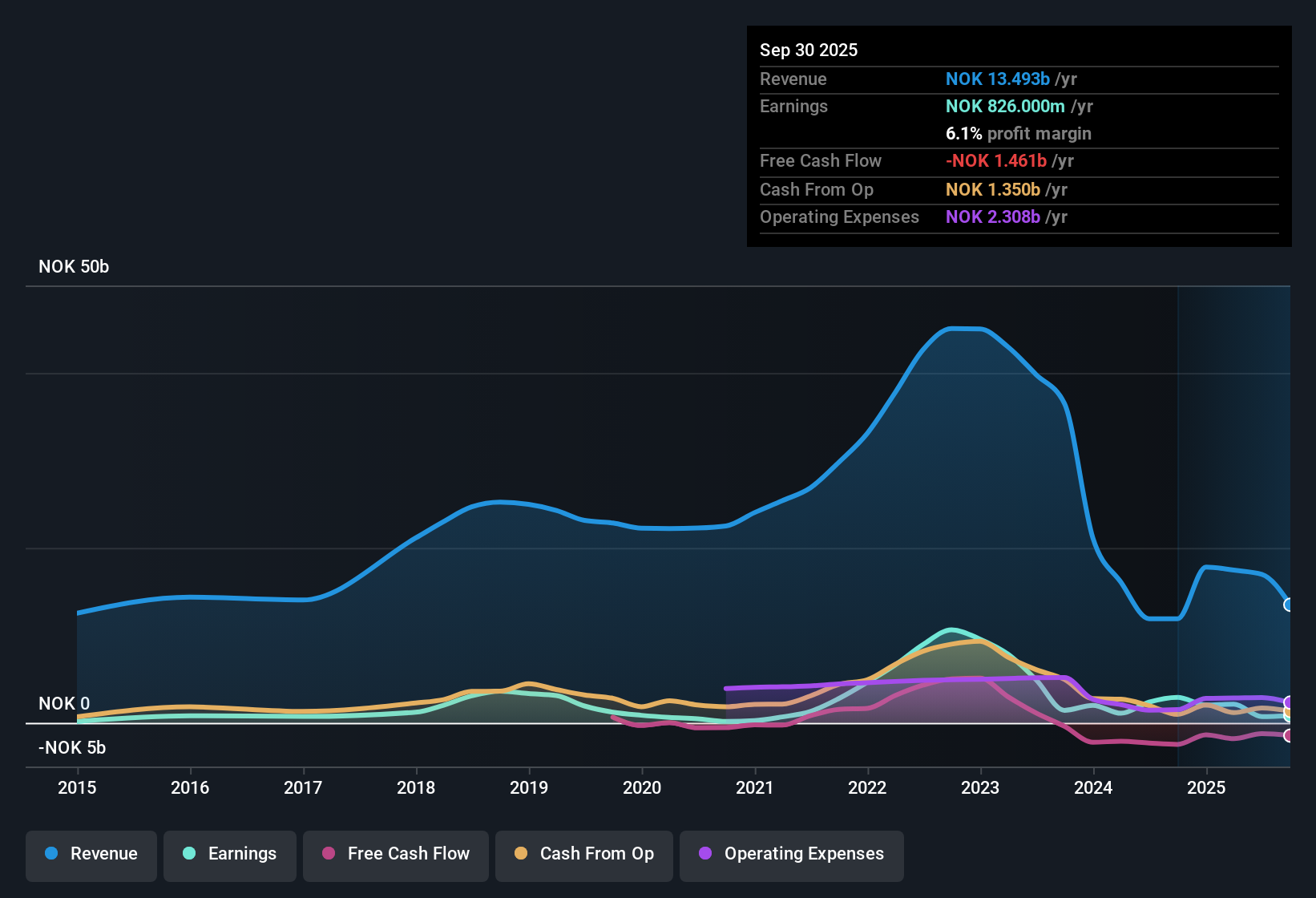

Elkem (OB:ELK) reported net profit margins of 4.1%, down sharply from 19.9% last year. Results were boosted by a one-off NOK792.0 million gain in the past twelve months. Over the past five years, earnings have declined by 3.4% per year. Looking ahead, earnings are forecast to surge by nearly 85% annually over the next three years, with revenue also expected to climb 7.4% each year, outpacing the Norwegian market average. While the near-term growth outlook is ambitious, investors will be weighing this against weaker profit margins and the impact of non-recurring gains on recent results.

See our full analysis for Elkem.Next, we will see how these headline numbers match up with the broader narratives investors are following, and where expectations might be recalibrated.

See what the community is saying about Elkem

DCF Fair Value Sits at a Massive Premium

- The DCF fair value for Elkem stands at NOK266.16, almost ten times the current share price of NOK26.74. This points to a significant gap between the market price and long-term intrinsic estimates.

- According to analysts' consensus view, this large discount does not fully capture ongoing risks and may be explained by:

- Non-recurring gains, such as the NOK792.0 million one-off, have boosted reported results and could distort traditional fair value models.

- Analyst price targets are much closer to the current price. This suggests that, while models indicate a deep discount, the market is more cautious due to recent profit margin pressure and ongoing sector headwinds.

Curious to see how valuation, risk, and forecasts interact in the big picture? Read the full consensus story for Elkem and compare your take with market experts. 📊 Read the full Elkem Consensus Narrative.

Profit Margins Remain Under Pressure

- Net profit margins have dropped from 19.9% to 4.1% over the year, highlighting a major compression in profitability even with non-recurring benefit.

- Analysts' consensus view notes Elkem’s margins may recover slowly:

- Forecasts expect margins to rise modestly to 4.5% over the next three years, showing only a partial recovery.

- Operational improvements, especially in China, could enhance competitiveness. However, persistent global trade tensions and market demand weakness continue to weigh on margin potential.

Earnings Growth Set to Outpace Industry

- Elkem is projected to post annual earnings growth of 85% over the next three years, outpacing the Norwegian market average and reversing the 3.4% annual earnings decline seen over the last five years.

- Consensus narrative emphasizes this outlook is built on several factors:

- Ongoing R&D in sustainability, along with a globally diverse revenue base, could support future growth and strengthen net earnings if global demand recovers.

- At the same time, some analysts remain concerned that continued volatility in global markets and sector-specific pressures could make such rapid growth forecasts difficult to achieve, especially if trade disruptions persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Elkem on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpreting these figures your own way? You can share your personal take in just a few clicks and help shape the ongoing discussion. Do it your way

A great starting point for your Elkem research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Elkem’s profit margins have sharply contracted and its earnings growth, while promising, relies on ambitious forecasts amid volatile market conditions.

If you want more consistent results, check out stable growth stocks screener (2090 results) to discover companies with reliable earnings and revenue expansion throughout different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elkem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ELK

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives