Here's Why I Think Protector Forsikring (OB:PROT) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Protector Forsikring (OB:PROT), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Protector Forsikring

How Fast Is Protector Forsikring Growing Its Earnings Per Share?

In the last three years Protector Forsikring's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Protector Forsikring's EPS soared from kr10.81 to kr14.14, in just one year. That's a impressive gain of 31%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Protector Forsikring's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Protector Forsikring shareholders can take confidence from the fact that EBIT margins are up from 19% to 24%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

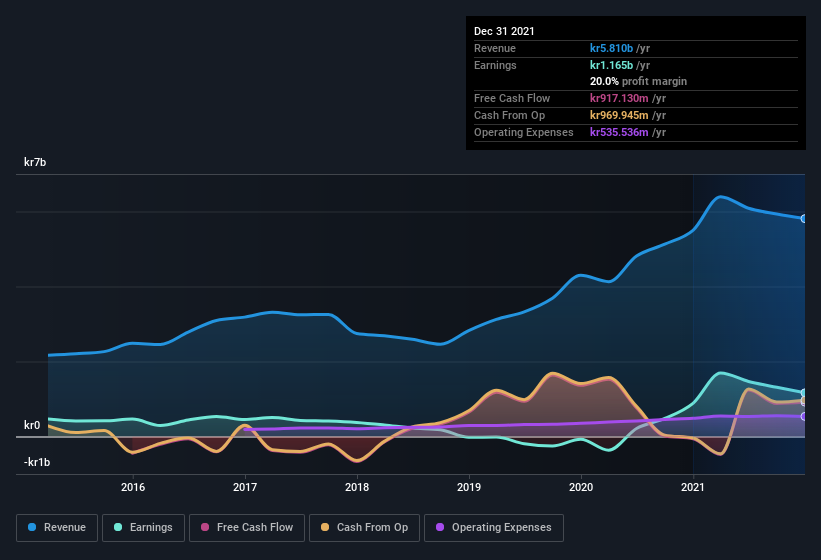

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Protector Forsikring's balance sheet strength, before getting too excited.

Are Protector Forsikring Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth -kr2.5m) this was overshadowed by a mountain of buying, totalling kr21m in just one year. I find this encouraging because it suggests they are optimistic about the Protector Forsikring's future. Zooming in, we can see that the biggest insider purchase was by Independent Deputy Chairman Arve Ree for kr13m worth of shares, at about kr91.10 per share.

On top of the insider buying, it's good to see that Protector Forsikring insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at kr528m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does Protector Forsikring Deserve A Spot On Your Watchlist?

You can't deny that Protector Forsikring has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. It is worth noting though that we have found 2 warning signs for Protector Forsikring (1 makes us a bit uncomfortable!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Protector Forsikring isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PROT

Protector Forsikring

Operates as a non-life insurance company, provides direct general insurance and reinsurance to the commercial lines of business, public sector, and affinity schemes.

Good value with proven track record.

Market Insights

Community Narratives