- Poland

- /

- Construction

- /

- WSE:PXM

Discovering 3 Undiscovered European Gems With Solid Foundations

Reviewed by Simply Wall St

As the European markets experience a lift, with the pan-European STOXX Europe 600 Index rising by 1.60% amid signs of steady economic growth and supportive monetary policies, investors are increasingly turning their attention to smaller companies that might offer untapped potential. In this environment, stocks with solid foundations—characterized by strong financials, innovative business models, and competitive positioning—are particularly appealing for those looking to uncover hidden opportunities in Europe's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Endúr (OB:ENDUR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Endúr ASA is a company that provides construction and maintenance projects, services, and solutions for infrastructure in Norway, the Norwegian Continental Shelf, Sweden, and internationally, with a market capitalization of NOK4.44 billion.

Operations: Endúr ASA generates revenue primarily from its Infrastructure and Aquaculture Solutions segments, with the Infrastructure segment contributing NOK4.07 billion and Aquaculture Solutions adding NOK856.50 million.

Endúr, a notable player in the machinery sector, has shown remarkable earnings growth of 2775% over the past year, outpacing its industry peers. Despite this impressive performance, challenges remain with interest payments not well covered by EBIT at 2.4 times coverage. The company's net debt to equity ratio stands at a satisfactory 8.9%, though it has increased from 24.7% to 46.9% over five years. Recently reported third-quarter sales reached NOK1,841 million compared to NOK742 million last year, and net income rose significantly to NOK63 million from NOK11 million previously, highlighting strong financial momentum despite shareholder dilution concerns.

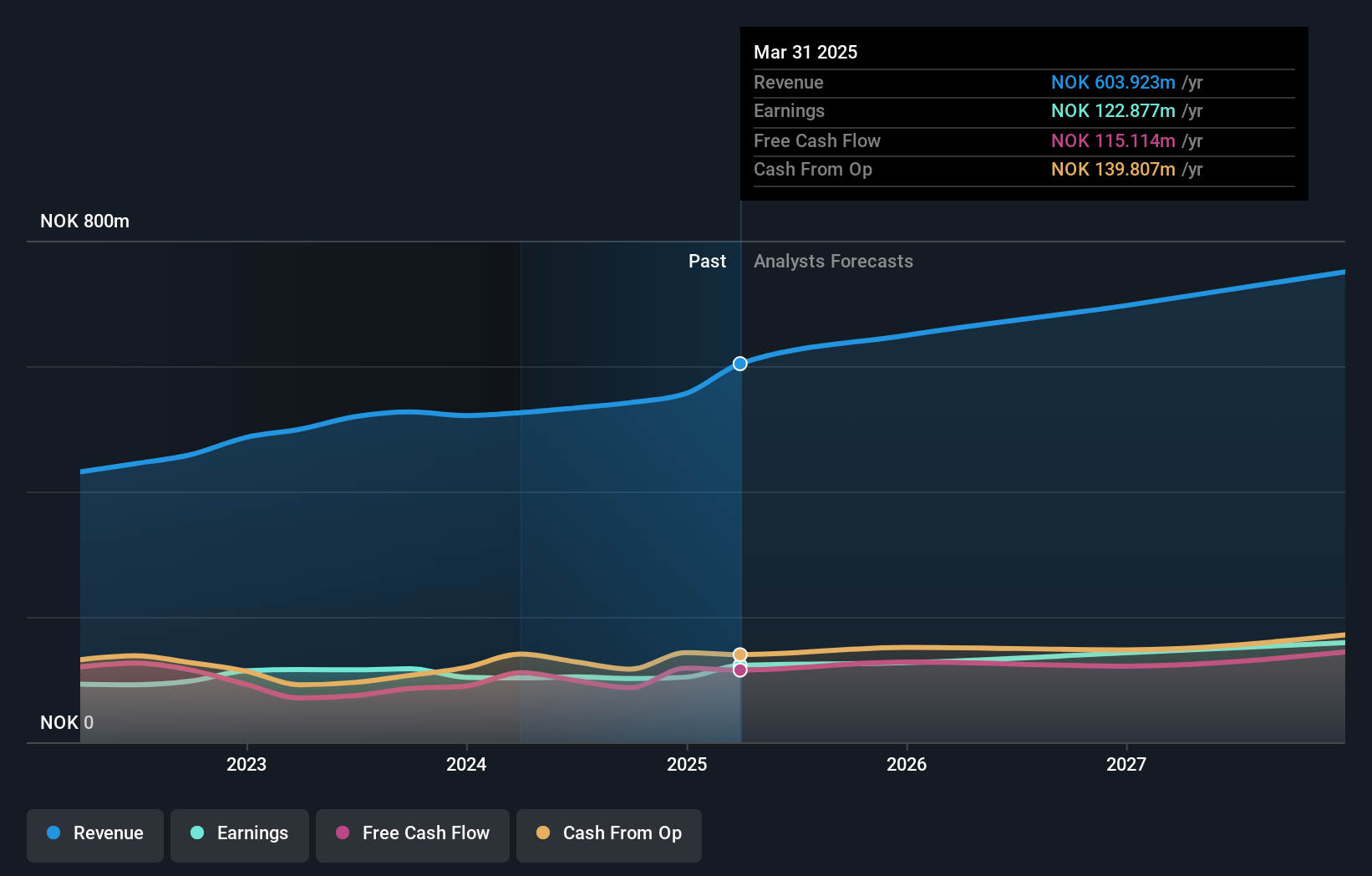

Medistim (OB:MEDI)

Simply Wall St Value Rating: ★★★★★★

Overview: Medistim ASA is a company that specializes in the development, production, servicing, leasing, and distribution of medical devices for cardiac and vascular surgery across various international markets with a market cap of NOK4.81 billion.

Operations: Medistim generates revenue primarily from its Medistim Products, contributing NOK 567.87 million, and Third-Party Products, adding NOK 100.74 million.

Medistim, a company in the medical device sector, has been making waves with its robust growth and strategic market expansions. Over the past year, earnings surged by 40.1%, significantly outpacing the industry average of 3.8%. Recent quarterly results revealed sales of NOK 166.85 million and a net income of NOK 34.71 million, both up from last year’s figures. The firm is debt-free now compared to a debt-to-equity ratio of 3.7% five years ago, reflecting strong financial health. However, potential shifts in surgical practices could challenge future performance despite current optimism fueled by innovative product launches like MiraQ platform upgrades and expansion into high-margin markets globally.

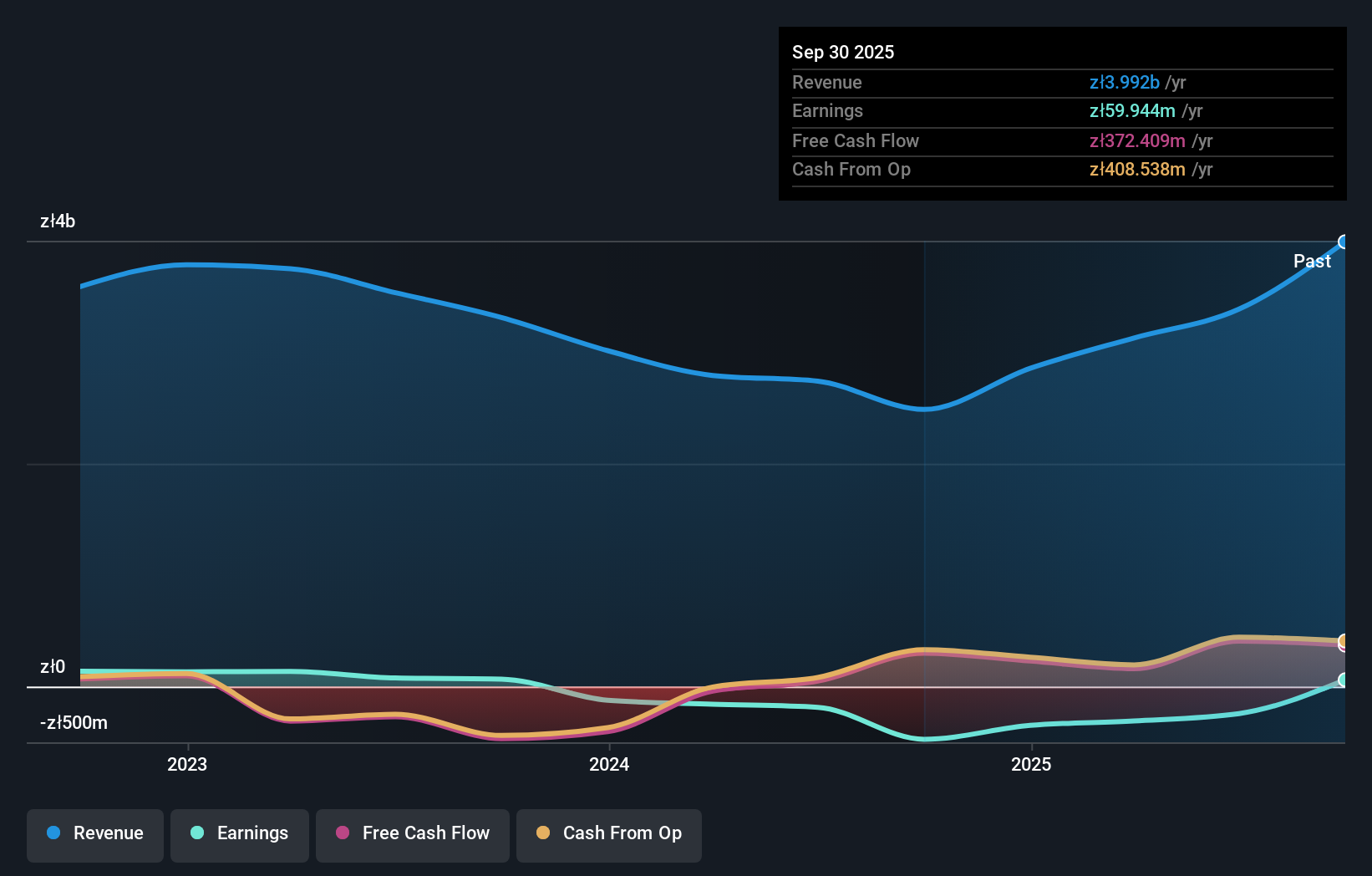

Polimex-Mostostal (WSE:PXM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Polimex-Mostostal S.A. is an engineering and construction company with operations in Poland and internationally, having a market cap of PLN2 billion.

Operations: Polimex-Mostostal generates revenue primarily from its Kerosene, Gas, Chemicals segment at PLN1.56 billion and the Power Industry segment at PLN1.16 billion. The Industrial Construction and Structural Construction segments contribute PLN714.85 million and PLN427.94 million respectively, while Production adds PLN992.04 million in revenue.

Polimex-Mostostal, a dynamic player in the construction sector, has shown remarkable progress with its debt to equity ratio dropping from 58% to 17.3% over five years. Its interest payments are comfortably covered by EBIT at a factor of 125.4, indicating robust financial health. The company reported impressive sales growth for Q3 2025 at PLN 1,097 million compared to PLN 492 million last year, translating into net income of PLN 35 million from a previous loss of PLN 267 million. Trading significantly below estimated fair value and boasting high-quality earnings, Polimex-Mostostal presents an intriguing investment opportunity despite recent share price volatility.

Next Steps

- Click this link to deep-dive into the 309 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PXM

Polimex-Mostostal

Operates as an engineering and construction company in Poland and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion