SalMar (OB:SALM): Assessing Valuation in Light of Q3 Growth and Ambitious Harvest Targets

Reviewed by Simply Wall St

SalMar (OB:SALM) just released its third quarter results, revealing an increase in sales and net income for the period. The company also outlined ambitious harvest volume growth targets for 2025 and 2026, which has drawn investor attention.

See our latest analysis for SalMar.

Despite a recent dip in the share price, with SalMar down 6.5% over the past month, the company has enjoyed a sharp rebound in the past three months, gaining more than 24%. This renewed optimism appears connected to the company’s ambitious harvest targets and solid Q3 sales and profitability figures. Looking at the bigger picture, SalMar’s one-year total shareholder return stands at 7.6%, and long-term holders have seen the stock soar nearly 95% over three years. Momentum is clearly building after a volatile stretch.

If you’re interested in what’s driving momentum in other corners of the market, now’s a good time to discover fast growing stocks with high insider ownership.

With recent gains and bold growth forecasts, the key question now is whether SalMar’s strong future outlook signals a buying opportunity or if the market has already factored in next year’s ambitious targets.

Most Popular Narrative: 3.5% Undervalued

SalMar’s most widely followed narrative places its fair value just above the last close price, suggesting there could still be room for upside. The narrative’s updated numbers reflect optimism around improving fundamentals, balanced by sector-wide uncertainties.

The new fair value estimate reflects confidence in SalMar’s ability to execute on its long-term growth strategies. Expectations of continued expansion in key markets support a positive outlook for future earnings.

Want to know what assumptions drive this bullish adjustment? The narrative hinges on a powerful combination of efficiency gains and ambitious earnings projections, along with a major uptick in profit margins. The real surprise comes from how these forecasts translate into the new fair value. Curious which financial trends could spark even bigger moves? Dive into the full narrative for all the behind-the-scenes number crunching.

Result: Fair Value of $592.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing environmental challenges and fluctuating input costs could quickly derail these optimistic projections. These factors act as key risks for SalMar’s future performance.

Find out about the key risks to this SalMar narrative.

Another View: Does the Market Agree?

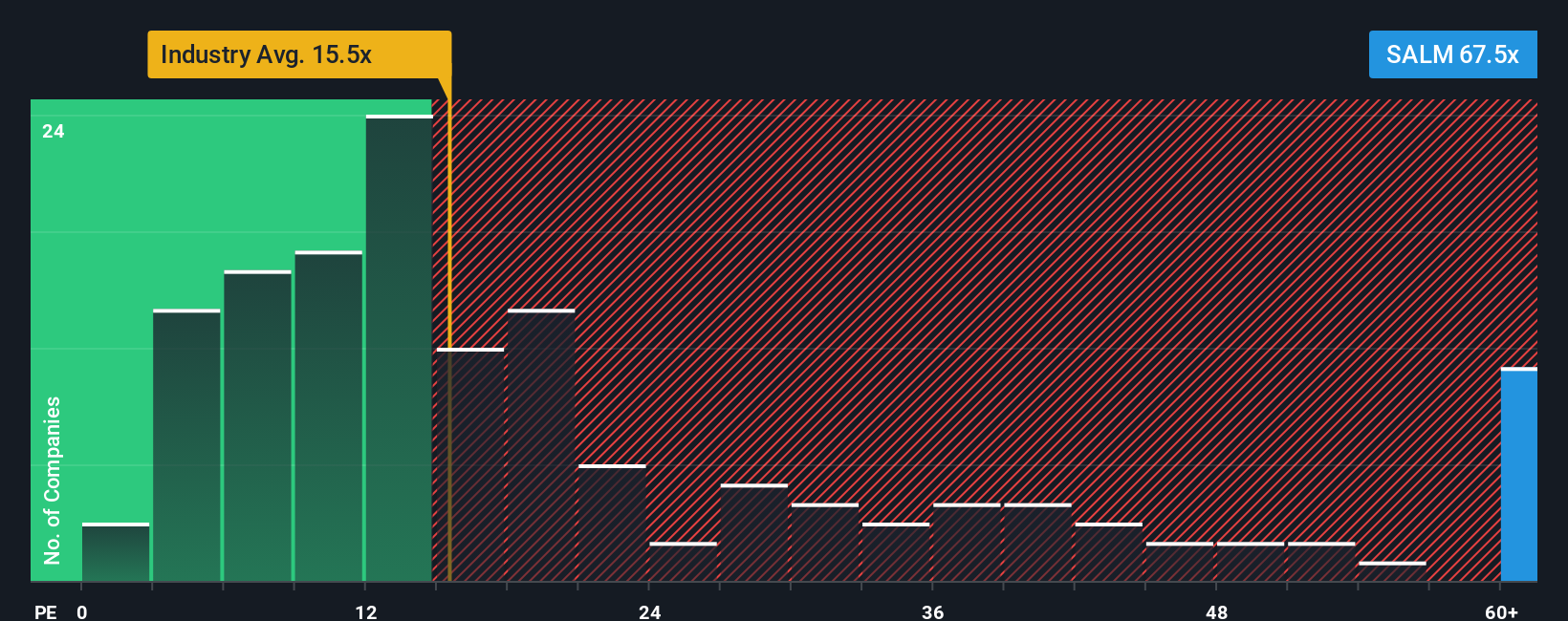

While the first valuation points to SalMar as undervalued, looking at the company’s price-to-earnings ratio tells a different story. At 67.2x, SalMar trades far above the industry average of 15x and the peer average of 26.4x. Even the fair ratio suggests a lower figure of 55.9x. This steep premium raises questions about whether optimism in the earnings outlook already sits in the price. Is there real upside left, or is caution called for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SalMar Narrative

If you see things differently or want to dig deeper into the data, you can create a SalMar narrative and reach your own conclusions in just a few minutes. Do it your way

A great starting point for your SalMar research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by checking out carefully chosen stock ideas using the Simply Wall Street Screener. Miss these, and you could be missing tomorrow’s biggest winners.

- Boost your portfolio's stability and secure solid income streams by reviewing these 16 dividend stocks with yields > 3% with impressive yields above 3%.

- Tap into the companies harnessing machine intelligence by scoping out these 25 AI penny stocks shaping the future of business and innovation.

- Uncover opportunities at compelling prices using these 894 undervalued stocks based on cash flows based on real cash flow fundamentals today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SALM

SalMar

An aquaculture company, produces and sells farmed salmon in Norway, Asia, Europe, North America, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives