The Bull Case For Mowi (OB:MOWI) Could Change Following Dividend Hike and Upgraded Harvest Guidance

Reviewed by Sasha Jovanovic

- Earlier this month, Mowi ASA reported third quarter 2025 results, revealing higher net income of €110 million despite a modest drop in sales, raised its full-year harvest guidance to 554,000 tonnes, and announced a NOK1.50 per share quarterly dividend distribution to shareholders.

- An important insight is the upgraded harvest outlook driven by the Nova Sea consolidation, which signals confidence in volume growth and operational scale.

- We'll assess how Mowi's higher dividend and boosted 2025 harvest target impact the company's investment narrative and growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mowi Investment Narrative Recap

To be a Mowi shareholder today, you need to believe that global salmon demand will eventually rebalance against recent supply surges, allowing Mowi’s cost reductions and expanding harvest volumes to support stronger margins ahead. The updated harvest guidance and dividend increase reinforce the near-term growth catalyst of scale but do not fundamentally change the major risk: prolonged industry oversupply and price pressure continue to threaten profitability and returns to shareholders.

The most relevant recent announcement is Mowi’s raised harvest volume guidance for 2025, now projected at 554,000 tonnes due to the Nova Sea consolidation. This underscores the company’s efforts to maintain a leading position in production scale, aiming to capture incremental growth even as supply-driven risks continue to impact salmon prices and net margins.

Yet, in contrast to promising harvest targets, investors should also be aware of ongoing margin vulnerabilities if supply growth remains elevated for longer than expected …

Read the full narrative on Mowi (it's free!)

Mowi's outlook projects €7.3 billion in revenue and €1.1 billion in earnings by 2028. This is based on an assumed 8.6% annual revenue growth and an increase in earnings of €764.7 million from the current €335.3 million.

Uncover how Mowi's forecasts yield a NOK236.47 fair value, a 5% upside to its current price.

Exploring Other Perspectives

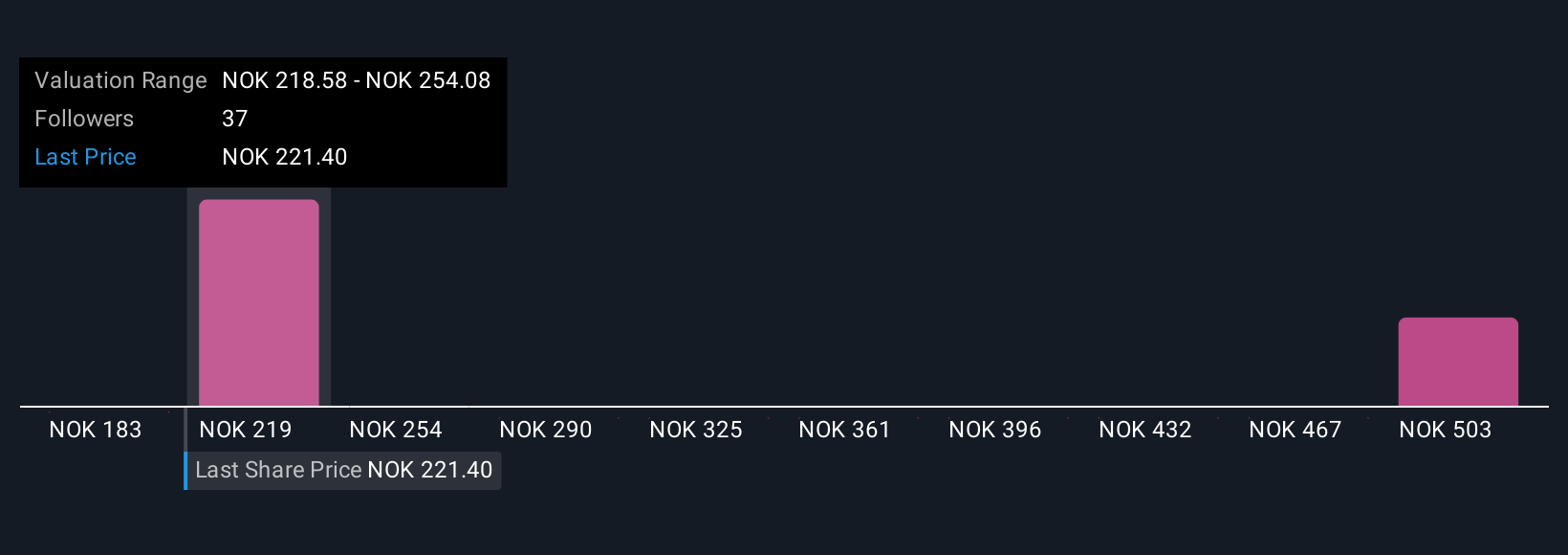

Your fellow Simply Wall St Community members have arrived at fair value estimates for Mowi ranging from NOK183 to NOK536, with seven unique perspectives represented. Many focus on the company’s ability to sustain cost reductions and volume growth even as prolonged price pressure from industry oversupply remains a central concern for future performance.

Explore 7 other fair value estimates on Mowi - why the stock might be worth over 2x more than the current price!

Build Your Own Mowi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mowi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mowi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mowi's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives