Lerøy Seafood Group (OB:LSG): Assessing Valuation After Successful NOK 500m Green Bond Issue Draws Strong Demand

Reviewed by Kshitija Bhandaru

If you’ve been watching Lerøy Seafood Group (OB:LSG) lately, today’s news is certainly worth a closer look. The company just wrapped up a NOK 500 million green bond issue, which not only raised capital for sustainable projects, but also attracted significantly more investor interest than anticipated. For investors deciding what to do with the stock right now, this move feels like more than just a routine capital raise. It serves as a vote of confidence in both the company’s credit profile and its green ambitions.

Zooming out, Lerøy Seafood Group’s shares have shown steady growth over the past year, gaining around 10 percent and building positive momentum in recent months. That trend has been supported by several earnings reports showing revenue and net income growth, along with the company’s clear push into sustainable financing initiatives. Short-term price swings have been mild, but the backdrop of long-term expansion remains intact.

Given the strong demand for this green bond and Lerøy’s performance this year, is the current share price a good entry for those seeking value, or is the market already factoring in all the future green upside?

Most Popular Narrative: 13% Undervalued

The current narrative indicates Lerøy Seafood Group shares are trading below estimated fair value, suggesting room for upside based on mainstream analyst forecasts and financial projections.

“Lerøy's sustained investment in new farming technologies (such as submerged and shielding technology) and its in-house improvement program have already yielded higher survival rates, lower mortality, and cost reductions. This positions the company for continued increases in production volumes with better efficiency, which should positively impact both revenue growth and net margins.”

Curious how Lerøy’s fair value taps into breakthrough aquaculture tech, future profit margins, and a growth roadmap that turns industry heads? The narrative's fair value rests on bullish earnings and revenue assumptions that could redefine what investors expect from the sector. Dive deeper to discover the ambitious projections driving this bullish price target.

Result: Fair Value of NOK 57.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent inflation in key inputs or major fluctuations in salmon and trout prices could undermine Lerøy’s projected earnings improvements and overall growth trajectory.

Find out about the key risks to this Lerøy Seafood Group narrative.Another View: Market-Based Comparison

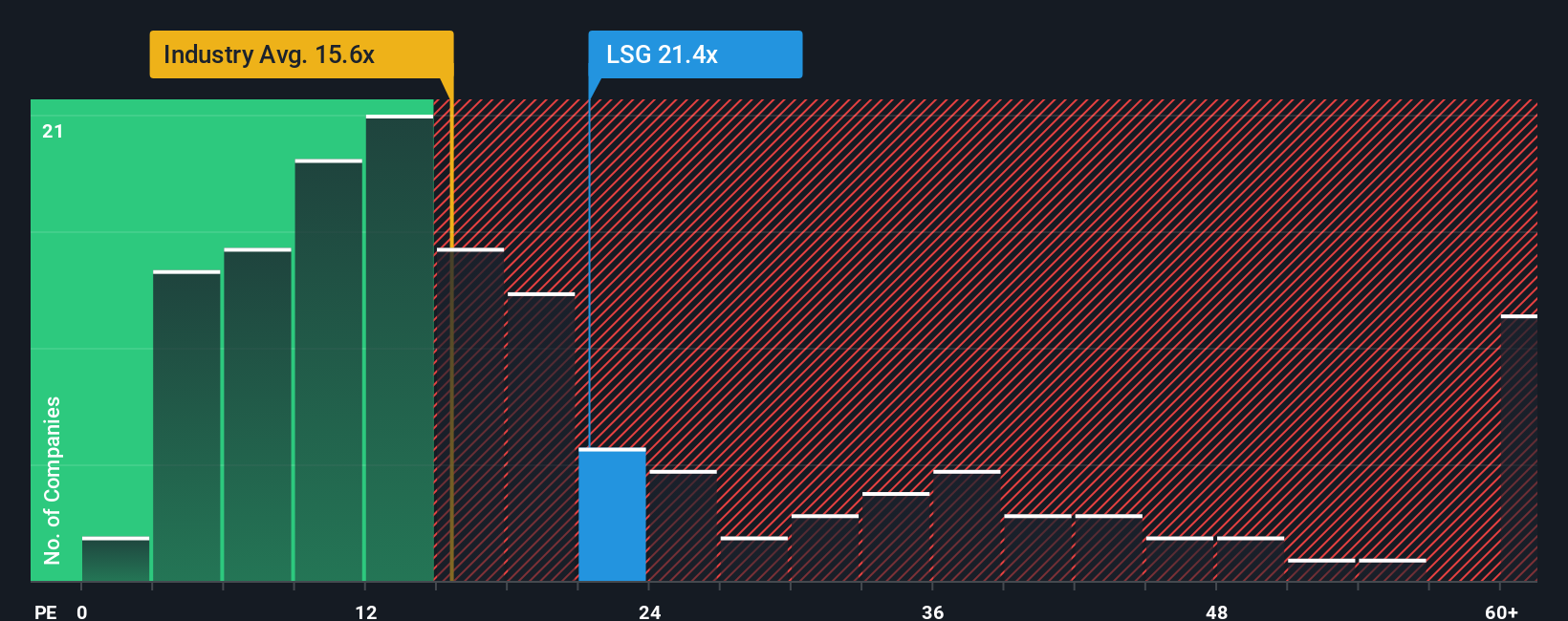

While analyst forecasts and earnings projections suggest Lerøy is undervalued, a quick look at its price-to-earnings ratio compared to the wider European Food sector tells another story. This may point to a relatively higher valuation. Could this mean optimism is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lerøy Seafood Group Narrative

If you think the current narrative misses something or if you'd rather dig into the details yourself, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Lerøy Seafood Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to get ahead of the market and discover the next opportunity before everyone else? Go beyond Lerøy Seafood Group and put your strategy to work with these smart investing angles:

- Capture potential high returns by scanning penny stocks with strong financials, which combine affordable prices and impressive fundamentals for early-mover gains.

- Harness the power of machine learning by checking out AI penny stocks, featuring companies that are revolutionizing industries with artificial intelligence innovations.

- Maximize your income with dividend stocks with yields > 3%, connecting you to stocks offering reliable yields above 3 percent in today’s uncertain economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:LSG

Lerøy Seafood Group

Produces, processes, markets, sells, and distributes seafood products.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives