P/F Bakkafrost (OB:BAKKA) Valuation in Focus Following Q3 Profitability Return and Production Updates

Reviewed by Simply Wall St

P/F Bakkafrost (OB:BAKKA) just released third quarter earnings, showing a swing to profit despite lower sales compared to last year. The company also reaffirmed its production targets and updated harvest figures for both key regions.

See our latest analysis for P/F Bakkafrost.

P/F Bakkafrost’s recent return to profitability arrives amid a challenging year for shareholders, with a current share price of NOK 474.0 and a one-year total shareholder return of -24%. While operational updates may offer some reassurance, the stock’s momentum has been mixed. There have been noticeable gains over the past quarter; however, there are lingering concerns from its longer-term performance.

If you’re weighing new opportunities as this sector finds its footing, now’s a great time to see what’s next and discover fast growing stocks with high insider ownership

With improved profits yet ongoing share price weakness, the key question is whether Bakkafrost is trading at a discount to its true value or if the market has already accounted for its recovery and future growth prospects.

Most Popular Narrative: 10.9% Undervalued

With P/F Bakkafrost's fair value assessed at NOK 532.01, compared to its last close of NOK 474.0, the current narrative suggests the stock still has meaningful upside according to the latest consensus outlook.

Investments in value-added products, branding, and operational efficiency are improving margins and positioning the company for stable, long-term earnings growth. Sustainability initiatives and vertical integration strengthen brand differentiation, supporting market share gains and resilience amid shifting consumer preferences.

Curious what unwavering growth assumptions are driving this fair value? The most popular narrative is betting on a dramatic pivot in profit margins and a market-defying projected earnings leap. Discover which future milestones have analysts raising their price targets. Then decide for yourself if these numbers signal real upside.

Result: Fair Value of $532.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational setbacks in Scotland and ongoing industry pressure on salmon prices could quickly undermine the positive outlook for Bakkafrost’s recovery.

Find out about the key risks to this P/F Bakkafrost narrative.

Another View: What Multiples Reveal

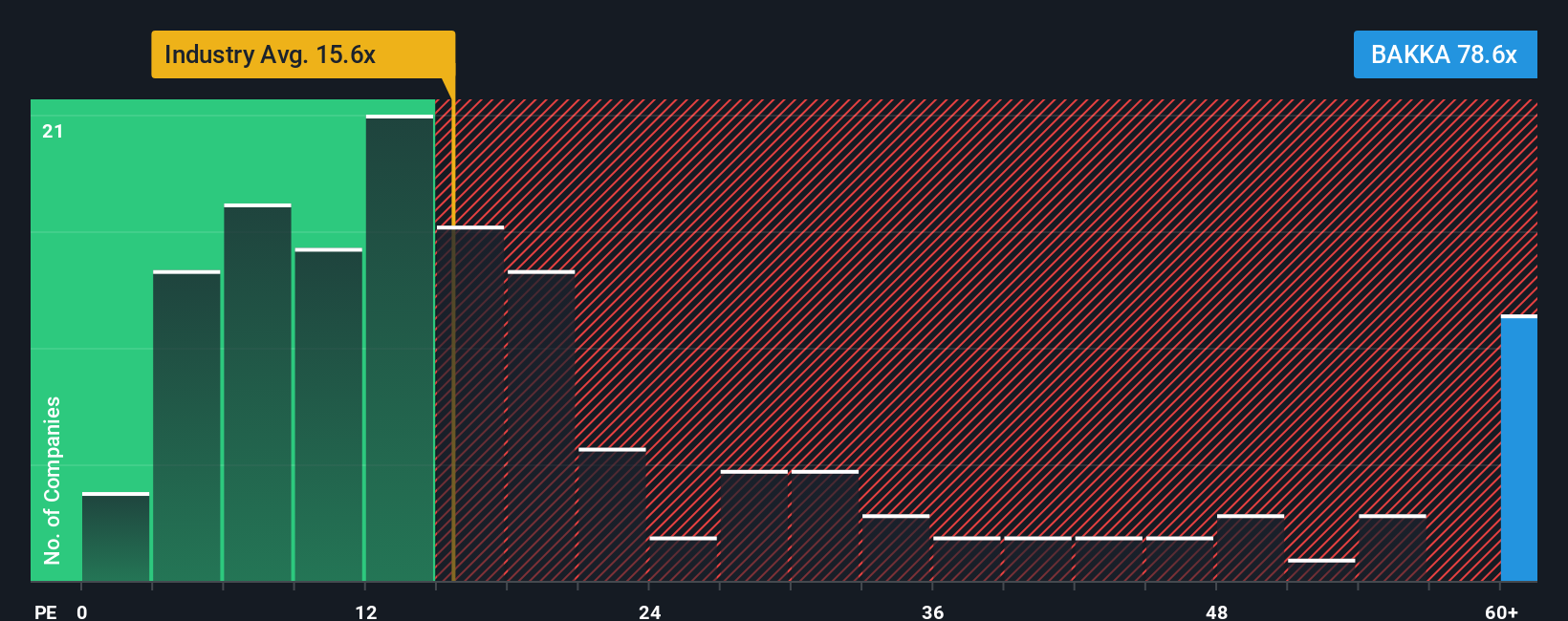

Looking at valuation through the lens of earnings, Bakkafrost is trading at a price-to-earnings ratio of 42.9 times, noticeably higher than its industry peers averaging 29.8 times and the broader European food sector at 15.5 times. While its fair ratio is estimated at 54.6 times, this sizeable premium raises real questions about valuation risk. Could Bakkafrost’s high multiple limit future upside, or is the market right to expect rapid growth ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own P/F Bakkafrost Narrative

If you’re keen to dig into the numbers or question the current consensus, you can easily craft your own perspective in just minutes, and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding P/F Bakkafrost.

Looking for More Investment Ideas?

Don’t wait and miss out on exceptional opportunities. Tap into investment ideas proven to spark growth and diversify your portfolio right now.

- Capitalize on rapid industry shifts and explore the high potential of innovative companies through these 25 AI penny stocks.

- Boost your passive income and seek attractive returns by selecting from these 16 dividend stocks with yields > 3% in today’s market.

- Ride the momentum of financial transformation and explore opportunities in digital assets by investing in these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives