- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

European Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In recent weeks, European markets have been influenced by concerns over inflated AI stock valuations and shifting expectations for U.S. interest rate policies, leading to declines in major indices such as the STOXX Europe 600 and Germany’s DAX. Amid this backdrop, growth companies with strong insider ownership can offer a unique perspective on potential investment opportunities, as insider confidence may signal alignment with shareholder interests and a commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

Andfjord Salmon Group (OB:ANDF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Andfjord Salmon Group AS is involved in land-based farming of Atlantic salmon in Norway, with a market capitalization of NOK2.86 billion.

Operations: The company's revenue segment is derived entirely from livestock, amounting to NOK0.94 million.

Insider Ownership: 26.5%

Revenue Growth Forecast: 56.2% p.a.

Andfjord Salmon Group, with significant insider ownership, is advancing its growth strategy through key operational changes and successful product developments. The recent appointment of Gro Skaar Knutsen to lead construction initiatives at Kvalnes highlights a focus on efficiency and expansion. Despite current financial challenges, including a net loss of NOK 44.82 million for H1 2025, the company anticipates substantial revenue growth of 56.2% annually, outpacing the Norwegian market's average rate significantly.

- Get an in-depth perspective on Andfjord Salmon Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Andfjord Salmon Group's share price might be too pessimistic.

GomSpace Group (OM:GOMX)

Simply Wall St Growth Rating: ★★★★★☆

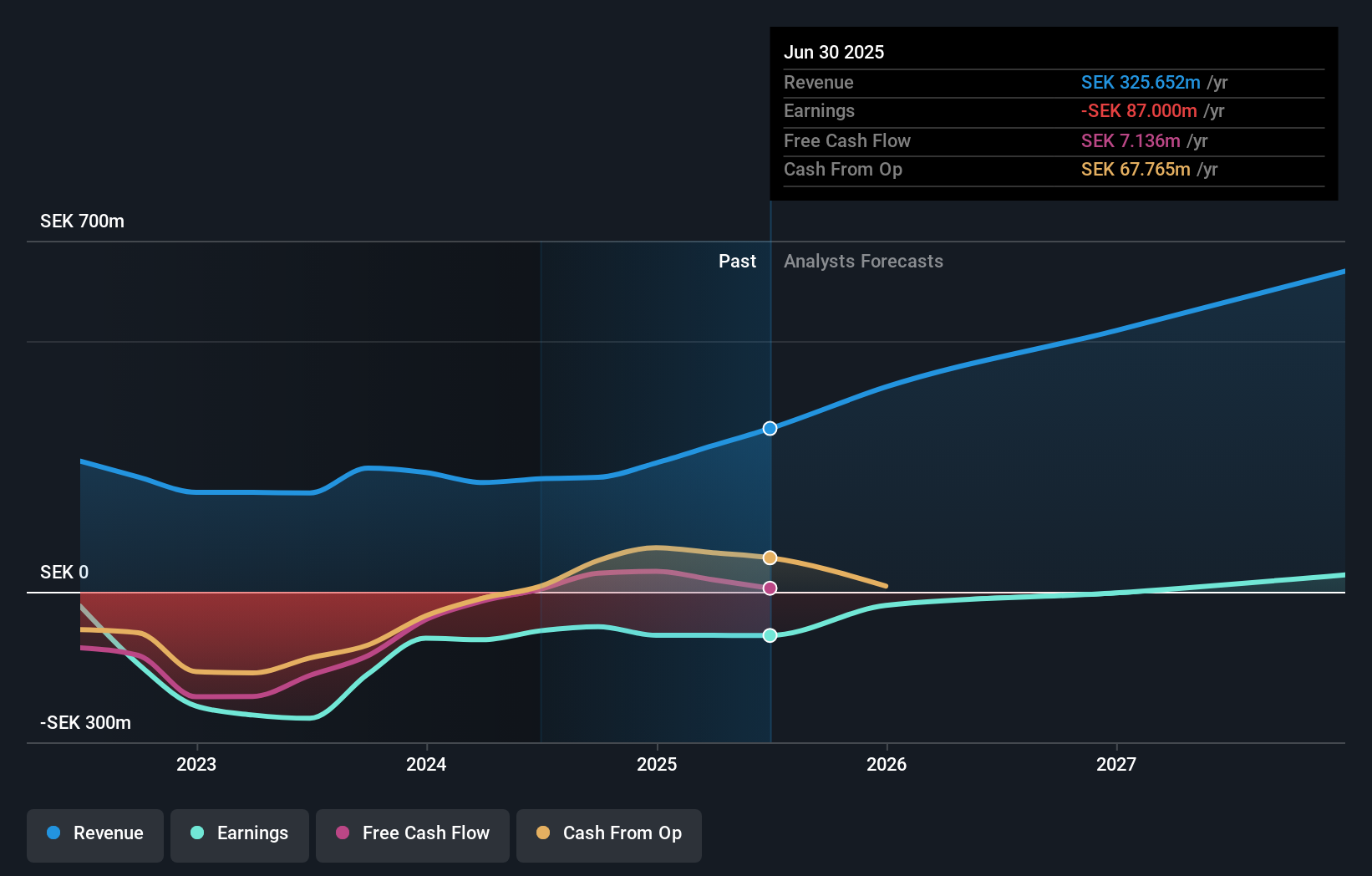

Overview: GomSpace Group AB (publ) specializes in manufacturing and selling nanosatellites, components, and turnkey satellite solutions across various regions including Europe, the United States, and Asia, with a market cap of SEK2.60 billion.

Operations: GomSpace Group generates revenue through its subsidiaries by providing nanosatellites, satellite components, and comprehensive satellite solutions in regions such as Denmark, Sweden, France, the rest of Europe, the United States, Asia, and other international markets.

Insider Ownership: 27%

Revenue Growth Forecast: 28.6% p.a.

GomSpace Group, with substantial insider ownership, is poised for significant growth, driven by strategic contracts and revenue forecasts. The company recently increased its 2025 revenue guidance significantly to SEK 420-450 million. Despite past shareholder dilution and negative equity, GomSpace's earnings are expected to grow over 121% annually. Recent contracts with the European Space Agency underscore its technological advancements in satellite operations, enhancing its market position amid volatile share prices and ongoing profitability challenges.

- Navigate through the intricacies of GomSpace Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of GomSpace Group shares in the market.

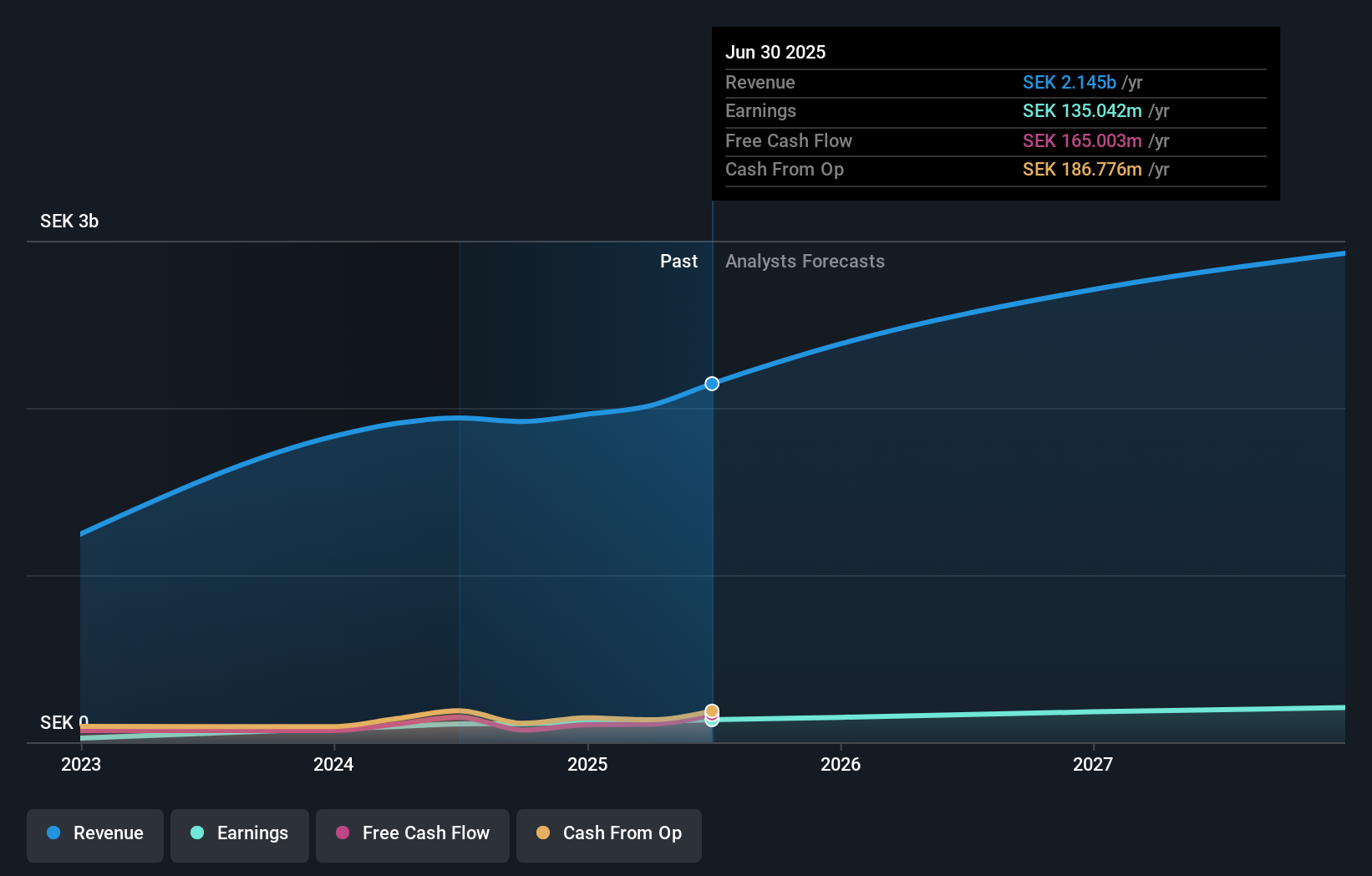

Nordrest Holding (OM:NREST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordrest Holding AB (publ) is a foodservice company operating in Sweden and internationally, with a market capitalization of SEK3.05 billion.

Operations: Nordrest Holding AB generates revenue primarily from its restaurants segment, amounting to SEK2.31 billion.

Insider Ownership: 31.1%

Revenue Growth Forecast: 11.1% p.a.

Nordrest Holding demonstrates robust growth potential with high insider ownership, evidenced by a 26.2% earnings increase last year and forecasts of 18% annual earnings growth, outpacing the Swedish market. Despite trading at a significant discount to its estimated fair value, revenue is projected to grow at 11.1% annually. Recent financial results show strong performance with Q3 sales reaching SEK 578.01 million and net income rising to SEK 29.07 million from the previous year’s SEK 23.46 million.

- Dive into the specifics of Nordrest Holding here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Nordrest Holding's current price could be quite moderate.

Seize The Opportunity

- Investigate our full lineup of 202 Fast Growing European Companies With High Insider Ownership right here.

- Contemplating Other Strategies? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GOMX

GomSpace Group

Through its subsidiaries, manufactures and sells nanosatellites and components, and turnkey solutions for satellites in Denmark, Sweden, France, rest of Europe, the United States, Asia, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success