- Norway

- /

- Oil and Gas

- /

- OB:VAR

Where Does Vår Energi Stand After Recent Share Price Dip and Sector Volatility?

Reviewed by Bailey Pemberton

If you are watching Vår Energi's stock and wondering whether it is time to make a move, you are not alone. The company has seen its share price slide 3.7% over the last week. However, if we zoom out, there's a different story. Over the past month, Vår Energi shares edged up 2.2%, and for the past year, they've delivered a solid 9.0% return. The three-year performance is even more impressive at 45.1%, reflecting both the energy sector's resilience and investors' shifting attitudes toward European oil and gas companies.

Recent industry news has underscored renewed investor interest in energy stocks, especially as volatility in global markets brings defensive plays back into focus. While there is always some risk with energy producers, long-term trends are showing that Vår Energi may still be an attractive prospect, particularly for those looking beyond headline moves.

What about the company's valuation right now? If you look at the latest scoring, Vår Energi is considered undervalued in 2 out of 6 standard checks, giving it a current valuation score of 2. This suggests there is some value here, but also that the market may be pricing in more than just current earnings and assets.

How should you approach deciding whether Vår Energi is undervalued, fairly valued, or overpriced? Classic valuation methods offer detailed insight, but there is an even more useful way to think about value that we will get to by the end of this article.

Vår Energi scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vår Energi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's fair value by forecasting its future cash flows and then discounting those projections back to today's value. This approach is commonly used to capture where a business’s real financial potential lies, rather than just what its current numbers show.

For Vår Energi, the most recent Free Cash Flow (FCF) stands at $1.17 Billion. Analyst estimates and extrapolations suggest that by 2029, annual FCF could reach around $1.32 Billion, with a series of smaller annual reductions or fluctuations projected by Simply Wall St through 2035. Over the next decade, actual analyst forecasts are available for the next five years, while longer-term figures are estimated.

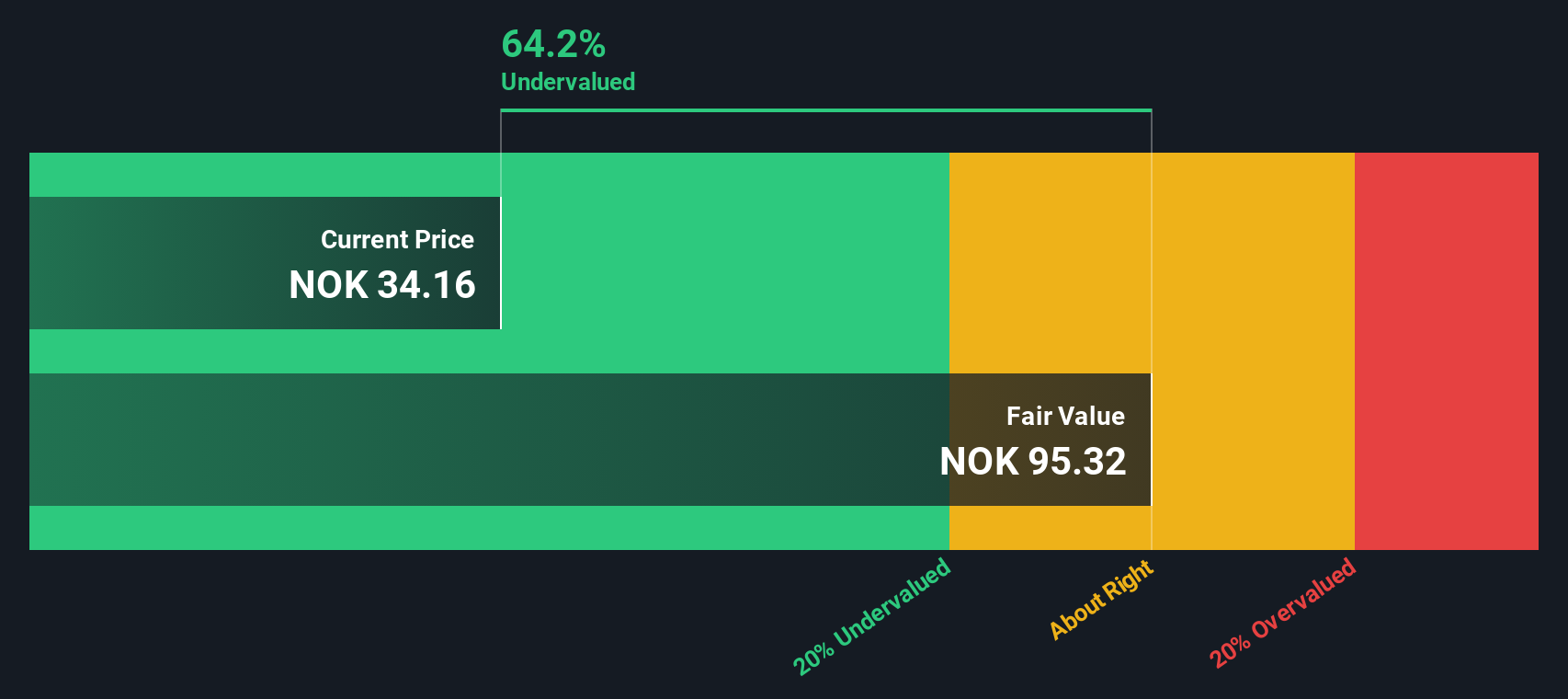

The DCF model calculates an intrinsic value per share of 95.33. When compared to the current share price, this points to the stock trading at a significant 64.2% discount, implying it could be markedly undervalued relative to its underlying cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vår Energi is undervalued by 64.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Vår Energi Price vs Earnings

The Price-to-Earnings (PE) ratio is broadly considered the most appropriate valuation metric for established, profitable companies like Vår Energi. It gives investors a straightforward sense of how much they are paying for each unit of the company's earnings, making it easier to compare valuations across businesses and sectors.

What constitutes a "normal" or "fair" PE ratio is influenced by several factors. If a company is expected to grow faster, or if it operates with less risk, the market will often justify a higher PE ratio. Conversely, slower growth or heightened risk usually pushes the fair PE lower. That means context matters, and raw numbers must be weighed carefully.

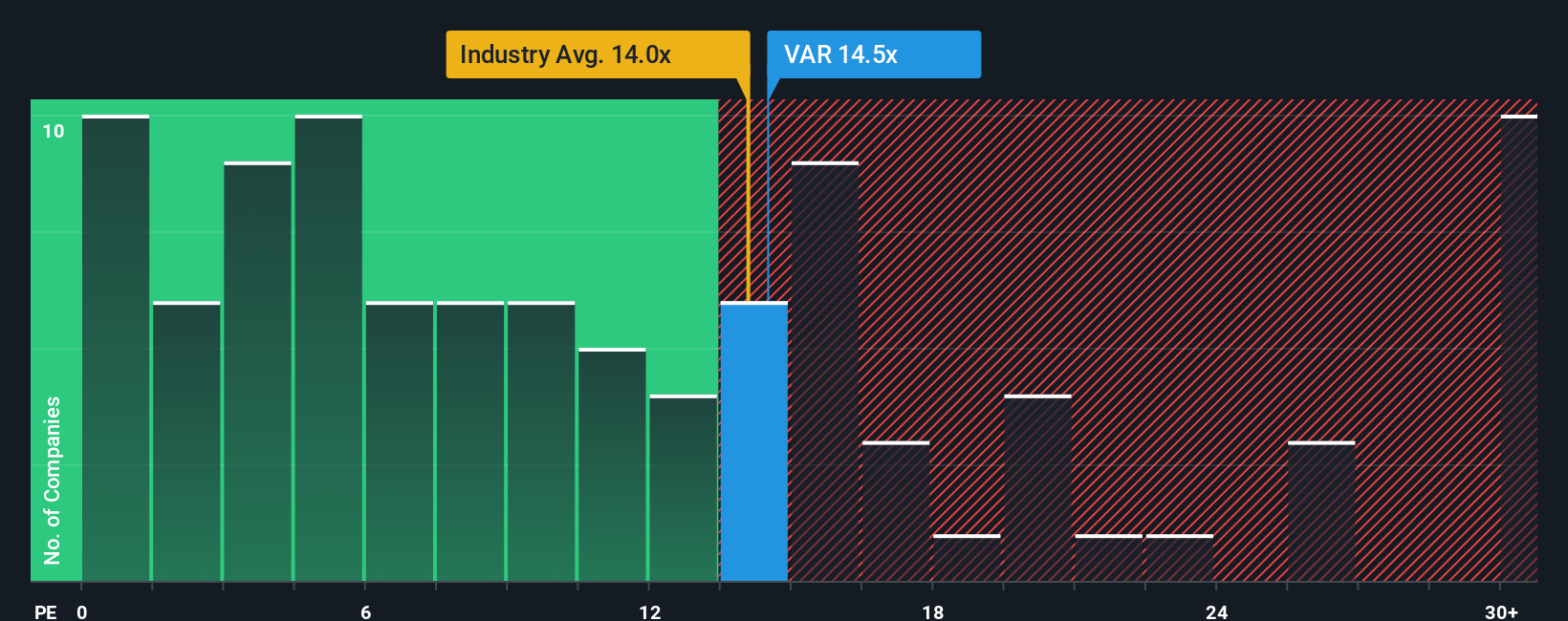

As of now, Vår Energi trades on a PE ratio of 14.0x. This is higher than both the industry average for oil and gas companies at 12.9x and its listed peer average of 10.4x. At first glance, this could make the stock appear a little expensive compared to peers, but multiples on their own do not tell the full story.

This is where the “Fair Ratio” from Simply Wall St comes in. The Fair Ratio, which is 8.4x for Vår Energi, is a proprietary measure that considers not just the company’s earnings, but also its growth prospects, profitability, market cap, and the unique risks it faces within its industry. Unlike simple peer or sector comparisons, the Fair Ratio provides a more holistic baseline of value tailored to the company’s fundamentals.

Comparing Vår Energi's actual PE of 14.0x to its Fair Ratio of 8.4x suggests the shares are trading at a premium relative to what would be justified by its underlying fundamentals. This points to the stock being overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vår Energi Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible way to spell out your view on a company, combining your story about its future, such as assumptions for revenue growth, profit margins, and risk factors, with a financial forecast and a fair value estimate.

This approach turns complex analysis into a clear roadmap. You start by laying out what you believe might drive Vår Energi’s business (like major project expansions or cost improvements) and then connect those assumptions to a projected valuation. Narratives are easy to create and share in the Simply Wall St Community, making it possible for millions of investors to collaborate and learn from real scenarios, not just abstract numbers.

- Narratives help you quickly gauge whether you believe Vår Energi is worth more or less than today’s price, so you can decide when to buy or sell based on your outlook instead of market noise.

- Because Narratives are updated dynamically whenever fresh news or earnings data comes in, your view always stays current.

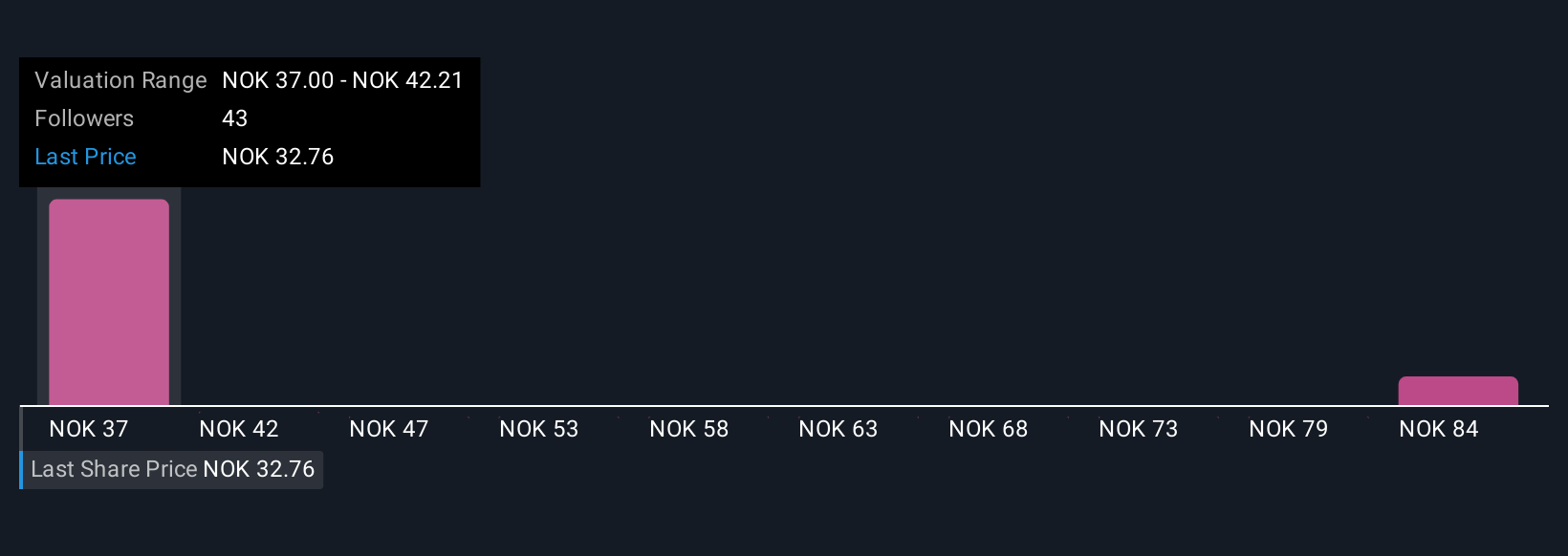

- For example, one investor might highlight rapid project ramp-ups and see a future value above NOK 44, while another focuses on commodity risk or aging assets and settles on a target closer to NOK 31.

This makes Narratives a powerful, practical tool for building conviction and context around your investment decisions.

Do you think there's more to the story for Vår Energi? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VAR

Vår Energi

Operates as an independent upstream oil and gas company on the Norwegian continental shelf in Norway.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives