- Norway

- /

- Oil and Gas

- /

- OB:VAR

Assessing Vår Energi (OB:VAR) Valuation After Q3 Results, Production Guidance and Dividend Update

Reviewed by Simply Wall St

Vår Energi (OB:VAR) just released its third quarter and nine-month 2025 results, reporting increased revenues compared to last year and confirming its production and dividend outlook for the coming year. Investors are watching these updates closely.

See our latest analysis for Vår Energi.

After a challenging start to the year, shares of Vår Energi have shown some resilience, closing at NOK 33.9 and trimming earlier losses with a modest 30-day share price return of 1.8%. While the year-to-date share price return remains negative, the company’s strong production guidance and continued dividend commitments have helped build momentum. This is reflected in a robust 10% total shareholder return over the past year and an impressive 44% over three years.

If you’re looking beyond single stocks, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With the stock currently trading at a discount to analyst targets and a history of strong total returns, the key question now is whether there is real upside left for new investors or if future growth is already reflected in the price.

Most Popular Narrative: 13.4% Undervalued

With Vår Energi closing at NOK 33.9 and the latest widely followed narrative setting a fair value at NOK 39.15, analysts see room for further upside. This sets expectations that the current market price has yet to reflect all growth drivers already in motion.

Material, near-term production ramp from 9 new project startups and successful ramp-up at Jotun FPSO and Johan Castberg will nearly double output versus 2023. This underpins robust top-line growth and EBITDA expansion. A large, flexible project pipeline (30+ early phase projects, over 3 billion barrels of resource potential) and a leading exploration track record position the company for organic, long-duration growth, helping sustain and increase future revenue.

Want to know why this valuation looks so optimistic? The narrative’s hidden engine is a sharp production surge, bold revenue hikes, and a surprising profitability leap. Which assumptions drive the bullish case, and could the next few years really transform Vår Energi’s future? Click in to see how ambitious the growth trajectory might be.

Result: Fair Value of NOK 39.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures and the company's reliance on aging North Sea assets remain key risks. These factors could quickly undermine this positive outlook.

Find out about the key risks to this Vår Energi narrative.

Another View: Multiples Tell a Different Story

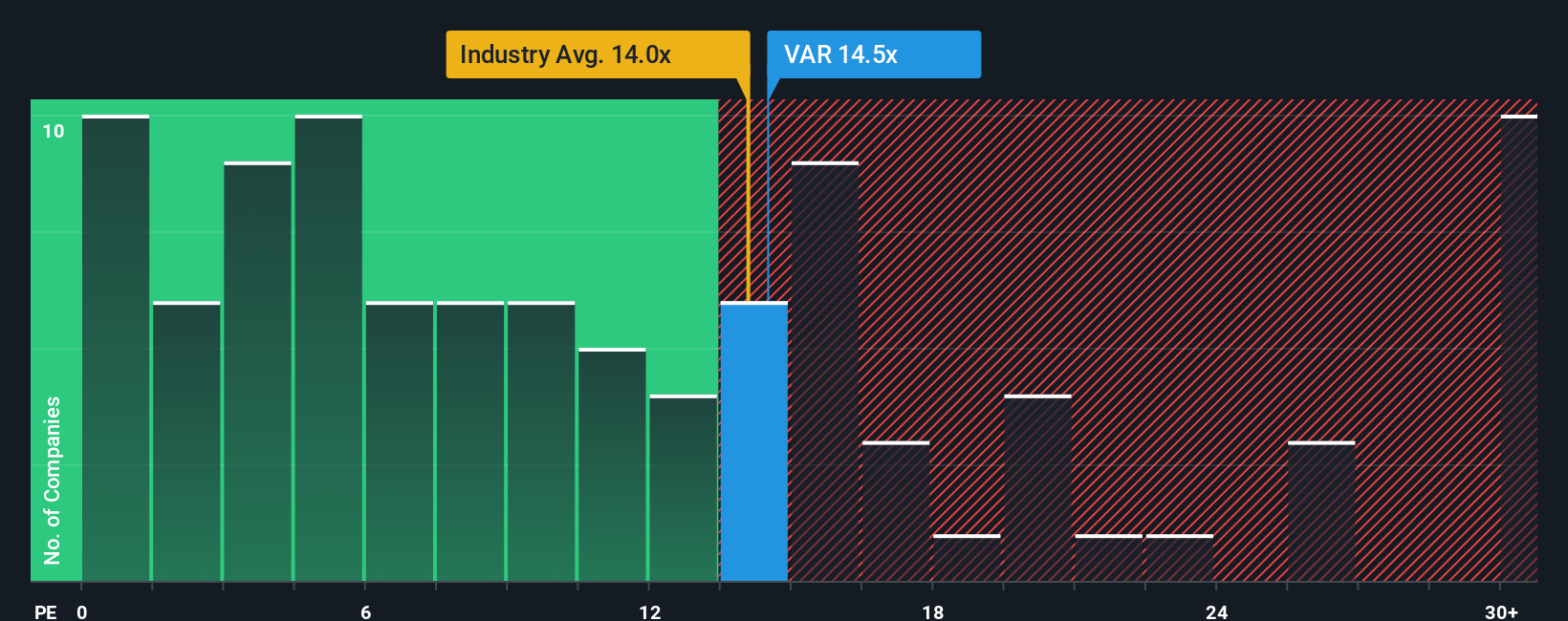

While some see Vår Energi as undervalued, a closer look at its price-to-earnings ratio paints a more cautious picture. The company's ratio sits at 14.5x, making it more expensive than both its peer average of 9.4x and the broader sector at 14.4x. Notably, this is also well above the 8.2x fair ratio, which is where the market could reasonably move over time. This gap suggests investors may be accepting extra valuation risk for potential growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vår Energi Narrative

If you'd rather draw your own conclusions or have a different take on Vår Energi, you can build a personalized view in just a few minutes, and Do it your way.

A great starting point for your Vår Energi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay a step ahead by searching for new opportunities before everyone else. Don’t leave profits on the table. Expand your watchlist with these potential winners:

- Tap into the next era of medicine by reviewing companies powering breakthroughs with these 34 healthcare AI stocks.

- Build your income stream by checking out these 24 dividend stocks with yields > 3% with reliable yields above the market average.

- Ride the future wave and scan these 28 quantum computing stocks fueling tomorrow’s technology landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VAR

Vår Energi

Operates as an independent upstream oil and gas company on the Norwegian continental shelf in Norway.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives