- Norway

- /

- Energy Services

- /

- OB:TGS

TGS (OB:TGS) One-Off $294.5M Loss Challenges Bullish Earnings Growth Narrative

Reviewed by Simply Wall St

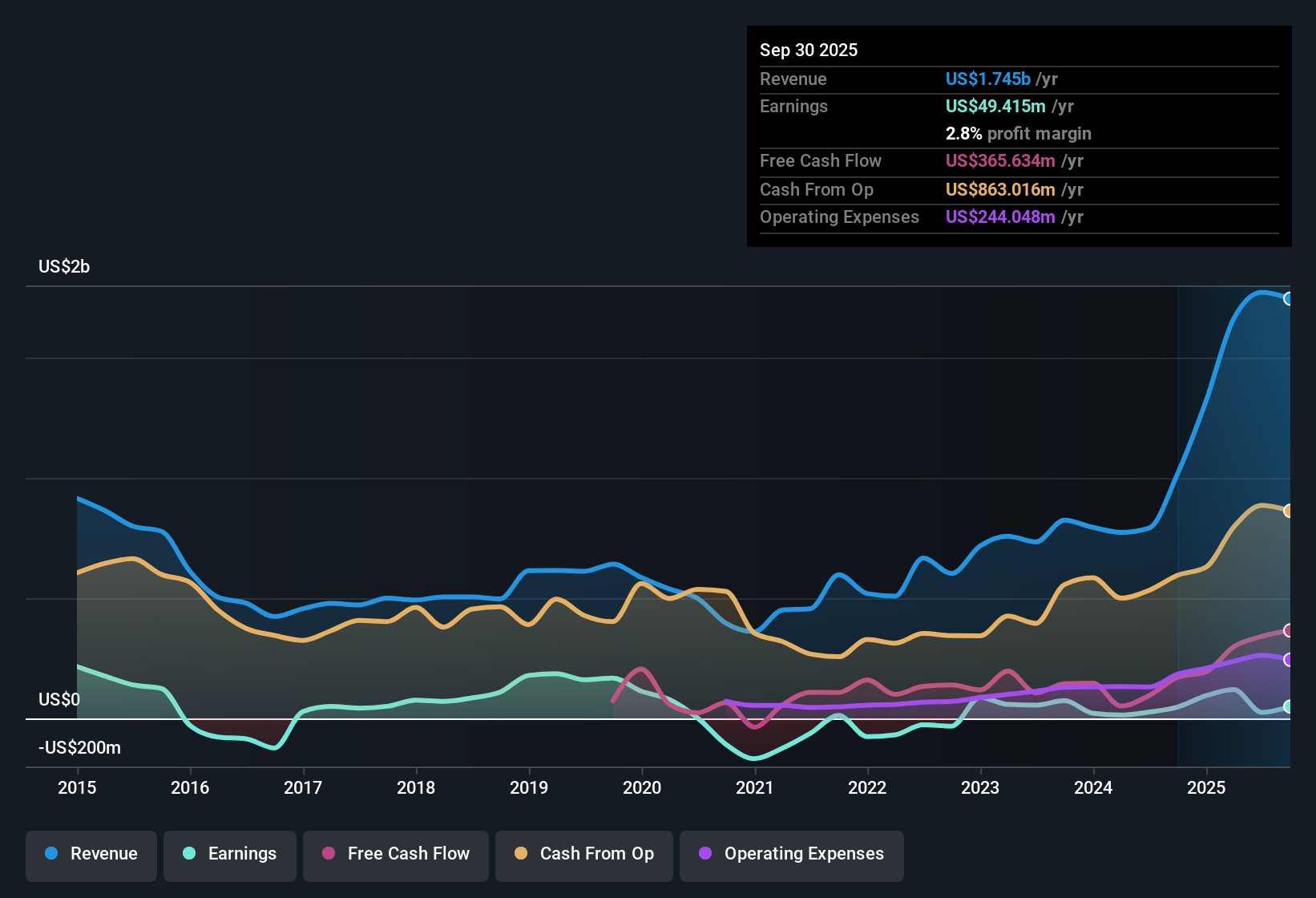

TGS (OB:TGS) just reported a one-off loss of $294.5 million that weighed heavily on its latest results, pushing net profit margins down to 1.4% from last year’s 3.3%. Earnings are set for a powerful rebound, with forecasts calling for 50.1% annual growth ahead of the Norwegian market’s 14%, but revenue growth is expected to be nearly flat at just 0.1% per year. For investors, that means strong projected earnings power faces off against lingering profitability challenges and a history of exceptional, but at times uneven, profit expansion.

See our full analysis for TGS.Next, we'll see how these headline numbers stack up against the widely followed narratives for TGS. Some expectations are confirmed, while others may be put to the test.

See what the community is saying about TGS

Profit Margins Projected to Climb Dramatically

- Analysts forecast net profit margins to jump from today's 1.4% to 15.2% within three years, which is a more than tenfold increase and points to sharp operational leverage if demand returns.

- Analysts' consensus view highlights TGS's push into digital transformation and recurring revenue streams as key reasons margins could expand:

- The Imaging & Technology division has already shown strong EBITDA margin expansion, and the company’s cost optimization, with recent vessel sales and restructuring, is expected to further boost profitability.

- This margin optimism relies on the belief that as market conditions stabilize and new tech offerings scale up, TGS can overcome its recent one-off loss to recapture higher profitability levels.

- Consensus narrative notes that while the margin outlook is very positive, continued oil price volatility or loss of a large contract could still make results bumpy.

PE Ratio Stands Out in Value Debate

- TGS’s Price-To-Earnings ratio is a steep 70.8x, far above the GB Energy Services industry’s 6.6x and even its own forecast 2028 level of 14.8x, provoking debate about how much future growth is already priced in.

- Analysts' consensus points to this premium valuation as a double-edged sword:

- On one hand, analysts see robust long-term earnings power, referencing TGS's five-year earnings growth of 66.8% annually, and expect earnings to reach $226.2 million by 2028.

- However, this optimism is counterbalanced by real risks, such as the non-recurring $294.5 million loss and questions about the sustainability of past growth rates, which could mean current valuations remain elevated if operational hiccups persist.

Current Price Trades Below DCF Fair Value

- With shares at NOK90, TGS is trading at a notable discount to its DCF fair value of NOK177.37 per share, implying potential upside if future earnings materialize as projected.

- Analysts' consensus narrative suggests that this gap is attractive, but warns it is only justified if you believe in margin expansion and resilient demand:

- Given consensus revenue estimates, which are flat at 0.1% annual growth, the market may be skeptical until TGS proves it can deliver digitalization-led sales and capitalize on new energy market exposures.

- The consensus price target is NOK124.55, about 38% above today’s price, highlighting both the perceived upside if improvements occur and the risk should challenges persist.

- As results challenge and reinforce the balanced analyst outlook, investors can dive deeper into the full community narrative for a well-rounded perspective. 📊 Read the full TGS Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TGS on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Shape your view in just a few minutes and contribute your own narrative: Do it your way.

A great starting point for your TGS research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

TGS is facing flat revenue growth and uneven profitability. Its future depends on achieving a turnaround despite recent one-off setbacks and a premium valuation.

If you want more consistency, target stable growth stocks screener (2090 results) to focus on companies with reliable growth and steady performance, no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives