- Norway

- /

- Energy Services

- /

- OB:TGS

How Chevron’s Multi-Year Seismic Deal Could Shape TGS (OB:TGS) Investor Expectations

Reviewed by Sasha Jovanovic

- On November 5, 2025, Chevron announced it had signed a three-year capacity agreement with TGS for marine streamer and ocean bottom node (OBN) seismic acquisition services, including an immediate start with the St Malo 4D OBN reservoir monitoring project in the Gulf of Mexico.

- This agreement not only brings substantial new business and a firm multi-year commitment to TGS, but also deepens collaboration on data technology and geophysical innovation between the two companies.

- We'll explore how this major Chevron partnership and expanded contract horizon could influence TGS's investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TGS Investment Narrative Recap

To be a TGS shareholder, you typically need to believe that demand for seismic data and services will rebound as energy exploration activity recovers and digital offerings gain traction, outweighing the company’s revenue sensitivity to oil prices and reliance on large client deals. The multi-year Chevron agreement, while positive in terms of backlog and data technology collaboration, does not fully resolve TGS’s most immediate risk: concentrated customer exposure and potential sales cyclicality.

Of the recent announcements, the October 20th OBN acquisition contract in the Gulf of America stands out as directly relevant. That deal, which will commence promptly and is embedded within the new Chevron arrangement, meaningfully extends TGS’s activity pipeline and feeds into the short-term catalyst of heightened exploration demand, though revenue lumpiness remains a consideration. Despite the contract wins, investors should be aware that persistent client concentration could mean...

Read the full narrative on TGS (it's free!)

TGS is projected to reach $1.5 billion in revenue and $226.2 million in earnings by 2028. This entails a yearly revenue decline of 5.7% and an earnings increase of $201.2 million from the current earnings of $25.0 million.

Uncover how TGS' forecasts yield a NOK87.90 fair value, a 6% downside to its current price.

Exploring Other Perspectives

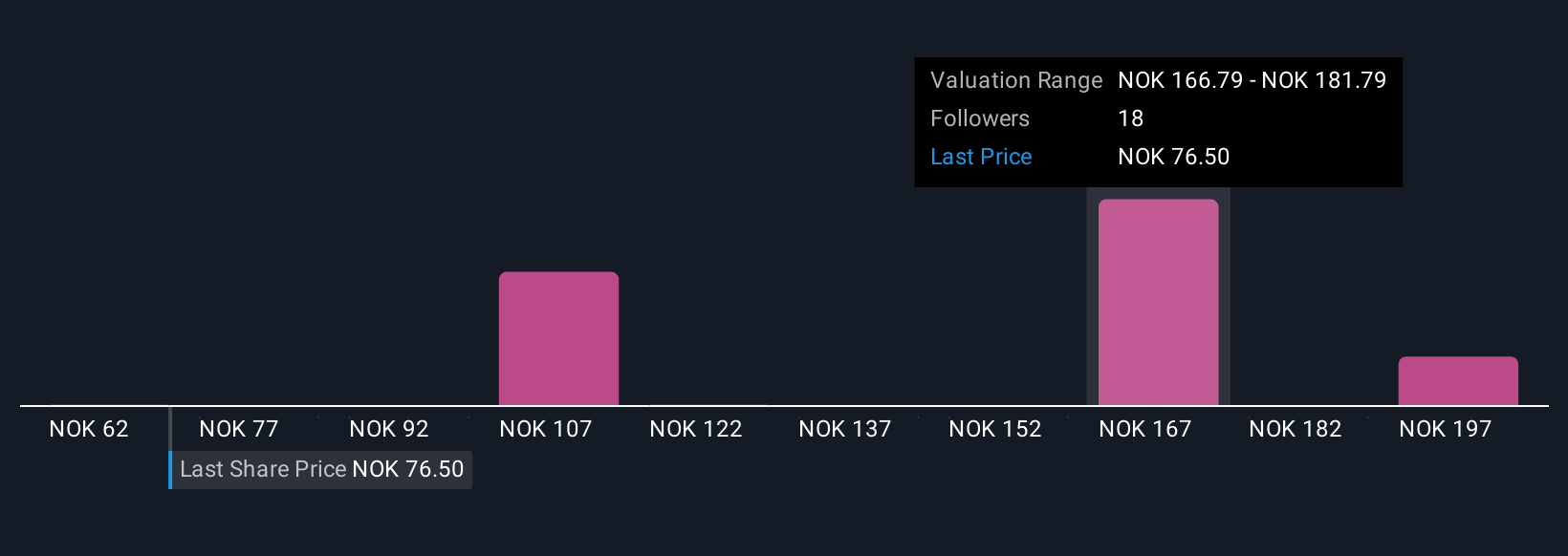

Six fair value assessments from the Simply Wall St Community span from NOK 61.77 to NOK 427.52, reflecting vastly different outlooks. Strong new contracts may reduce volatility but revenue swings tied to large customers are still a key factor for your decision making.

Explore 6 other fair value estimates on TGS - why the stock might be worth 34% less than the current price!

Build Your Own TGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TGS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TGS' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives