- Norway

- /

- Energy Services

- /

- OB:TGS

Discover AlphaCorp And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence and manufacturing indicators showing signs of softness amidst moderate gains in major stock indexes, investors are increasingly focused on identifying opportunities that may be undervalued. In this context, finding stocks priced below their estimated value can offer potential advantages, especially when market conditions reflect both volatility and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.80 | SEK123.12 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.87 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

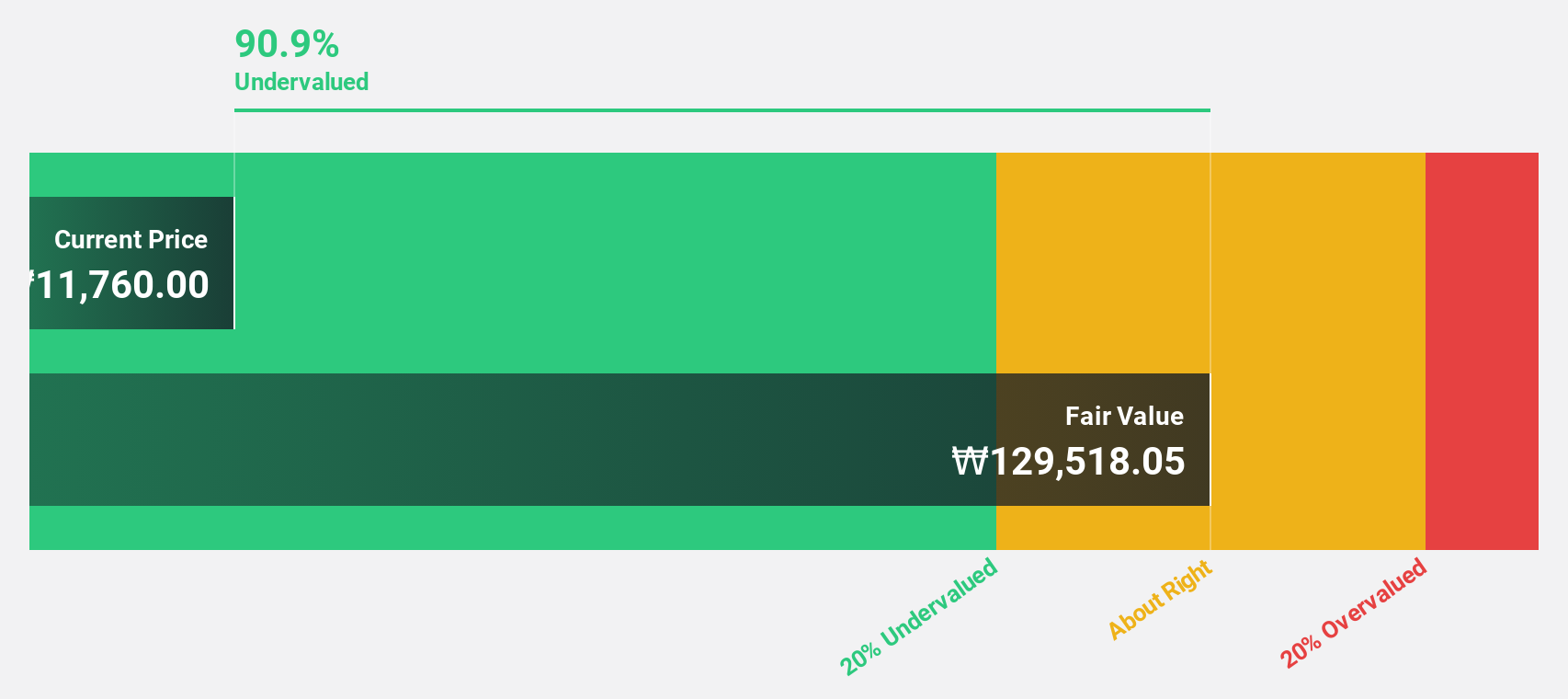

ZeusLtd (KOSDAQ:A079370)

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions both in South Korea and internationally, with a market cap of ₩394.91 billion.

Operations: The company's revenue is primarily derived from its Equipment Division, which accounts for ₩477.92 billion, and Valve segment, contributing ₩23.54 billion.

Estimated Discount To Fair Value: 33.6%

Zeus Ltd. is trading at a significant discount, 33.6% below its estimated fair value of ₩19,463.97, with a current price of ₩12,930. Despite slower revenue growth forecasts (15.4% annually), earnings are expected to grow significantly at 39.35% per year, outpacing the market's rate of 28.8%. Recent buybacks totaling KRW 4,991.66 million and strong third-quarter earnings underscore its robust cash flow position and potential undervaluation based on cash flows.

- Our growth report here indicates ZeusLtd may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of ZeusLtd stock in this financial health report.

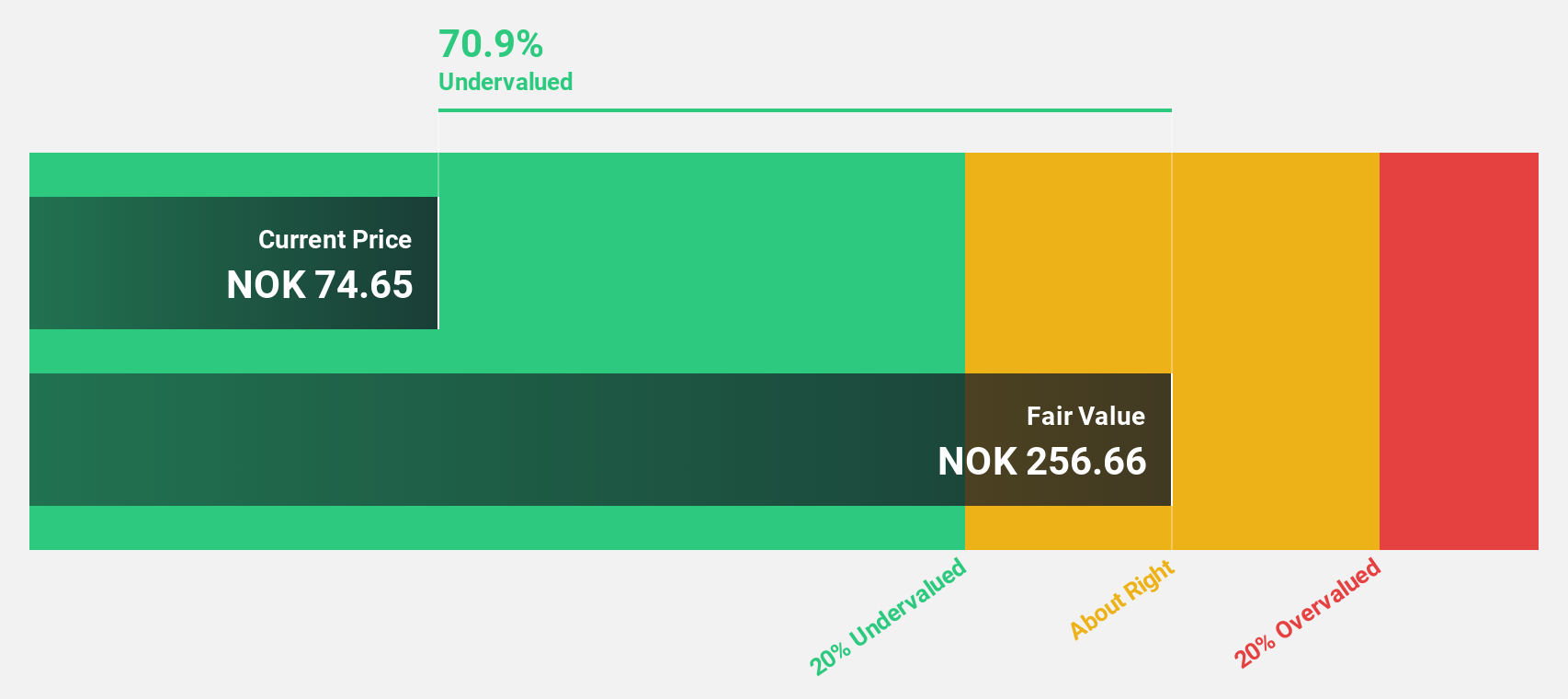

TGS (OB:TGS)

Overview: TGS ASA offers geoscience data services to the global oil and gas industry, with a market cap of NOK 23.09 billion.

Operations: The company's revenue segments include Imaging at $59.23 million and Contract services at $530.14 million, with a Segment Adjustment of $579.37 million.

Estimated Discount To Fair Value: 49.5%

TGS ASA is trading at NOK 117.7, significantly below its estimated fair value of NOK 233.24, highlighting potential undervaluation based on cash flows. Despite recent shareholder dilution and a dividend not fully covered by earnings, TGS's revenue is forecast to grow at 19% annually, outpacing the Norwegian market's growth rate. The company's strategic contract wins in seismic surveys and a robust pipeline suggest strong future cash flow generation capabilities despite current profit margins being lower than last year.

- Insights from our recent growth report point to a promising forecast for TGS' business outlook.

- Get an in-depth perspective on TGS' balance sheet by reading our health report here.

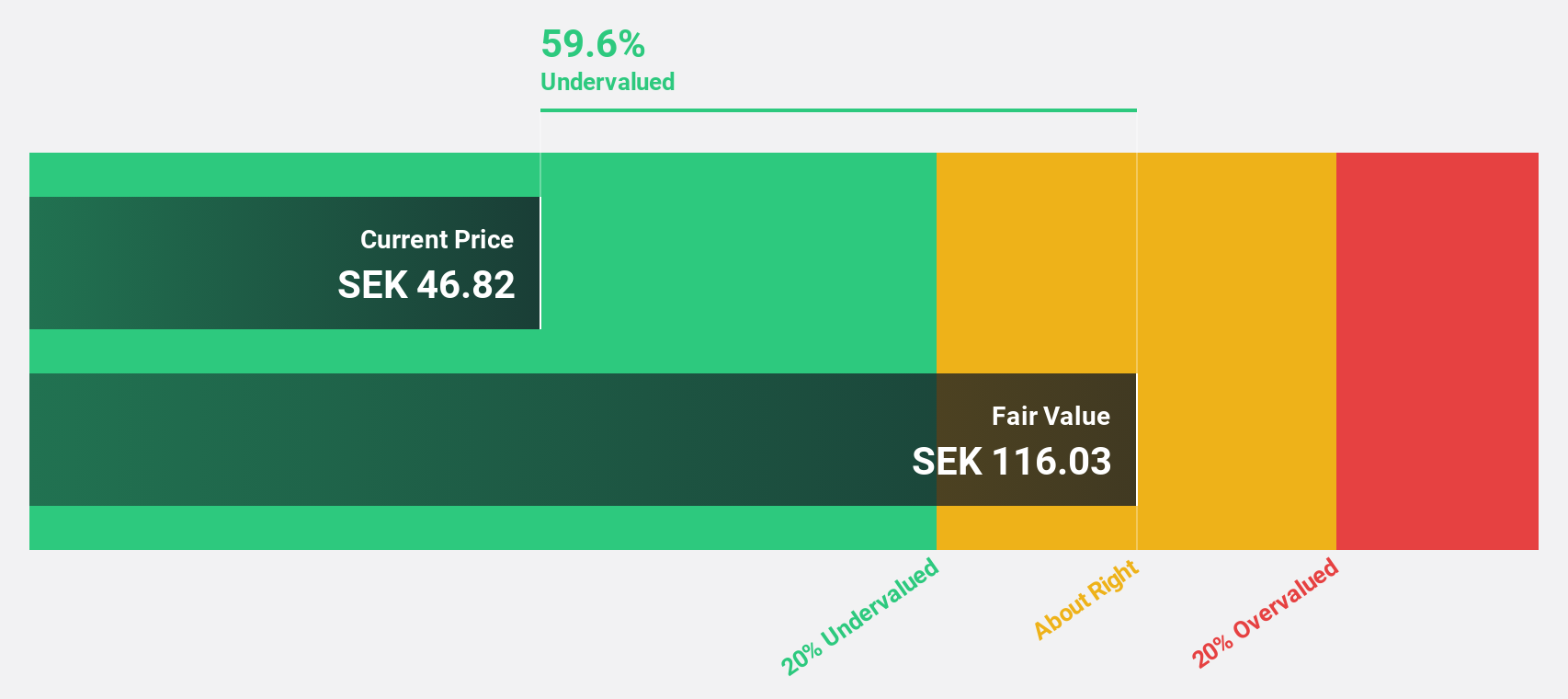

Elekta (OM:EKTA B)

Overview: Elekta AB (publ) is a medical technology company that provides clinical solutions for treating cancer and brain disorders globally, with a market cap of approximately SEK23.61 billion.

Operations: The company's revenue is segmented into APAC with SEK6.08 billion, Americas with SEK5.41 billion, and Europe, Middle East, and Africa (EMEA) with SEK6.23 billion.

Estimated Discount To Fair Value: 49.8%

Elekta, trading at SEK 61.8, is significantly undervalued compared to its fair value estimate of SEK 123.12, suggesting potential for cash flow-based valuation upside. Despite a high debt level and a dividend yield of 3.88% not covered by earnings or free cash flows, Elekta's revenue and earnings are forecast to grow faster than the Swedish market. Recent product advancements like the Elekta Evo enhance its competitive position in adaptive radiation therapy technology.

- The analysis detailed in our Elekta growth report hints at robust future financial performance.

- Dive into the specifics of Elekta here with our thorough financial health report.

Summing It All Up

- Discover the full array of 897 Undervalued Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives