- Norway

- /

- Energy Services

- /

- OB:SOMA

Solstad Maritime (OB:SOMA) Net Margin Surge Challenges Quality of Earnings Narratives

Reviewed by Simply Wall St

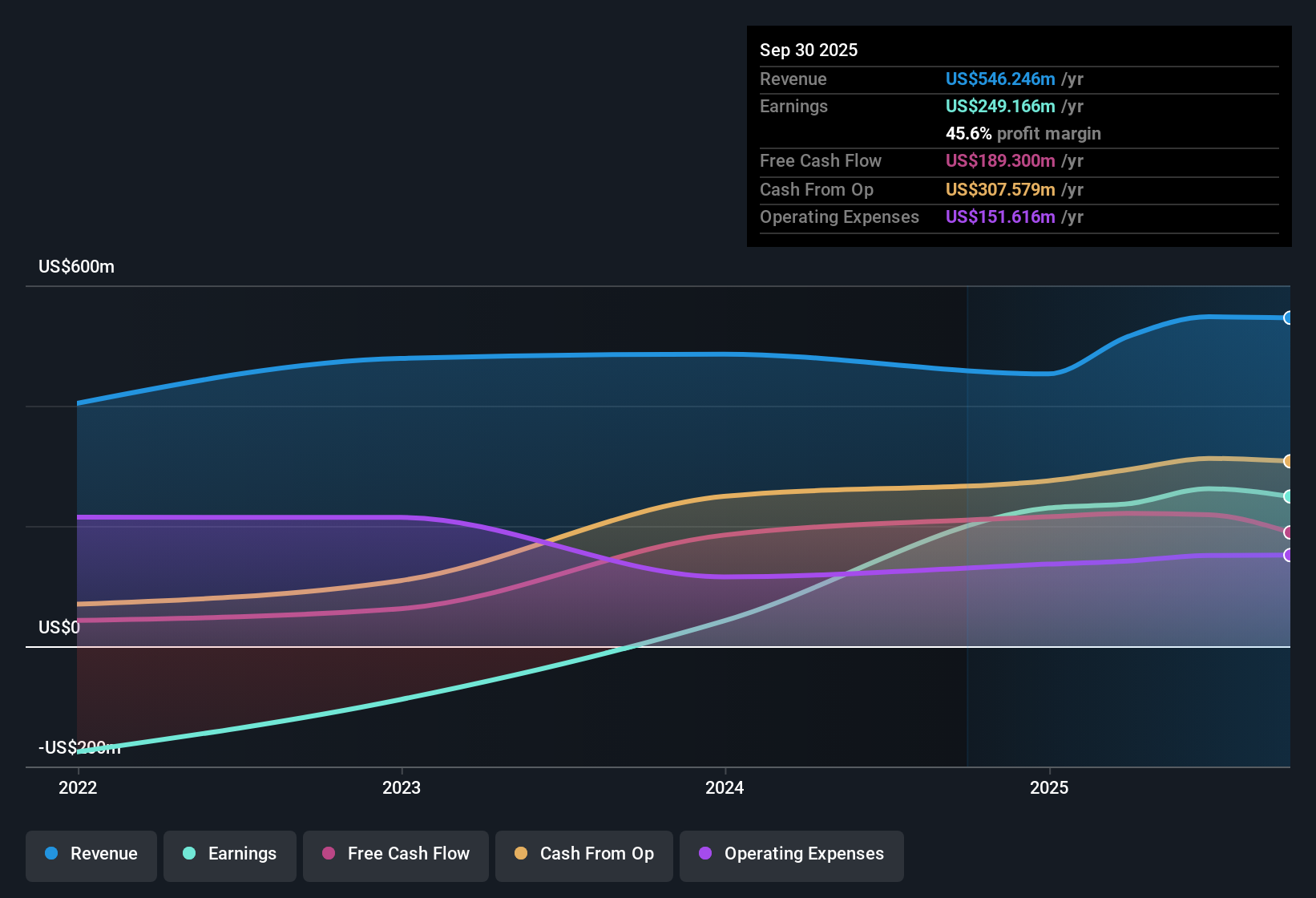

Solstad Maritime (OB:SOMA) posted robust revenue and earnings growth, with revenue expected to climb 5.7% per year, well ahead of the Norwegian market’s 2.3%. EPS is on a stronger trajectory, with forecast growth of 18.8% annually, and a stellar net profit margin of 48.5%, up from 28.9% a year ago. Notably, earnings got a further boost from a one-off gain of $50.6 million, accelerating annual profit growth to 93.4% in the most recent year. Shares are trading at just 3.1x earnings, far below industry and peer averages, setting a clear value narrative even as some risks around non-recurring income and financial position temper the outlook.

See our full analysis for Solstad Maritime.The real test is how these figures stand up when compared to the market’s big-picture stories. Some expectations will be reinforced, and others put under the microscope.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Nearly Doubled Despite One-Off Gain

- Net profit margin has surged to 48.5%, up from 28.9% a year ago. This jump was partly driven by a non-recurring $50.6 million gain, highlighting the boost from one-off items rather than purely operational performance.

- Supporting the narrative that operational momentum is strong, profit margins remain far above typical industry levels.

- The significance of the $50.6 million one-time gain means some of the headline profitability may not repeat, tempering optimism that all of the margin improvement is sustainable.

- It is noteworthy that even excluding the one-off, Solstad Maritime’s margin stands well above historic sector averages, keeping the underlying bullish case alive.

Rapid Five-Year Profit Growth Outpaces Market

- Reported earnings have increased at 77.3% per year over the past five years, surging to 93.4% in the latest year, sharply ahead of both historical norms and the broader Norwegian market’s pace.

- This growth trajectory amplifies value-focused arguments, especially for those bullish on turnaround stories.

- With an 18.8% annual earnings growth forecast, Solstad’s story remains above the market average but below the 20% threshold, adding nuance to the bullish long-term view.

- At the same time, critics point to the uncertainty in maintaining such rapid expansion, especially as the one-off gain is unlikely to recur and ongoing growth forecasts have moderated slightly.

Ultra-Low 3.1x P/E Compounds Valuation Appeal

- Solstad Maritime trades at 3.1x earnings, compared to the industry average of 6.2x and peer average of 11.9x. The current NOK17.86 share price stands far below the DCF fair value of NOK145.54, illustrating a steep valuation discount even after its strong profit surge.

- The prevailing market view suggests this deep discount provides a margin of safety for investors willing to bet on continued profit delivery.

- Some of the appeal is cushioned by ongoing risks around non-recurring income and a financial position not rated as strong, which can justify lower market multiples for now.

- Still, trading below both sector peers and even analyst price targets adds to Solstad Maritime’s standing as a value opportunity, provided operational momentum continues.

This steep valuation gap and outsized profit margins mean investors watching for renewed sector momentum will be eyeing Solstad's operational follow-through in coming quarters.

See what the community is saying about Solstad MaritimeNext Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Solstad Maritime's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid profit growth and strong margins, Solstad Maritime faces questions over recurring income and a financial position that remains less robust than its peers.

If you want companies with stronger financial foundations and fewer surprises, check out solid balance sheet and fundamentals stocks screener (1984 results) which is built to weather downturns and deliver consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SOMA

Solstad Maritime

Owns and operates offshore service vessels (OSVs) that provides maritime services to the offshore energy industry in North Sea, North and Central America, Mediterranean and rest of the Europe, Africa, South America, Australia, and Asia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives