- Germany

- /

- Capital Markets

- /

- XTRA:BWB

Three European Small Cap Gems with Promising Potential

Reviewed by Simply Wall St

In recent weeks, the European market has shown resilience, with the pan-European STOXX Europe 600 Index remaining stable as investors navigate interest rate policies and trade uncertainties. Amidst this backdrop of cautious optimism, identifying small-cap stocks with strong fundamentals and growth potential can be a strategic move for investors looking to capitalize on emerging opportunities in Europe's dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cembre (BIT:CMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Cembre S.p.A. is involved in the manufacture and sale of electrical connectors, cable accessories, and tools across Italy, Europe, and internationally with a market cap of €918.10 million.

Operations: Cembre generates revenue primarily from the sale of electric connectors and related tools, amounting to €234.44 million.

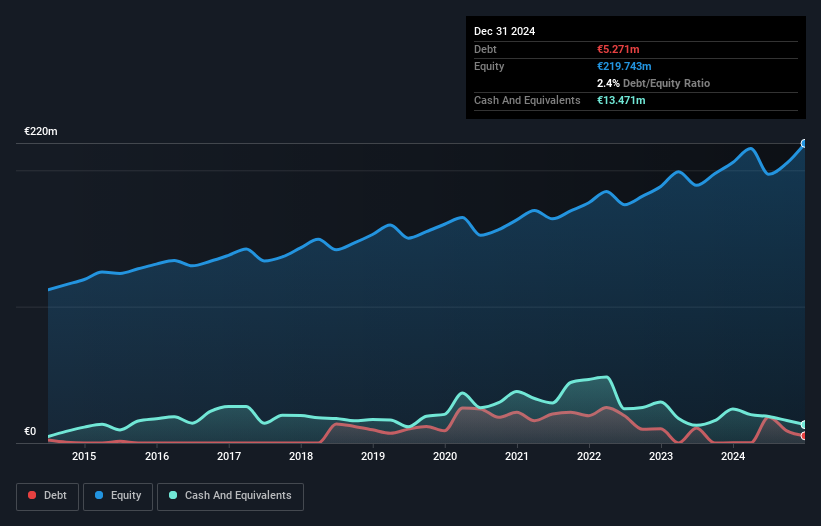

Cembre, a notable player in the niche market of electrical connectors and tools, has demonstrated robust financial health with its debt to equity ratio improving from 16.4% to 15.5% over five years. The company's earnings growth of 17.5% outpaced the industry average, showcasing its competitive edge. High-quality earnings and satisfactory net debt to equity ratio at 7.6% further underline its stability. Recent results highlight an increase in revenue to €124.94 million and net income rising to €22.62 million, reflecting solid operational performance with basic EPS climbing from €1.24 to €1.34 year-on-year.

- Click here to discover the nuances of Cembre with our detailed analytical health report.

Examine Cembre's past performance report to understand how it has performed in the past.

Solstad Offshore (OB:SOFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solstad Offshore ASA owns and operates offshore service vessels and has a market capitalization of NOK 4.49 billion.

Operations: Solstad Offshore generates revenue primarily from its Anchor Handling Tug Supply Vessels (AHTS) segment, amounting to $54.60 million. The company also records a segment adjustment of $242.85 million in its financials.

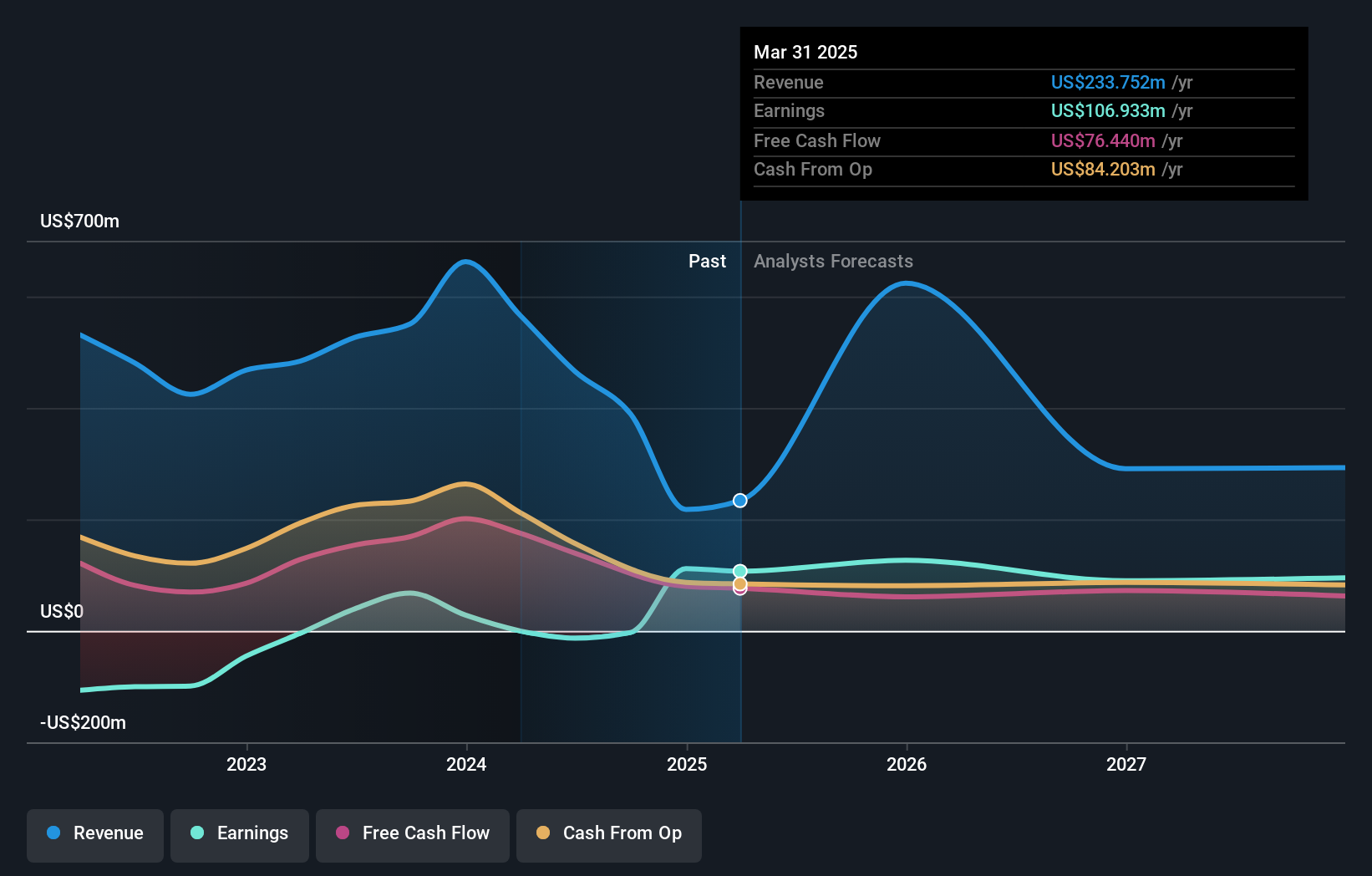

Solstad Offshore has been making waves with recent contract wins, including a $65 million deal for Normand Turmalina and Superior, and a $108 million contract for the Normand Commander with Petrobras. The company's financials show impressive growth, with net income jumping to $37.78 million in Q2 2025 from $2.54 million the previous year. Despite having interest payments not well covered by EBIT at 1.7x, Solstad's price-to-earnings ratio of 3.1x suggests it's trading below the Norwegian market average of 12.5x, offering potential value to investors in this niche sector of energy services.

- Unlock comprehensive insights into our analysis of Solstad Offshore stock in this health report.

Gain insights into Solstad Offshore's past trends and performance with our Past report.

Baader Bank (XTRA:BWB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Baader Bank Aktiengesellschaft offers investment and banking services across Europe, with a market capitalization of €302.54 million.

Operations: The bank generates revenue through its investment and banking services across Europe. Its market capitalization stands at €302.54 million, reflecting its financial position in the industry.

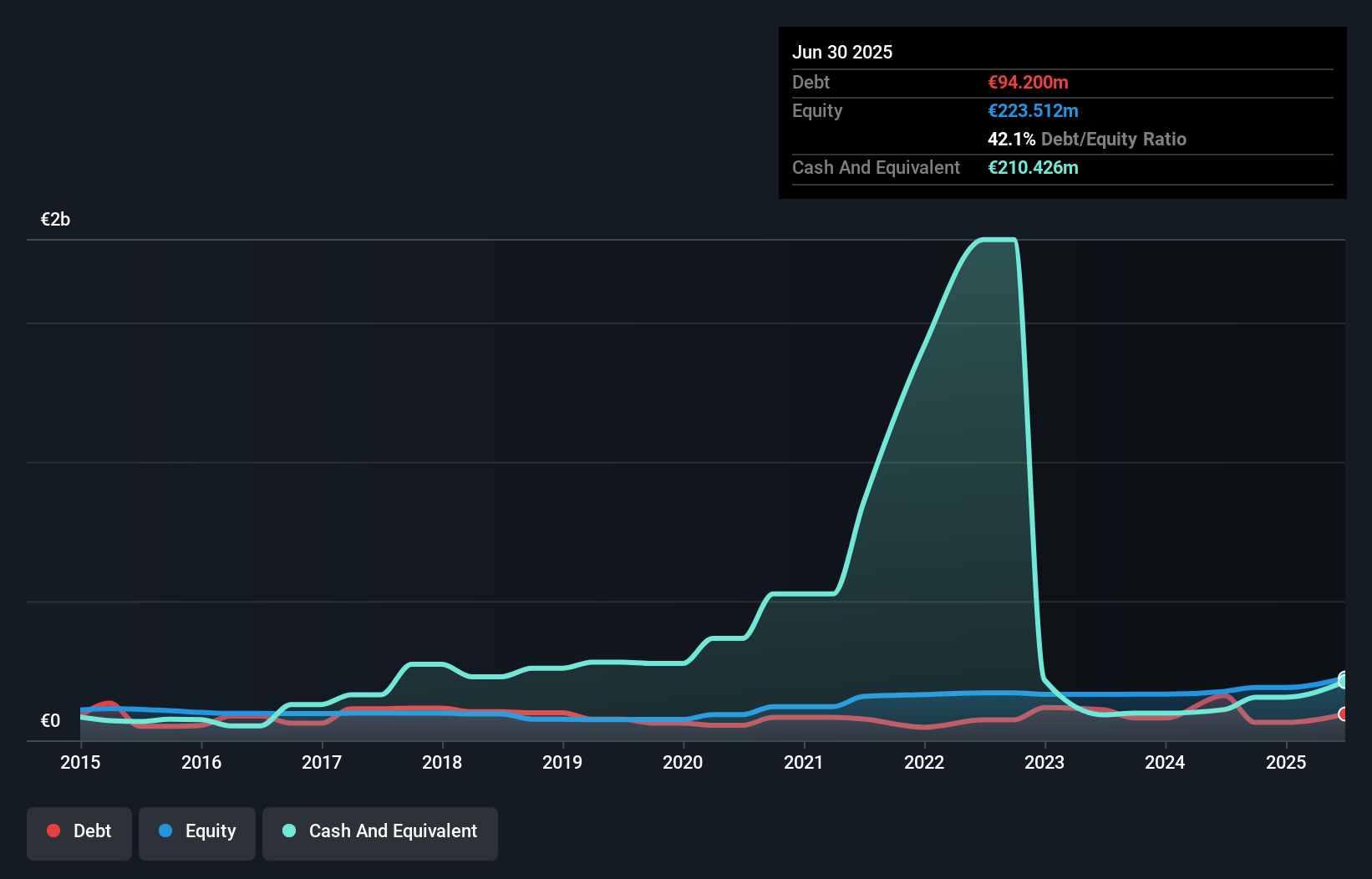

Baader Bank has shown impressive earnings growth of 268.1% over the past year, outpacing the Capital Markets industry average of 29%. Despite a decline in earnings by 24.3% annually over the last five years, recent performance indicates a turnaround. The bank's debt-to-equity ratio improved from 58.4% to 42.1%, suggesting stronger financial health. With a price-to-earnings ratio of just 6.3x compared to the German market's average of 18.6x, Baader appears undervalued relative to its peers. Additionally, net income for the half-year ending June saw an increase to €34.97 million from €10.33 million previously, reflecting robust operational gains.

- Take a closer look at Baader Bank's potential here in our health report.

Gain insights into Baader Bank's historical performance by reviewing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 331 European Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baader Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BWB

Solid track record with excellent balance sheet.

Market Insights

Community Narratives