Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Shelf Drilling, Ltd. (OB:SHLF) shareholders over the last year, as the share price declined 42%. That's disappointing when you consider the market returned 8.2%. We wouldn't rush to judgement on Shelf Drilling because we don't have a long term history to look at. Furthermore, it's down 26% in about a quarter. That's not much fun for holders.

View our latest analysis for Shelf Drilling

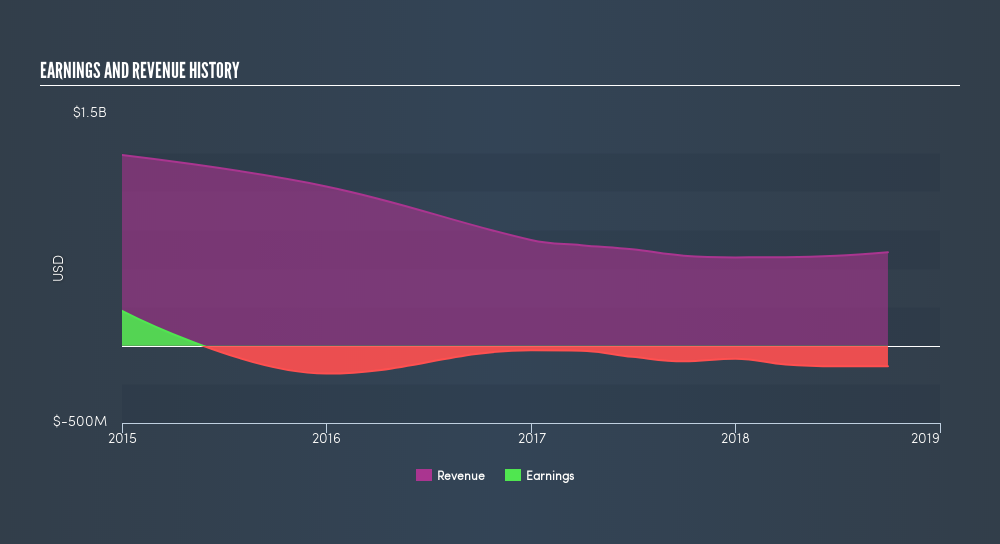

Shelf Drilling isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Shelf Drilling increased its revenue by 3.8%. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 42% in a year. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

If you are thinking of buying or selling Shelf Drilling stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

While Shelf Drilling shareholders are down 42% for the year, the market itself is up 8.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 26% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Shelf Drilling may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:SHLF

Shelf Drilling

Operates as a shallow water offshore drilling contractor in the Middle East, North Africa, the Mediterranean, Southeast Asia, India, West Africa, and the North Sea.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives