- France

- /

- Diversified Financial

- /

- ENXTPA:MLEFA

European Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of geopolitical tensions and economic adjustments, the pan-European STOXX Europe 600 Index recently ended 1.54% lower, reflecting broader concerns. In this context, penny stocks—often smaller or newer companies—remain a relevant investment area due to their potential for significant value and growth when supported by strong financials. Despite their vintage name, these stocks can offer an intriguing mix of affordability and opportunity for investors seeking under-the-radar prospects with promising financial strength.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.03 | €19.6M | ✅ 2 ⚠️ 4 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.966 | SEK533.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.90 | €61.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.43 | €16.56M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €1.95 | €41.55M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.52 | SEK214.15M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €283.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.962 | €32.44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 328 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Eduform'action Société Anonyme (ENXTPA:MLEFA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eduform'action Société Anonyme offers education and training services, with a market cap of €6.50 million.

Operations: Eduform'action Société Anonyme has not reported any specific revenue segments.

Market Cap: €6.5M

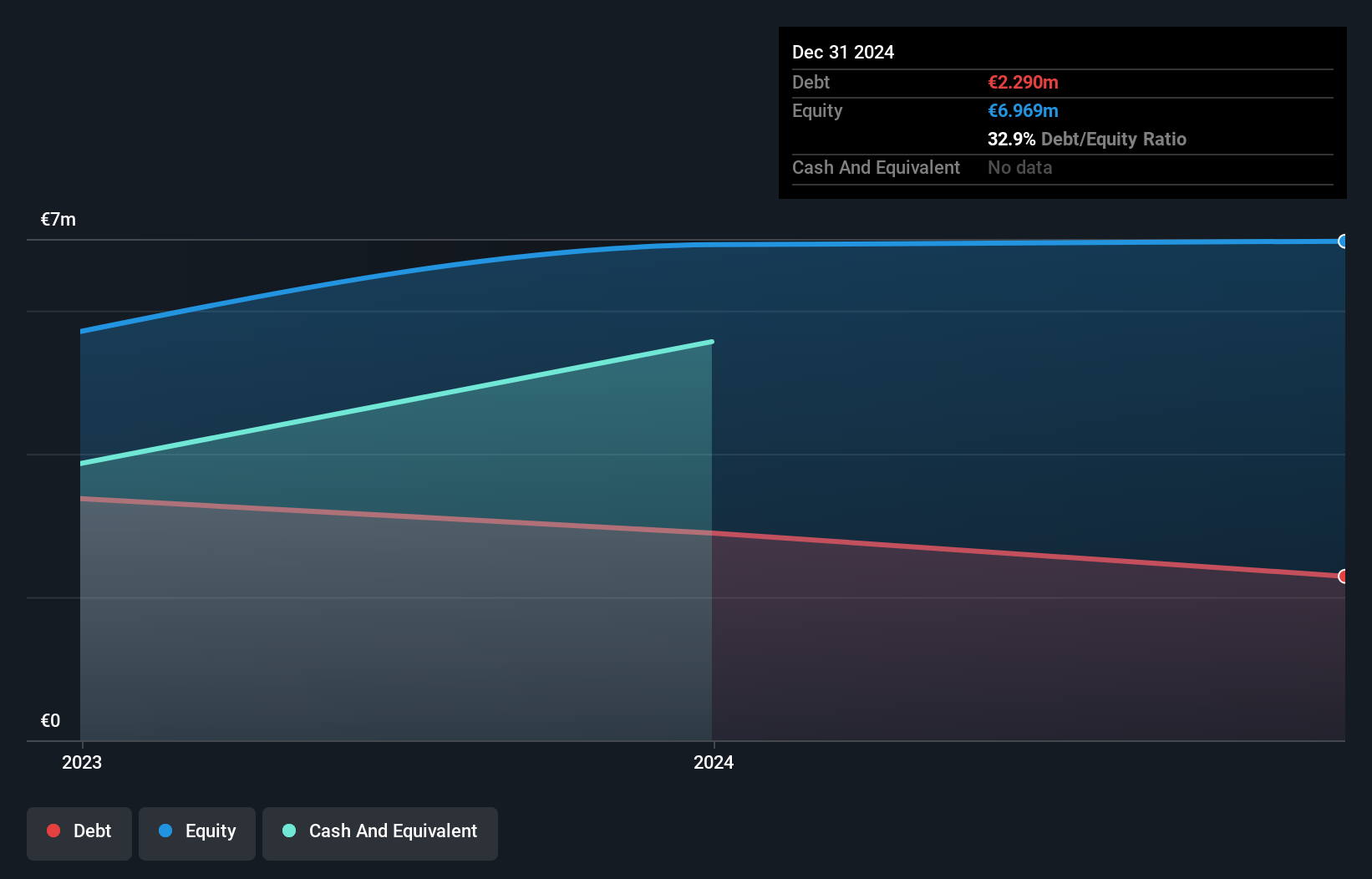

Eduform'action Société Anonyme, with a market cap of €6.50 million, has transitioned to profitability over the past year, reporting net income of €0.028 million for 2024 after a previous loss. Despite its small size and high volatility compared to most French stocks, the company's short-term assets comfortably cover both short and long-term liabilities. However, its Return on Equity remains low at 0.7%, and interest coverage is not robust enough at 2.4 times EBIT. A significant one-off loss impacted recent financial results but operating cash flow effectively covers debt obligations by 26.7%.

- Get an in-depth perspective on Eduform'action Société Anonyme's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Eduform'action Société Anonyme's track record.

S.D. Standard ETC (OB:SDSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.D. Standard ETC Plc is an investment holding company that operates in the energy, transport, and commodities sectors with a market cap of NOK970.29 million.

Operations: The company reported a revenue segment of $-14.23 million from its investment holding activities.

Market Cap: NOK970.29M

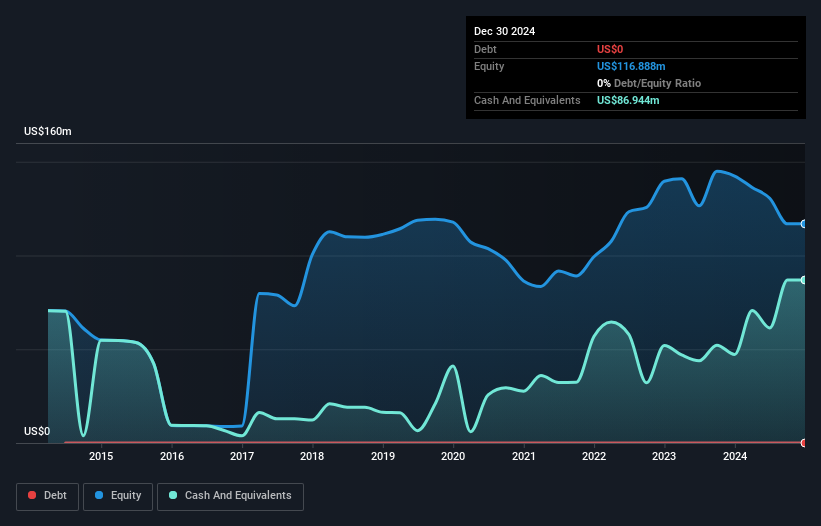

S.D. Standard ETC Plc, with a market cap of NOK970.29 million, is pre-revenue and unprofitable but has been reducing losses over the past five years by 11% annually. The company is debt-free and maintains sufficient short-term assets to cover its liabilities, with a stable cash runway exceeding three years due to positive free cash flow growth of 10.3% per year. Recent developments include Saga Pure ASA's acquisition of a significant stake in the company for approximately NOK440 million, reflecting strategic interest despite S.D. Standard's current financial challenges and negative revenue performance in recent earnings reports.

- Click here to discover the nuances of S.D. Standard ETC with our detailed analytical financial health report.

- Gain insights into S.D. Standard ETC's past trends and performance with our report on the company's historical track record.

AlzeCure Pharma (OM:ALZCUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AlzeCure Pharma AB is a pharmaceutical company focused on developing drug therapies for central nervous system diseases, with a market cap of SEK264.89 million.

Operations: AlzeCure Pharma AB does not currently report any revenue segments.

Market Cap: SEK264.89M

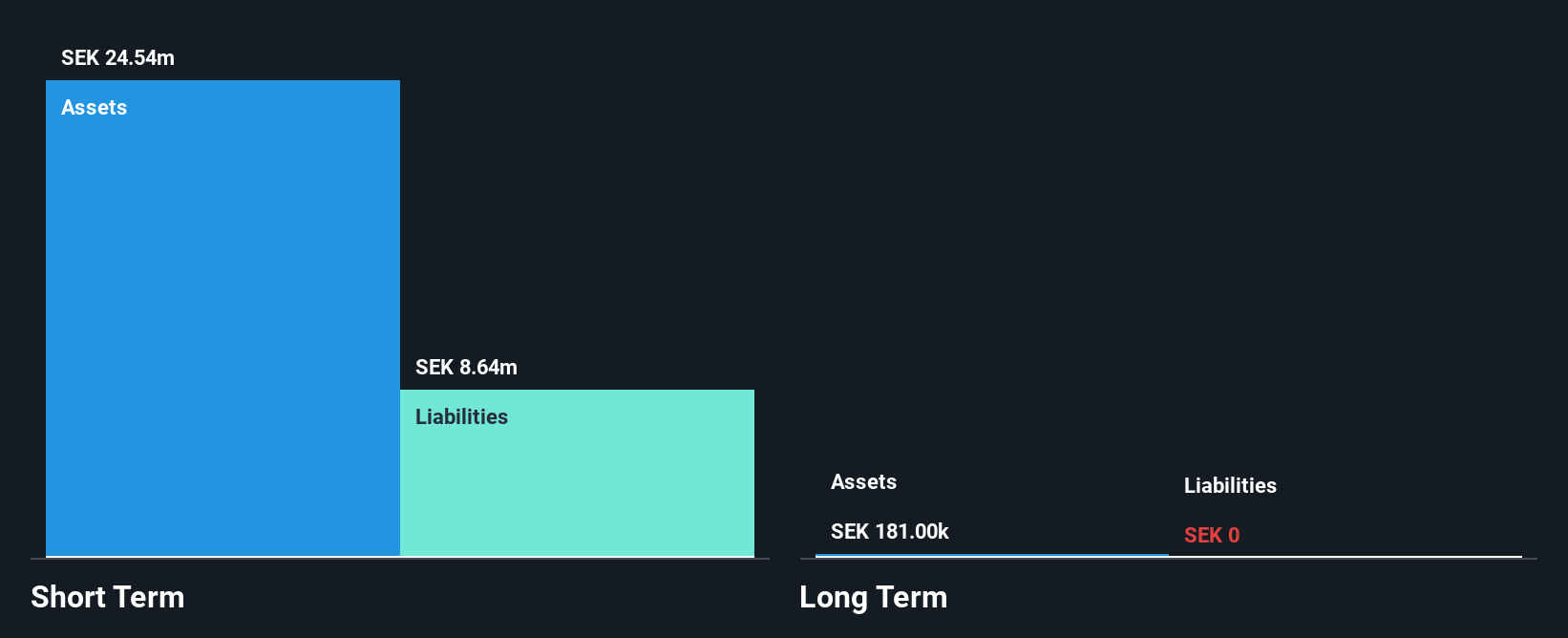

AlzeCure Pharma AB, with a market cap of SEK264.89 million, is pre-revenue and focused on developing treatments for central nervous system diseases. The company recently received positive feedback from the FDA for its lead drug candidate ACD440, aimed at treating erythromelalgia, a rare pain disorder. This development supports further clinical progress and highlights the significant unmet medical need in this area. AlzeCure has no long-term liabilities and maintains adequate short-term assets to cover its liabilities. However, it faces high share price volatility and has raised SEK48.56 million through a rights offering to extend its cash runway beyond seven months.

- Unlock comprehensive insights into our analysis of AlzeCure Pharma stock in this financial health report.

- Gain insights into AlzeCure Pharma's future direction by reviewing our growth report.

Seize The Opportunity

- Unlock our comprehensive list of 328 European Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eduform'action Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLEFA

Excellent balance sheet with low risk.

Market Insights

Community Narratives