- Norway

- /

- Energy Services

- /

- OB:PSE

The Petrolia (OB:PSE) Share Price Is Down 74% So Some Shareholders Are Rather Upset

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Petrolia SE (OB:PSE) during the five years that saw its share price drop a whopping 74%. On the other hand the share price has bounced 7.9% over the last week.

See our latest analysis for Petrolia

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

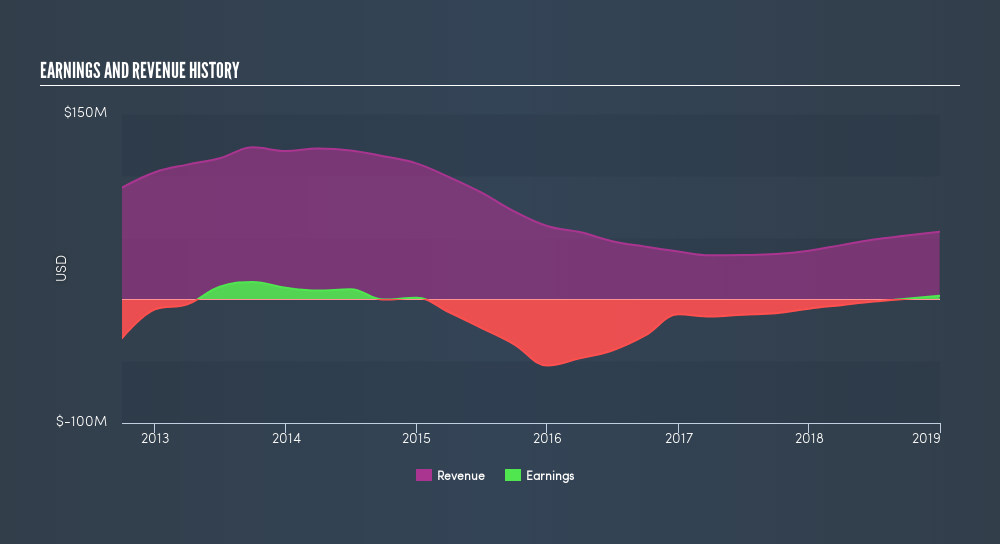

During five years of share price growth, Petrolia moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Arguably, the revenue drop of 26% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

This free interactive report on Petrolia's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Petrolia shareholders are down 13% for the year. Unfortunately, that's worse than the broader market decline of 2.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 23% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before deciding if you like the current share price, check how Petrolia scores on these 3 valuation metrics.

But note: Petrolia may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:PSE

Petrolia

Engages in the rental and sale of energy service equipment to energy industry in Norway, rest of Europe, Asia, and Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives