- Norway

- /

- Energy Services

- /

- OB:PRS

Could Prosafe SE's (OB:PRS) Investor Composition Influence The Stock Price?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

If you want to know who really controls Prosafe SE (OB:PRS), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Companies that have been privatized tend to have low insider ownership.

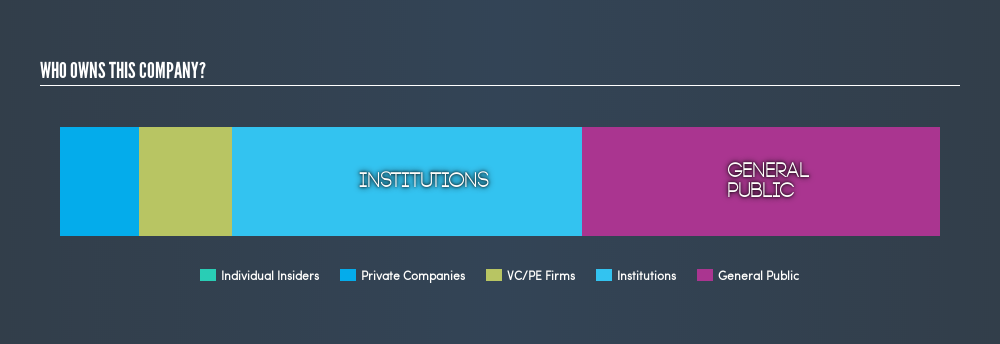

Prosafe is a smaller company with a market capitalization of øre987m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholder can tell us about PRS.

Check out our latest analysis for Prosafe

What Does The Institutional Ownership Tell Us About Prosafe?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

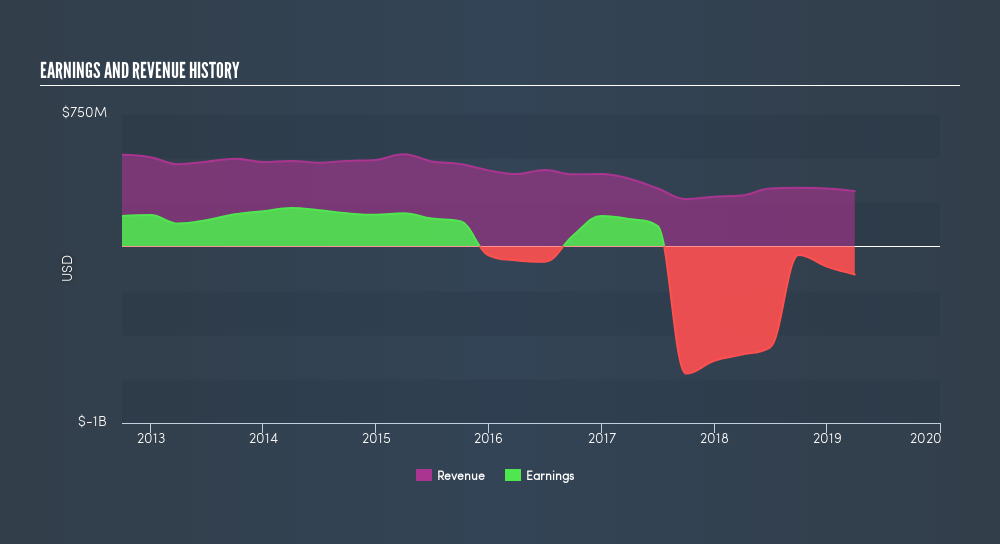

We can see that Prosafe does have institutional investors; and they hold 40% of the stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Prosafe, (below). Of course, keep in mind that there are other factors to consider, too.

Prosafe is not owned by hedge funds. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Prosafe

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Prosafe SE in their own names. But they may have an indirect interest through a corporate structure that we haven't picked up on. It seems the board members have no more than øre907k worth of shares in the øre987m company. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public holds a 41% stake in PRS. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

With an ownership of 11%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Private Company Ownership

Our data indicates that Private Companies hold 9.0%, of the company's shares. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow .

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:PRS

Prosafe

Owns and operates semi-submersible accommodation vessels in South America, North America, and Europe.

Undervalued slight.

Market Insights

Community Narratives