- Norway

- /

- Oil and Gas

- /

- OB:OKEA

OKEA (OB:OKEA) Forecasts Profitability Despite 11.5% Revenue Decline, Challenging Bearish Narratives

Reviewed by Simply Wall St

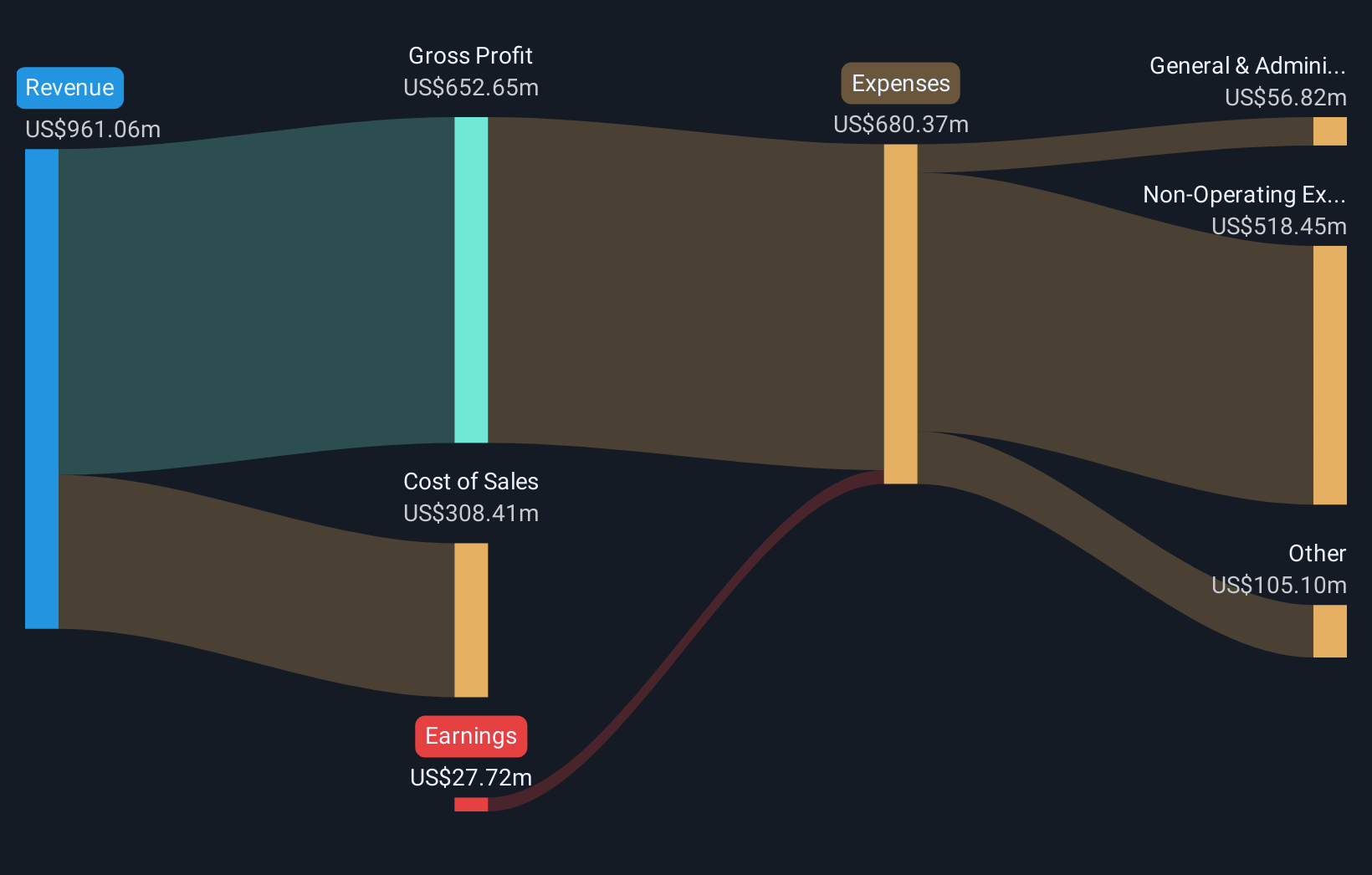

OKEA (OB:OKEA) faces a mixed outlook, with revenue projected to decline at an annual rate of 11.5% over the next three years, even as earnings are forecast to grow a robust 52.4% per year and shift the company into profitability. Losses have deepened by 10.4% per year over the past five years and no margin improvement has yet materialized, but analysts now anticipate a transition into the black within three years, outpacing the broader market’s recovery pace.

See our full analysis for OKEA.The real test is how these results compare with the narratives being discussed around OKEA. Let’s see where the story lines up and where investors might be surprised.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price/ Sales Ratio at Deep Discount

- OKEA is trading at a Price-To-Sales (P/S) ratio of just 0.2x, which is a significant discount compared to both its peer average of 1.2x and the Norwegian Oil and Gas industry average of 1.1x.

- From the prevailing market view, investors who focus on valuation see this low P/S as a sign that the market is either skeptical of near-term growth or undervaluing OKEA's potential for a turnaround.

- The narrative of OKEA as a nimble North Sea specialist aligns with the idea of the company being overlooked despite sector-wide cost discipline.

- The emphasis on cost-efficient operations, combined with a big valuation gap to industry peers, heavily supports arguments for upside if the business returns to profitable growth as forecasted.

Share Price Lags Far Behind DCF Fair Value

- The share price of NOK20.3 sits far below the DCF fair value estimate of NOK3079.92, highlighting a huge gap between current market pricing and modeled fundamentals.

- What stands out in the prevailing market view is that such a large fair value gap typically sparks interest among valuation-focused investors.

- This DCF disparity creates tension; either the market doubts the reliability of growth projections, or there is outsized re-rating potential should OKEA deliver.

- Given there are no flagged risk catalysts, further profitable execution could push sentiment rapidly toward the fair value. However, the revenue decline remains a roadblock to full conviction.

Turn to Profitability Despite Shrinking Top Line

- Forecasts predict OKEA will reverse its five-year trend of deepening annual losses (down 10.4% per year) by becoming profitable within three years, even as revenue drops at an 11.5% annual rate.

- The prevailing market view emphasizes that this transition defies sector convention.

- Normally, shrinking revenues make a return to profitability less likely, but margin efficiency and disciplined cost controls could drive OKEA into the black despite top-line pressure.

- This narrative sharply contrasts with companies that need growth to restore profits, placing OKEA in a rare position for recovery without expansion.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on OKEA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

OKEA’s shrinking revenues and a history of deepening losses signal uncertainty around its ability to sustain performance if cost controls falter.

If you want steadier growth profiles, consider stable growth stocks screener (2074 results) where you will find companies with reliable revenue and earnings expansion, designed to withstand market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:OKEA

OKEA

An oil and gas company, engages in the development and production of oil and gas in the Norwegian Continental Shelf.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives