- Norway

- /

- Oil and Gas

- /

- OB:IOX

Interoil Exploration and Production ASA (OB:IOX) Might Not Be As Mispriced As It Looks After Plunging 27%

Interoil Exploration and Production ASA (OB:IOX) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

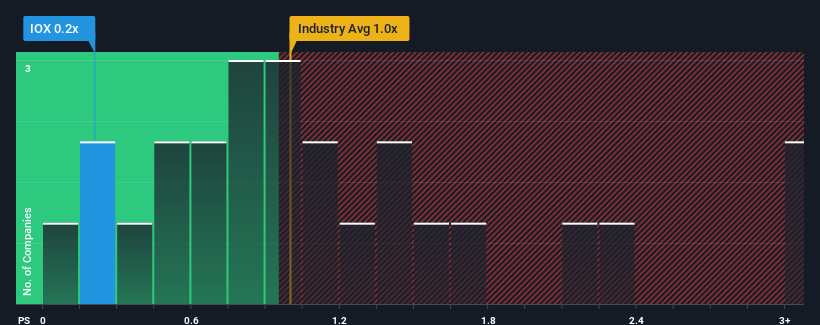

Since its price has dipped substantially, it would be understandable if you think Interoil Exploration and Production is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Norway's Oil and Gas industry have P/S ratios above 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Interoil Exploration and Production

How Interoil Exploration and Production Has Been Performing

As an illustration, revenue has deteriorated at Interoil Exploration and Production over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Interoil Exploration and Production, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Interoil Exploration and Production's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 6.8% shows it's a great look while it lasts.

With this information, we find it very odd that Interoil Exploration and Production is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Interoil Exploration and Production's P/S

Interoil Exploration and Production's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at the figures, it's surprising to see Interoil Exploration and Production currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

It is also worth noting that we have found 4 warning signs for Interoil Exploration and Production that you need to take into consideration.

If these risks are making you reconsider your opinion on Interoil Exploration and Production, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:IOX

Interoil Exploration and Production

Operates as an upstream oil exploration and production company in Argentina and Colombia.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives