- Norway

- /

- Oil and Gas

- /

- OB:HAFNI

Is Index Removal Reshaping the Investment Case for Hafnia (OB:HAFNI)?

Reviewed by Sasha Jovanovic

- Hafnia Limited was recently removed from the Oslo OBX Total Return Index, an event that typically triggers attention among investors and index-tracking funds.

- This index exclusion can impact trading volumes and investor access, especially for companies previously included in benchmark portfolios.

- We'll explore how Hafnia's removal from a key Norwegian index affects its medium-term outlook and investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Hafnia Investment Narrative Recap

For investors considering Hafnia, belief in continued global demand for refined petroleum products and efficient fleet management is essential. While being removed from the Oslo OBX Total Return Index draws attention, the impact on near-term operating catalysts, such as favorable tanker supply-demand dynamics, is likely limited, but could slightly dampen trading liquidity. The biggest risk remains long-term regulatory and market shifts linked to decarbonization, rather than short-term index reshuffles.

Amid these developments, Hafnia’s recent move to secure a US$715 million seven-year revolving credit facility stands out as particularly relevant; bolstering balance sheet flexibility, it provides financial resilience regardless of index status. This enhanced access to capital might help counteract any transitory effects on investor exposure stemming from the OBX index exit and supports ongoing fleet efficiency investments that remain a central thesis.

However, unlike headline index changes, what truly deserves your attention is the accelerating global regulatory pressure on maritime emissions, which could...

Read the full narrative on Hafnia (it's free!)

Hafnia's narrative projects $581.6 million in revenue and $353.1 million in earnings by 2028. This requires a 37.3% annual revenue decline and a $80.7 million decrease in earnings from $433.8 million today.

Uncover how Hafnia's forecasts yield a NOK69.33 fair value, a 12% upside to its current price.

Exploring Other Perspectives

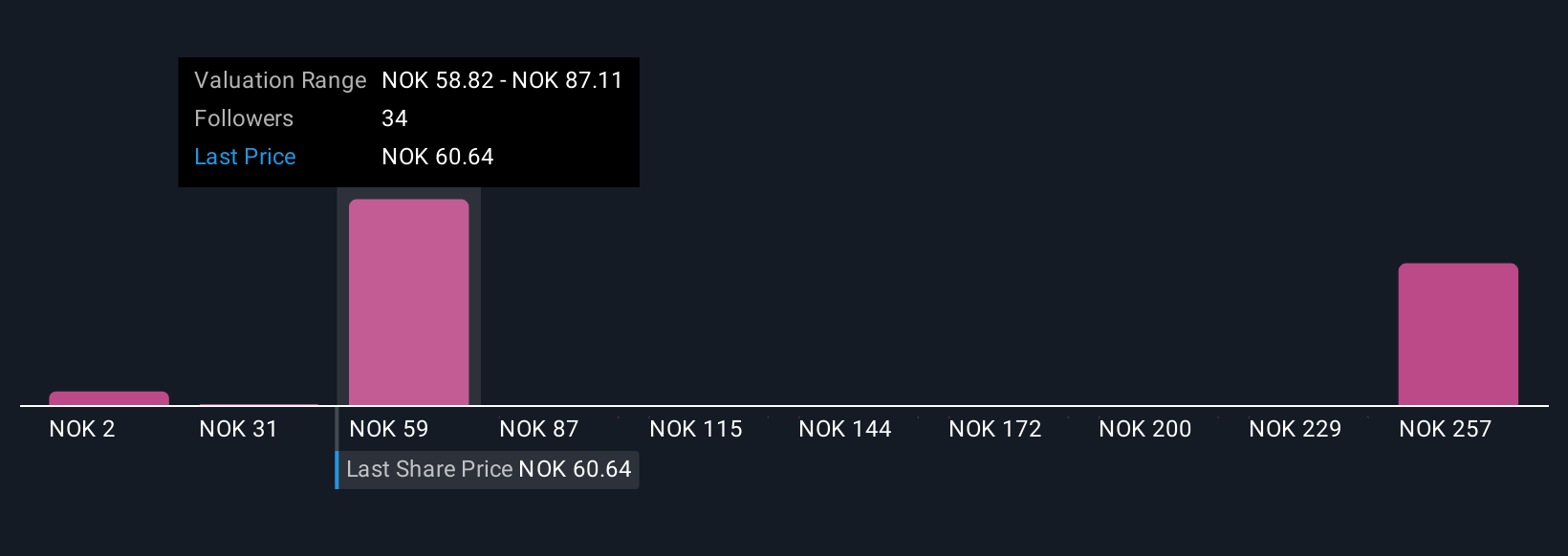

The Simply Wall St Community shared nine fair value estimates for Hafnia, ranging widely from US$2.25 to US$281.97 per share. Many participants anticipate tightening fleet supply, but opinions highlight just how differently investors interpret Hafnia’s long-term earnings outlook, explore several views and inform your own stance.

Explore 9 other fair value estimates on Hafnia - why the stock might be worth over 4x more than the current price!

Build Your Own Hafnia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hafnia research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hafnia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hafnia's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hafnia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAFNI

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success