- Norway

- /

- Oil and Gas

- /

- OB:HAFNI

Evaluating Hafnia (OB:HAFNI) After Its Recent 16% Pullback: Does the Valuation Signal Opportunity?

Reviewed by Simply Wall St

Hafnia (OB:HAFNI) has quietly slipped over the past month, with the share price down around 16% even as its longer term 3 year return sits above 60%. That gap is worth unpacking.

See our latest analysis for Hafnia.

The recent pullback, including a 16.4 percent 30 day share price return and weaker year to date performance, looks more like fading momentum after an exceptional three year total shareholder return than a fundamental reset.

If Hafnia has you thinking about where else shipping strength and cyclicality might show up, it could be worth exploring fast growing stocks with high insider ownership as a way to spot the next set of leaders.

With the shares now trading at a hefty discount to analyst targets despite a still strong multi year record, the key question is whether Hafnia is quietly undervalued or if the market is already pricing in its future growth?

Most Popular Narrative: 24.5% Undervalued

Compared to Hafnia's last close at NOK54.14, the most popular narrative sees fair value materially higher, suggesting the recent pullback clashes with long term fundamentals.

Continuous investment in fleet renewal, including new dual fuel and eco efficient vessels, as well as digitalization and operational optimizations, is expected to deliver structurally lower operating costs and improved vessel earnings, supporting higher margins and long term profitability. Conservative balance sheet management, reduced net leverage, and access to new, competitively priced credit facilities further enable Hafnia to pursue strategic growth while lowering cash flow breakevens, strengthening resilience and supporting sustained dividend capacity and potential for higher shareholder returns.

Want to see how shrinking revenues can still translate into fatter margins, firm earnings and a richer future multiple than the wider oil and gas pack? The narrative spells out the full playbook.

Result: Fair Value of $71.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tougher emissions rules or a faster than expected drop in refined oil demand could hit utilization, compress margins and cap any valuation re-rating.

Find out about the key risks to this Hafnia narrative.

Another Angle on Value

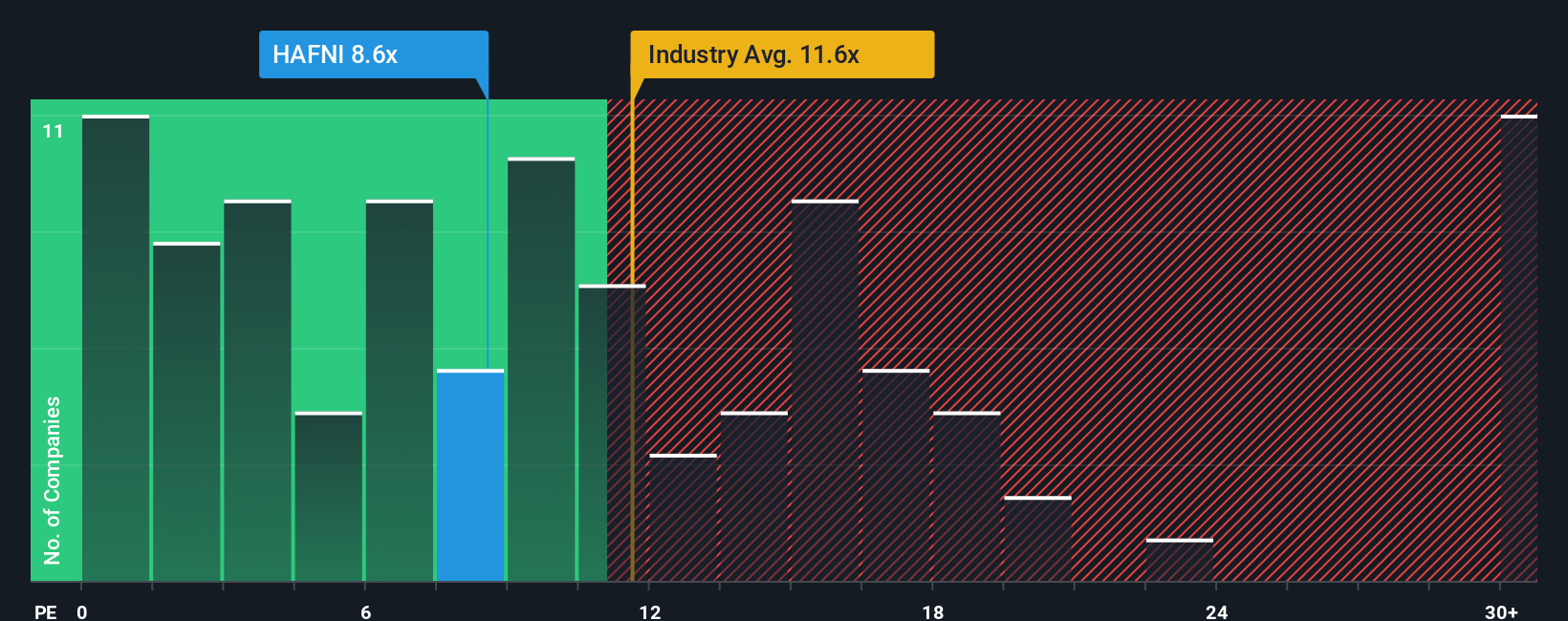

On simple earnings ratios, Hafnia looks cheap against both European oil and gas peers, at 8.6 times versus 11.4 times, but pricey versus its own fair ratio of 7 times. That mix hints at upside if sentiment normalizes, but also real rerating risk if earnings soften further.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hafnia Narrative

If you see the story differently or want to dive into the numbers yourself, you can craft a complete narrative in just a few minutes: Do it your way.

A great starting point for your Hafnia research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Hafnia, you could miss some of the market's most compelling setups. Use the Simply Wall Street Screener to surface tomorrow's standouts today.

- Capture early-stage potential by tracking these 3634 penny stocks with strong financials that pair tiny market caps with balance sheets and earnings profiles built for real staying power.

- Ride structural shifts in medicine by targeting these 29 healthcare AI stocks that apply algorithms to diagnostics, treatment planning, and operational efficiency across hospitals and biotech.

- Lock in meaningful income streams with these 10 dividend stocks with yields > 3% that aim to combine resilient cash flows, reliable payouts, and the prospect of long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hafnia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAFNI

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion