- Norway

- /

- Oil and Gas

- /

- OB:EQNR

Will Higher Production and a Net Loss Shift Equinor's (OB:EQNR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Equinor ASA recently released its third quarter 2025 financial results, reporting higher sales, revenue, and energy production alongside a net loss of US$210 million compared to net income in the prior year period.

- Additionally, Equinor's Board announced that Tone H. Bachke will step down to focus on her executive role as CFO at SHV Holding N.V., effective October 31, 2025.

- We'll now examine how Equinor's increased production, yet quarterly net loss, affects its investment narrative moving forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Equinor Investment Narrative Recap

To be an Equinor shareholder, one must believe in the company's ability to convert increased energy production and resilient sales into sustainable long-term profits, despite near-term earnings volatility and evolving sector headwinds. The recent net loss and board change are unlikely to materially alter the most important short-term catalyst, persistent oil and gas demand for energy security in Europe, but reinforce the immediate risk around maintaining stable capital returns amid earnings swings.

The company's affirmation of a US$0.37 per share dividend for the third quarter remains highly relevant. This move is a signal of intent to continue rewarding shareholders, despite short-term earnings pressure, and ties directly to the ongoing catalyst of robust capital distribution in the face of sector uncertainty.

Yet, it's important for investors to remember that if global decarbonization efforts accelerate more rapidly than anticipated, the downside risk to long-term oil and gas demand could quickly become more pronounced than expected...

Read the full narrative on Equinor (it's free!)

Equinor's outlook projects $90.2 billion in revenue and $7.6 billion in earnings by 2028. This assumes a yearly revenue decline of 5.4% and a $0.6 billion decrease in earnings from the current $8.2 billion.

Uncover how Equinor's forecasts yield a NOK245.79 fair value, in line with its current price.

Exploring Other Perspectives

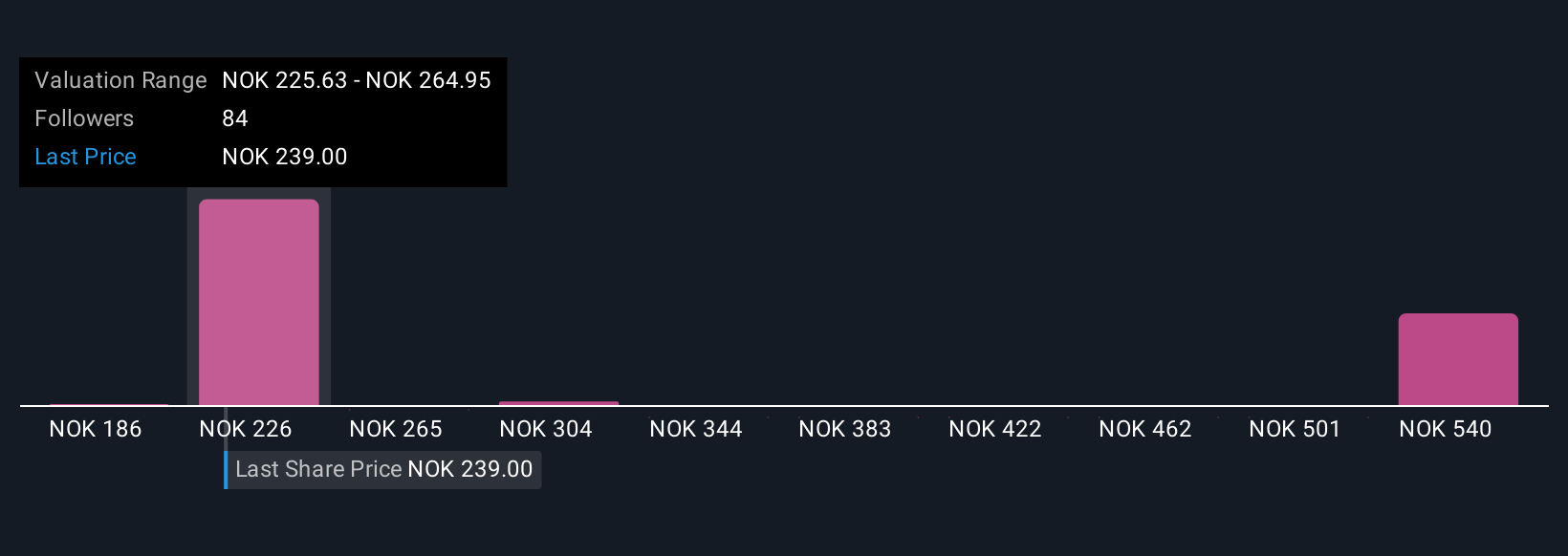

Sixteen members of the Simply Wall St Community estimate Equinor's fair value between US$186 and US$549 per share. With a wide range like this, consider how potential underperformance in renewables projects, as highlighted earlier, could shape the company's outlook and see how these views stack up against your own expectations.

Explore 16 other fair value estimates on Equinor - why the stock might be worth over 2x more than the current price!

Build Your Own Equinor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Equinor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinor's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EQNR

Equinor

An energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy in Norway and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives