- Norway

- /

- Oil and Gas

- /

- OB:EQNR

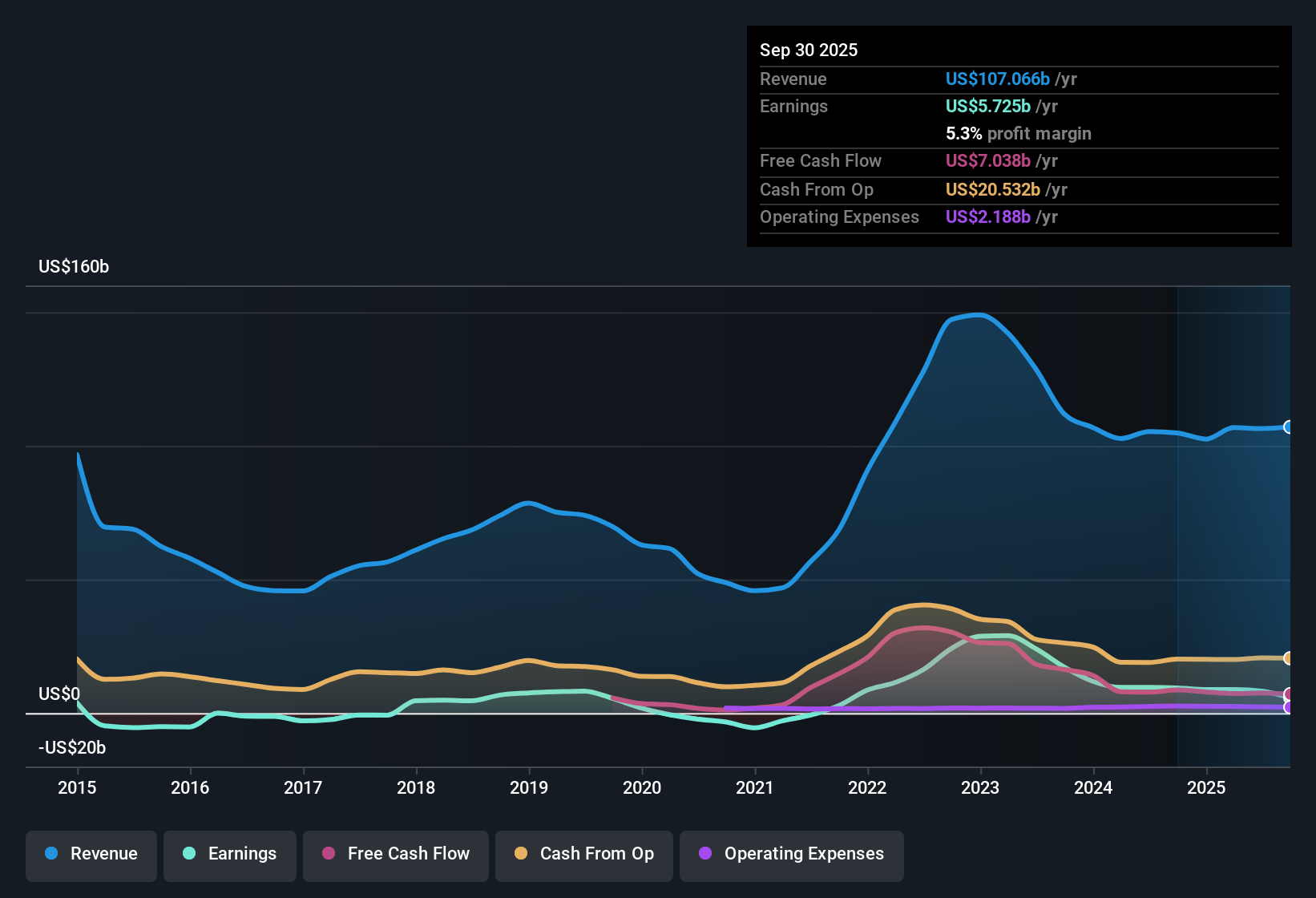

Equinor (OB:EQNR) Net Profit Margin Drops to 5.3%, Reinforcing Cautious Valuation Narratives

Reviewed by Simply Wall St

Equinor (OB:EQNR) reported earnings that tell a mixed story for investors. Revenue is forecast to decline by 4.7% per year over the next three years, while EPS is expected to grow at a rate of 5.53% annually. Notably, the company’s net profit margin has compressed to 5.3% from 9% last year, reflecting a challenging recent period after negative earnings growth over the past year. However, looking further back, average annual earnings growth reached 16.8% over the past five years, and Equinor has become consistently profitable during that time.

See our full analysis for Equinor.Up next, we will put these results side-by-side with the most widely followed narratives to see where the data confirms the market consensus and where it challenges those views.

See what the community is saying about Equinor

PE Ratio Stands Out Versus Industry

- Equinor’s current Price-to-Earnings (PE) ratio of 10.5x is noticeably lower than both the European Oil and Gas industry average of 14.3x and the peer group’s average of 14.5x.

- According to analysts' consensus view, this PE gap signals the market is factoring in either slower earnings growth or heightened risks. This perspective is underlined by concerns over rising capital requirements and the pace of Equinor’s renewables expansion.

- Consensus notes that while Equinor’s low multiple offers immediate value, it may also reflect caution about the sustainability of high dividends as legacy oil and gas fields mature.

- The consensus also points out that persistent optimism assumes offshore wind and renewables will offset margin pressures. Recent U.S. offshore wind impairments highlight the difficulty of rapidly replacing oil cash flows with profitable renewable income.

What is striking is how this valuation mismatch shapes market expectations for fair pricing and future returns. Read the full context in the consensus narrative for the company. 📊 Read the full Equinor Consensus Narrative.

Dividend Seen as Potential Risk

- The company’s dividend has been flagged as unsustainable, especially as cash flows come under pressure and net profit margin has dropped from 9% to 5.3% over the last year.

- Consensus narrative draws attention to the risk that high shareholder payouts may not last if earnings and oil and gas revenues falter in the coming years.

- Analysts emphasize that if energy prices soften or capital needs for new projects increase, cash returns to shareholders could be squeezed, challenging assumptions of steady future income.

- The narrative points out how maturing assets and tighter ESG regulations could further increase capex, heightening the risk that payout policies will have to adjust downward.

DCF Fair Value Signals Deep Discount

- With shares trading at NOK242, Equinor is valued far below its DCF fair value estimate of NOK579.71, suggesting a substantial gap between market price and intrinsic value.

- Consensus narrative maintains that this disconnect is partly explained by analyst forecasts of a 4.7% annual revenue decline. Ongoing profit growth and new long-term gas contracts could add upside.

- Consensus highlights that the fair value premium is only meaningful if projected margin improvements and cash flows from new projects materialize amid regulatory and price risks.

- This wide discount, combined with moderate analyst price targets near current levels, shows how the market is balancing potential upside with caution about decarbonization and energy transition headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Equinor on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the data? In just minutes, you can build your own story and share your perspective. Do it your way

A great starting point for your Equinor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Equinor’s shrinking profit margins, flagged dividend risks, and dependence on volatile commodity prices highlight challenges to sustaining reliable shareholder returns in coming years.

If you want consistency instead, use stable growth stocks screener (2095 results) to zero in on companies that deliver steady revenue and earnings growth across different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EQNR

Equinor

An energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy in Norway and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives