As European markets navigate concerns over inflated AI stock valuations and the impact of U.S. interest rate expectations, investors are increasingly focusing on companies with strong fundamentals and insider ownership as potential indicators of growth resilience. In this environment, stocks that combine robust growth prospects with significant insider investment may offer a compelling narrative for those seeking stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 86.1% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

DNO (OB:DNO)

Simply Wall St Growth Rating: ★★★★★★

Overview: DNO ASA is involved in the exploration, development, and production of oil and gas assets across the Middle East, North Sea, and West Africa with a market cap of NOK 14.23 billion.

Operations: Revenue from oil and gas activities amounts to $1.17 billion.

Insider Ownership: 13.5%

DNO ASA's revenue is forecast to grow at 28.8% annually, surpassing the Norwegian market average. The company is expected to become profitable within three years, with earnings projected to rise by 97.53% per year. Despite trading at a significant discount to its estimated fair value, DNO carries high debt levels and its dividend yield of 10.27% isn't well covered by earnings or cash flow. Recent strategic alliances with Aker BP could enhance resource recovery and operational efficiencies in key areas.

- Unlock comprehensive insights into our analysis of DNO stock in this growth report.

- The valuation report we've compiled suggests that DNO's current price could be quite moderate.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company that owns and manages a diverse real estate portfolio across several European countries, including Sweden, Finland, France, Benelux, Spain, and Germany, with a market cap of SEK71.78 billion.

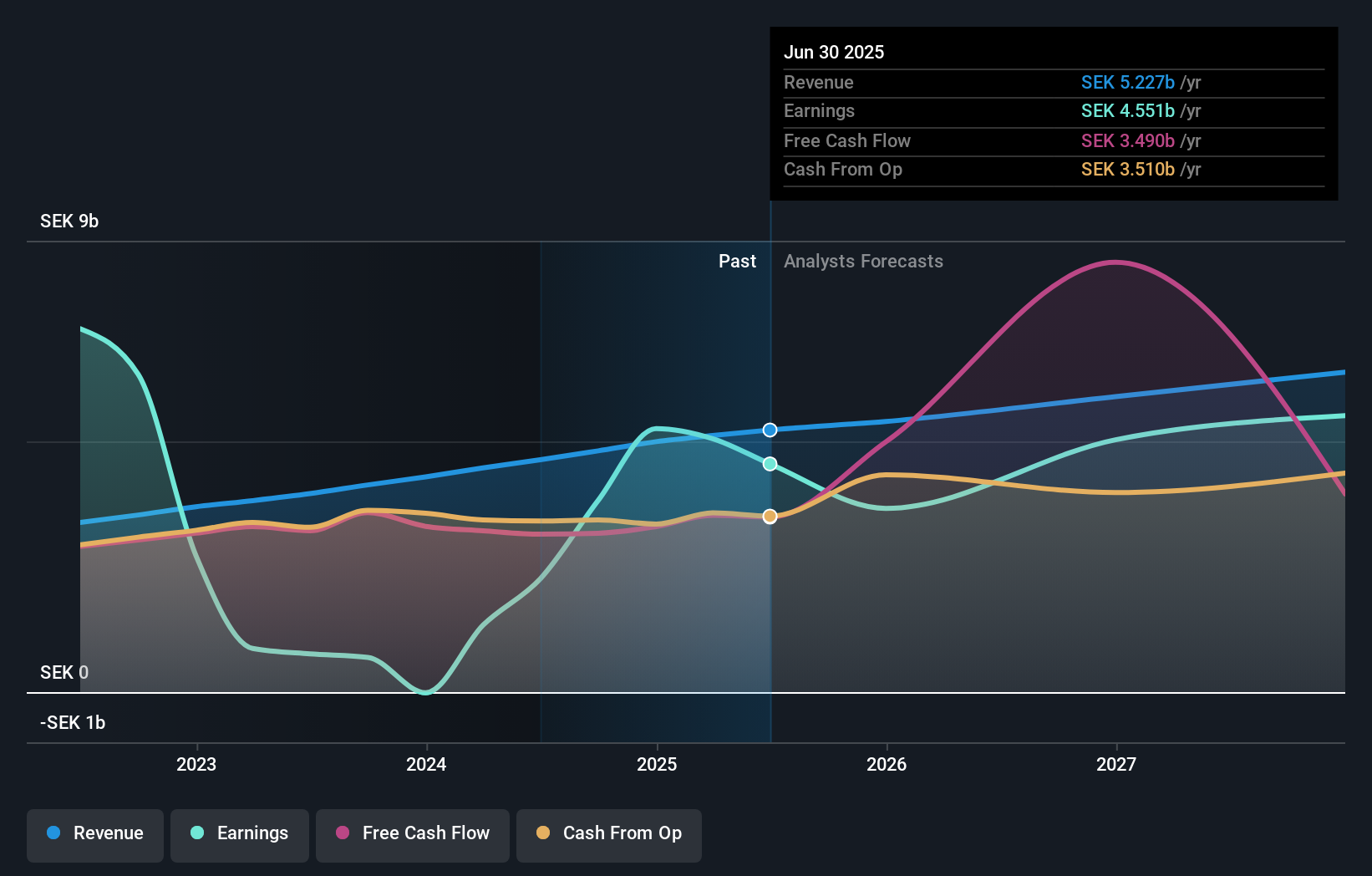

Operations: The company's revenue segment primarily consists of Real Estate - Rental, generating SEK5.30 billion.

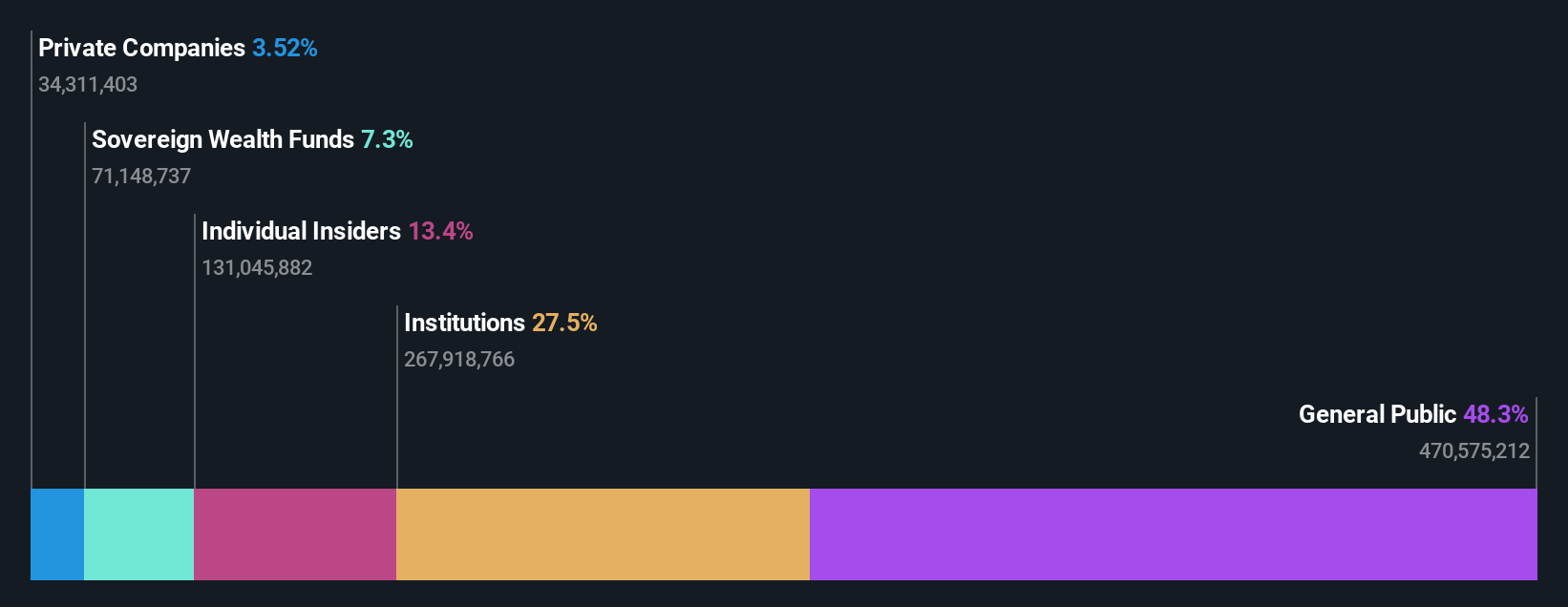

Insider Ownership: 28.7%

AB Sagax's earnings are forecast to grow significantly at 23.9% annually, outpacing the Swedish market average. However, revenue growth is slower at 7.7% per year, though still above the market rate. Recent financials show a decline in net income for both the third quarter and nine months ending September 2025 despite increased sales, partly due to large one-off items affecting results. The company's debt coverage by operating cash flow remains inadequate.

- Take a closer look at AB Sagax's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that AB Sagax is priced higher than what may be justified by its financials.

AlzChem Group (XTRA:ACT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AlzChem Group AG, with a market cap of €1.29 billion, develops, produces, and markets a range of chemical specialties across Germany, the European Union, the rest of Europe, Asia, the NAFTA region, and internationally.

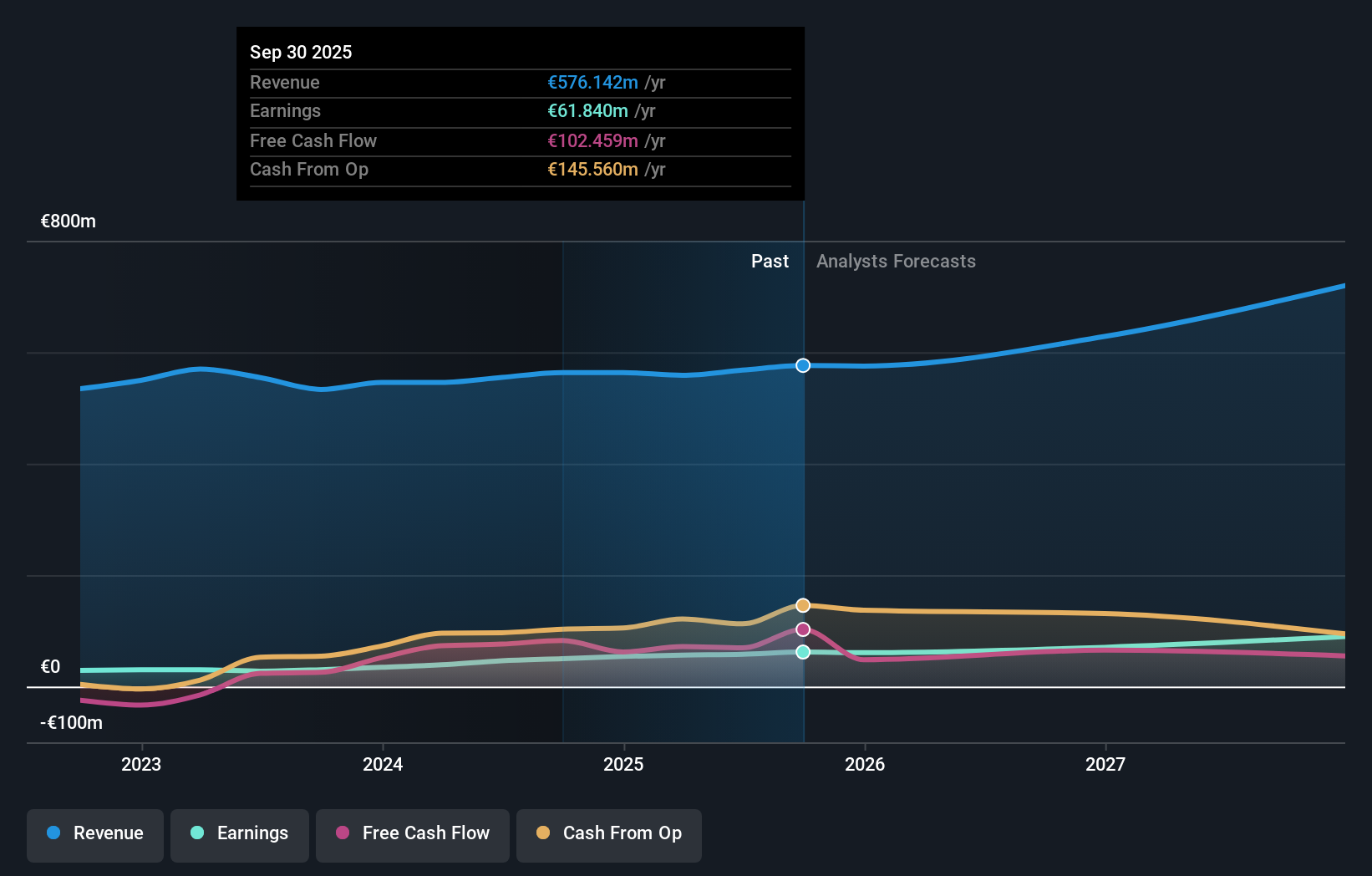

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, which accounts for €370.59 million, followed by the Basics & Intermediates segment with €163.48 million.

Insider Ownership: 13%

AlzChem Group is trading significantly below its estimated fair value, with analysts expecting a 31.4% price increase. Earnings are projected to grow at 17.7% annually, surpassing the German market's average, while revenue growth is forecasted at 9.2%. Recent reports show an increase in both sales and net income for Q3 and the first nine months of 2025. The company confirmed strong full-year guidance with expected sales reaching €580 million, bolstered by new product launches like Creavitalis®.

- Navigate through the intricacies of AlzChem Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that AlzChem Group is trading behind its estimated value.

Next Steps

- Reveal the 201 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ACT

AlzChem Group

Develops, produces, and markets a range of chemical specialties in Germany, European Union, rest of Europe, Asia, NAFTA region, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success